Practice Exam Questions

Tariff on Chinese Steel (Revision Essay Plan)

- Level:

- A-Level

- Board:

- Edexcel

Last updated 1 May 2018

Here is a suggested essay plan for this question: "Evaluate the possible microeconomic and macroeconomic impact of a decision by the EU/UK to impose a tariff on imports of Chinese steel."

Micro point 1

One micro effect of a tariff on Chinese steel is that steel manufacturing firms in the UK will see an increase in demand and improved profits from selling output.

This is because an import tariff makes Chinese steel more expensive which can lead to expenditure-switching effects. Users of steel such as construction firms may substitute towards relatively cheaper UK steel leading to an outward shift of demand and a higher supernormal profit per tonne of steel supplied.

However the strength of the substitution effect depends on the size of the import tariff because Chinese steel might have been significantly cheaper than the UK. It also depends on whether there is a compensating change in the exchange rate e.g. a devaluation of the Yuan against the £ sterling.

Micro point 2

A second micro effect of a tariff on Chinese steel is that the UK steel industry may become less contestable.

Import tariffs are barriers to trade and they make it harder for imports to compete with domestic suppliers. Weaker import competition increases the monopoly power of UK producers and might lead to both allocative and productive inefficiency.

A counter-argument is that the dumping of cheap steel at a price below cost into the UK by Chinese suppliers is itself an attempt to weaken market competition and give Chinese firms more monopoly power in the long run.

Macro point 1

A macro effect of a tariff on steel is that the policy will help to prevent a rise in structural unemployment in regions where steel-making is a key industry.

The closure of loss-making steel plants creates structural unemployment because workers in these factories often have specific skills that are not fully transferable to other jobs. Workers therefore suffer from occupational immobility. Rising unemployment can then lead to a negative multiplier effect.

A critique of this point is that a tariff does not address the long-term problems of low productivity and higher unit costs in the UK steel industry. Occupational immobility might be better addressed with a significant increase in government investment in training programs.

Macro point 2

A 2nd macro effect of a tariff is that the current account of the balance of payments is likely to improve.

This is because a tariff increases prices and therefore reduces the quantity of imports bought which then leads to a fall in spending on imports. UK steel makers will be able to supply a higher percentage of total market demand for steel.

However, many other industries use steel and will be affected by the tariff. For example, car makers will see rising costs which might make them less price competitive in overseas markets leading to a possible decline in UK exports.

Diagram opportunities for analysis marks

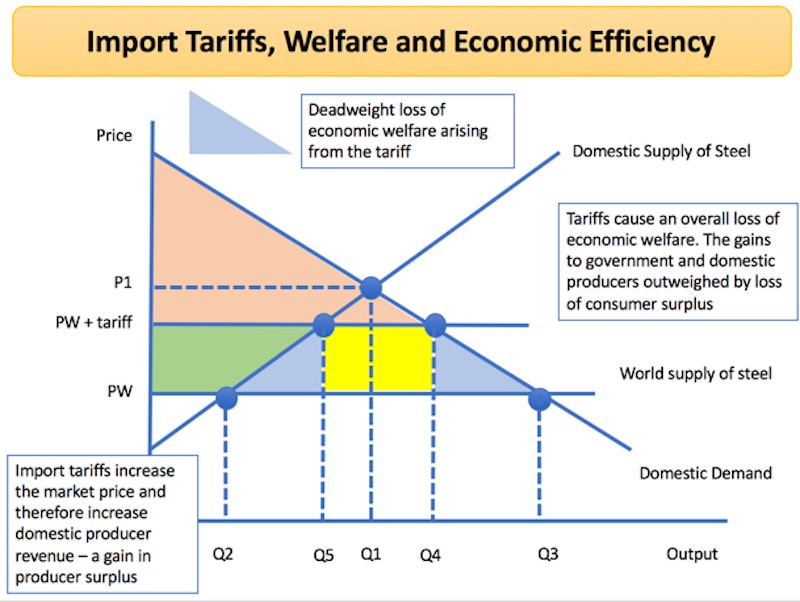

Tariff diagram – showing rise in imported steel price, changes in domestic demand and supply

Welfare diagram – e.g. impact of a tariff on consumer and producer surplus

AD-AS diagram - Rising import costs causing an inward shift of SRAS

Essential revision resources for A Level Economics students

-

7

Revision Flashcards for A-Level Economics Students

Resource Collection

You might also like

Causes and Effects of China's Growth Slowdown - Views from Economists

27th November 2015

Banks and steel: thorny problems in economic theory

5th April 2016

China's State-Owned Car Making Giants

18th September 2016

BBC This World - The Great Chinese Crash (2016)

9th January 2017

EU Supply Chains after Brexit

12th May 2017

China's carbon trading scheme set to accelerate demise of coal

20th December 2017

Does the UK economy need a steel industry in the UK anymore?

8th April 2023

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails