Topic Videos

What next for UK interest rates in 2020?

- Level:

- AS, A-Level, BTEC National, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 27 Feb 2020

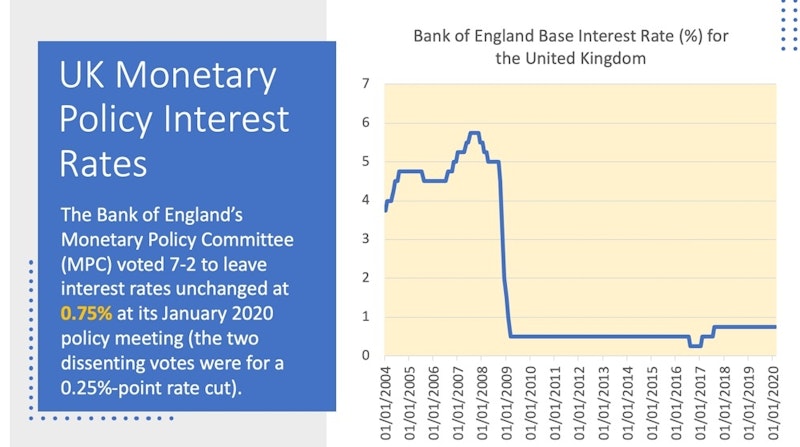

In this short video we look at five arguments for the Bank of England raising interest rates from their current very low level and five counter arguments making the case perhaps for a rate cut rather than an increase. We’ll also look at a range of updated macroeconomic indicators.

Justifications for raising UK interest rates

- Business and consumer optimism is increasing as Brexit uncertainty lifts. The economy can sustain a slightly higher level of interest rates

- Fiscal policy is being loosened by the new government – monetary policy can seek to control risks of excess aggregate demand by acting as a counter-balance

- The UK labour market continues to be strong (wages now rising at 3.2% pa) – interest rates should normally be higher at this stage of the cycle

- Rising interest rates justified to bring about an improvement in housing affordability for millions struggling to find properties to buy or rent

- Unless interest rates rise now – with the economy still growing – there will be less scope to cut them again in the next economic downturn

Justifications for cutting UK interest rates

- UK growth is slowing – real GDP grew by only 1.1% in the last year – a rise in interest rates would risk causing a broadly-based downturn. Inflation remains below target.

- Manufacturing industry is close to recession. Higher interest rates might cause the sterling exchange rate to appreciate leading to a deterioration in net trade and export jobs

- Household debt levels are high – millions of people are vulnerable small increases in the cost of credit / debt that might follow a base rate increase

- Although unemployment is low (3.8% of the labour force), real wages have only just recovered from their 2008 pre GFC level and there remains a high level of under-employment

- There are big uncertainties about the global impact of the coronavirus with growing fears of a global recession as trade stalls and labour movement is restricted

You might also like

Twin Peaks for the UK Economy

19th October 2014

Regulation of Payday Loans (Financial Economics)

Study Notes

Macro Revision - Topical Issues in the UK Economy

Teaching PowerPoints

Why Financial Markets Matter - Short Lesson Video

20th November 2015

Negative interest rates defy gravity

9th June 2016

Consumer Confidence & Economic Cycles

Topic Videos

What is Crowding In?

Study Notes

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails