Study Notes

Price Wars in Oligopoly - Examples and Evaluation

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 3 Feb 2019

Price wars are often short-lived and intense periods when competing businesses lower their prices in a bid to win extra market share, generate improved cash-flow and perhaps increase total revenues.

Price wars are common in industries where – perhaps after a period of relative price stability – one firm decides to make an aggressive move on rivals and undercut prices. Game theory can be used to help explain why it might be in the rational self-interest of each business to set low prices given that they expect their rivals to do the same.

Recent examples of price wars

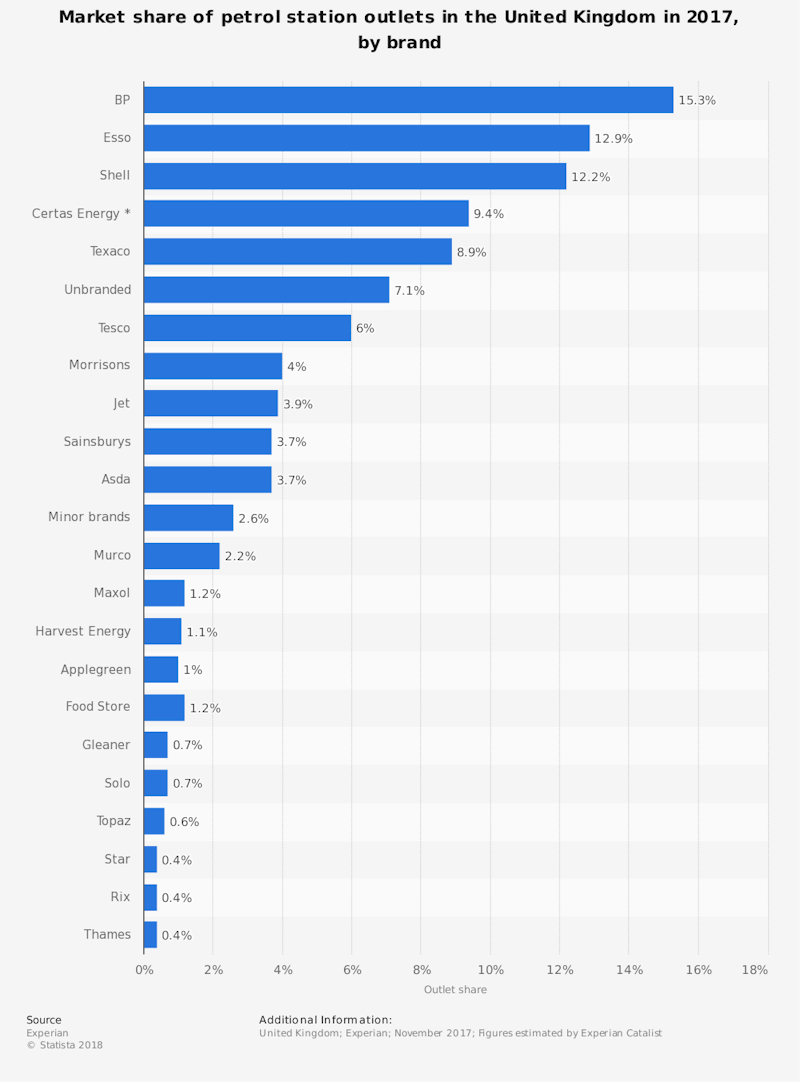

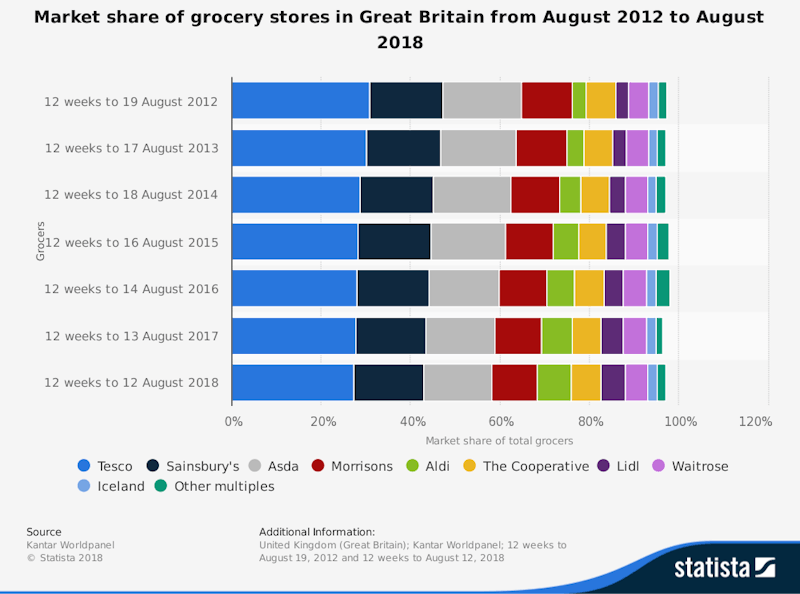

Recent examples include a price war between the supermarkets in the UK petrol retail industry involving Asda, Morrisons and Tesco. Read more about this here.

Another example of a price war is in the low-cost airline market caused in part by over-capacity on some routes. Read more about this here.

The leading supermarkets often engage in extensive price-cutting for staple products after Christmas when budgets are tight, and many families are even more price-sensitive than usual. Read more about this here.

We can find examples of price wars in many other markets including price discounting in cinemas, the UK funeral industry, the mortgage market and the online film streaming industry (Hulu v Netflix)

Advantages of price wars

Prices fall for consumers which leads to an increase in their real incomes (their disposable incomes stretch further each month) and an increase in consumer surplus

Price wars can help bring down the annual rate of consumer price inflation

Price wars on staple / essential products might have a bigger impact on larger and relatively low-income families. In this sense, aggressive price wars can have a progressive effect on the distribution of real income and consumption

Disadvantages of price wars

Price wars are nearly always bad news for the majority of businesses that get locked into them. Deep discounts on prices doesn’t necessarily increase revenues as this depends on the coefficient of price elasticity of demand and also that rival firms will have also lowered their prices in response.

Price cutting erodes profit margins and, in some cases, can lead to firms making losses and at risk of leaving the market. Lower profits mean fewer resources are available to fund capital investment. Consider for example a price war in broadband services. Ultimately service providers need to make sufficient profit not only to meet the expectations of their shareholders but also because the industry needs to invest huge amounts in increasing the capacity and efficiency of telecoms infrastructure.

A balance might need to be struck between the short-term needs of customers to get the best deal on their phones and the medium-term challenge of expanding the supply-side capacity of the industry.

If some smaller firms with less backing eventually go out of business, then competition in a market can be stifled and this might lead to higher prices for consumers in the long run. Customers might then be left with less choice. Price wars squeeze out marginal firms and can make a market less contestable than it once was.

Typically it is the bigger firms with deep pockets who can withstand a price war which – for example – might lead to price reductions of 10 to 20 percent over a six month period.

Price wars which lower profits can also cause a decline in direct tax revenues to the government from corporation tax which makes it harder for the state to achieve fiscal balance.

You might also like

Contestable Markets

Study Notes

Streaming and the Music Industry

30th July 2015

Sainsburys agrees a deal with Home Retail (Argos)

3rd February 2016

Ducts, Poles and Increasing Contestability

2nd May 2016

Ten Companies that dominate Global Brands!

6th November 2016

Surge pricing comes to the supermarket

5th June 2017

3.4.7 Contestable Markets (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails