Study Notes

Trade Deficits

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 7 Jun 2023

Why do some countries run large persistent trade deficits whilst others successfully manage to operate with a trade surplus? It will come as no surprise that there are several demand and supply-side explanations for trade imbalances between countries.

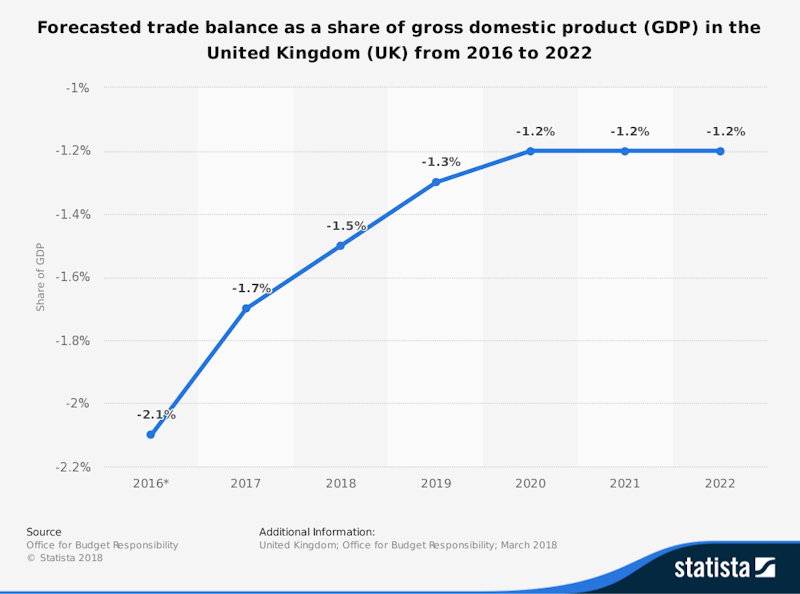

Trade deficits occur when the value of imports exceeds the value of exports sold overseas. The UK for example runs a sizeable trade deficit each year. The latest data shows that in 2017, the UK’s exports of goods and services totalled £618 billion and imports totalled £641 billion. Overall, the UK imports more than it exports meaning that it runs a trade deficit. A deficit of £137 billion on trade in goods was partially offset by a surplus of £113 billion on trade in services in 2017. The overall UK trade deficit was £24 billion in 2017.

(Source: UK Parliament Research Briefing, 19th January 2019).

One important distinction to make is between cyclical and structural causes:

Cyclical causes

Cyclical causes link to the stage of an economic cycle a country might be in and also cyclical changes in different regions and the global economy as a whole. The world economy goes through a trade and investment cycle affecting for example, the real prices of many internationally traded commodities. Some cyclical causes of a trade deficit are summarised below:

- Rising real incomes - leads to an increased demand for imports especially goods and services with a high income elasticity of demand

- Increasing consumer spending - perhaps financed by borrowing/debt - as consumption grows (and savings fall) then spending on imports rises

- Expanding production - businesses need to import more component parts and raw materials

- Growing investment spending - perhaps a significant amount of new capital machinery and technology comes from overseas

- Strong exchange rate - if there is an appreciation of the exchange rate, then export prices rise and import prices fall. Depending on the price elasticity of demand for exports and imports, a stronger currency might lead to a larger trade deficit

Key point:

When an economy is in the boom phase of an economic cycle, normally the size of a trade deficit will rise as spending on imports increases. This can be offset by an expanding export sector, but when domestic GDP growth is strong, there may not be much spare capacity for exporters to increases their overseas sales.

Key point:

In an economic downturn, the trade deficit tends to improve. This is mainly because of a steep fall in employment and real incomes which then leads to a fall in consumer spending. Greece and Spain are two good examples of nations whose external balance has improved in recent years. However in large part this has been the consequence of a persistent decline in real per capita incomes and, in the case of Greece, a full-blown depression with real GDP falling by more than 25 percent and consumption of goods and services collapsing by 40 percent.

Structural causes

Structural causes refer mainly to longer-term changes in an economy’s structure and supply-side competitiveness. In the case of the UK for example, there is a persistent productivity gap measured by output per hour or output per person employed between the UK and many of our major trade competitors.

- Low levels of research and development to help develop new products. In the UK for example, research and development spending has remained stubbornly below 2 percent of GDP.

- Low level of capital investment spending which limits the growth of a country’s productive capacity

- Relatively weak productivity - which leads to higher unit costs and therefore a decline in relative cost competitiveness

- Long term decline in the world price of a country’s major export - many countries continue to experience primary product dependency when the trade balance is highly susceptible to volatile commodity prices

- Emergence of scaled competition in an industry from producers in other countries - for example the shift of manufacturing in industries such as textiles and steel to lower-cost countries and regions.

Trade deficits are also linked to the stage of economic development that a country may have reached. Many developing / emerging countries run large trade deficits because they are importing capital equipment and components that they cannot produce themselves.

Providing this investment bears fruit in the long run by expanding long run aggregate supply, the trade balance may well improve. Much depends on the efficiency of capital investment projects and whether the trade/current account deficit can be financed.

You might also like

Balance of Payments - Current Account Deficits

Study Notes

Britain's Tourism Trade Deficit Widens

21st May 2015

International Trade Agreements

26th June 2015

Growth and Governments

26th May 2016

UK exports and imports in six charts

28th September 2017

Test 4: A Level Economics: MCQ Revision on International Economics

Practice Exam Questions

Reducing a Trade Deficit (Revision Essay Plan)

Practice Exam Questions