Study Notes

World Bank

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

The World Bank comprises two institutions managed by 188 member countries: the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA)

- The IBRD aims to reduce poverty in middle-income and creditworthy poorer countries

- The IDA focuses exclusively on the world's poorest countries

The World Bank:

- Provides grants and low interest loans

- Offers policy advice and technical assistance to developing countries

- Co-ordinates projects with governments

Assistance from the IMF or World Bank might be accompanied by a Structural Adjustment Program (SAP). The country receiving assistance might be required to orientate its economy more towards the free market, reduce trade barriers and corruption. Developing countries and newly emerging countries complain about their lack of influence in the World Bank. In 2014 Brazil, Russia, India, China and South Africa – struck an agreement this month to establish a development bank with an initial capital of $100bn. The Brics want the bank to mobilise resources for infrastructure and sustainable development projects.

The overall performance of developing countries during the past two decades has been positive, with major gains in economic growth and poverty reduction globally. Champions of the Millennium Development Goals (MDGs) eagerly welcomed the success of the poverty goal five years ahead of schedule in 2010, and the pace of poverty reduction (by current measures) has been so robust that the World Bank has set the effective elimination of extreme poverty by 2030 as one of its twin institutional goals.

The BRICS Development Bank (2014)

- In the summer of 2014, the five BRICS countries – Brazil, Russia, India, China, and South Africa – established the New Development Bank and a contingent reserve fund to diversify sources of official lending to developing countries.

- The BRICS' “no strings" policy challenges the conditionality imposed on borrowers by the World Bank and the International Monetary Fund.

Recent developments have led some economists to challenge the future for the World Bank

One factor is the opening up of new sources of finance for lower-income and middle-income developing countries. These include:

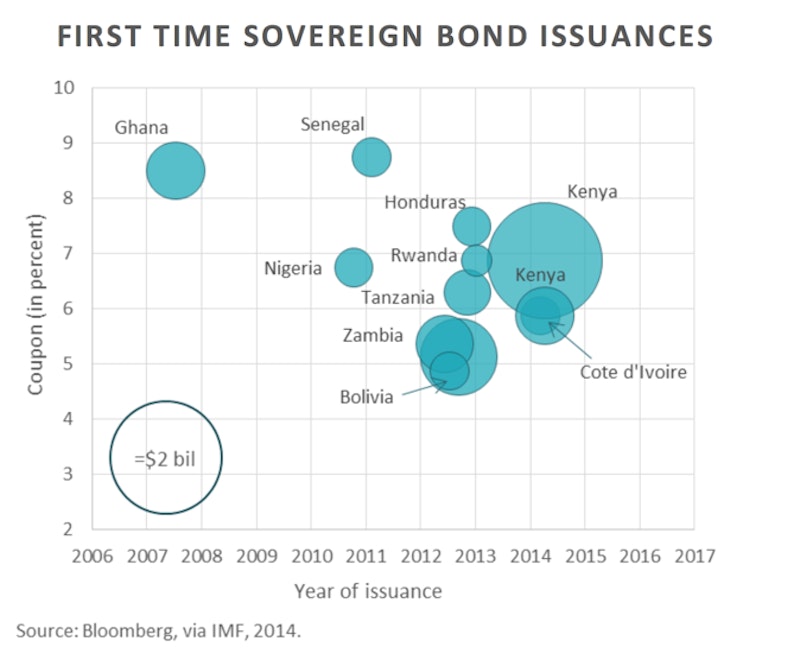

- More countries issuing their own sovereign bonds

- Rising foreign direct investment from OECD (advanced) countries

- Growing foreign direct investment from other emerging countries such as the BRICs - FDI flows from emerging markets to developing countries are growing at an average 21 percent per year, and investment from BRICS countries alone reached $71 billion in 2012

- Significance of remittance inflows for many of the world's poorer countries

- Rising tax revenues as per capita incomes grow following sustained economic growth

- The rise of development banks such as the African Development Bank, the Asian Development Bank and the new AIIB

You might also like

Extreme Poverty

Study Notes

Where next for the IMF?

25th July 2015

Global Economy 2016 in 12 Charts (and a video)

15th January 2017

Barriers to Economic Development (June 2018 Update)

Topic Videos

Mauritius becomes Africa's 2nd High Income Country

7th July 2020

Is an expanding BRICS a challenger to G7?

28th August 2023