Study Notes

PPF Analysis: Ways to Increase the Labour Supply

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 22 Nov 2018

One approach to increase a country's productive potential and bring about an outward shift of the production possibility frontier is to increase the active labour supply.

There are a number of ways in which this might be achieved - here is a selection:

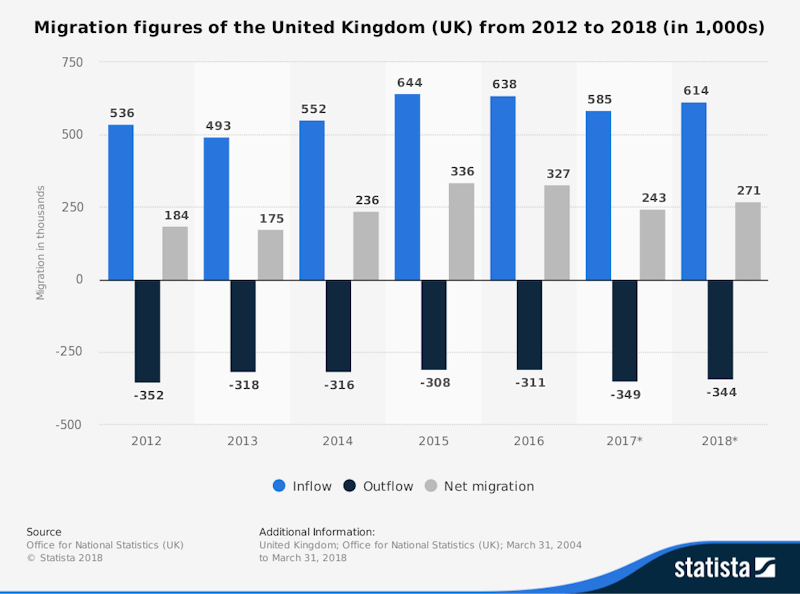

- Encourage positive net inward migration of labour: Within the European Union single market, there is free movement of labour between member countries. The UK is likely to move away from this after Brexit and perhaps introduce a skills-based migration system which effectively limits free movement. 2 million non-EU citizens immigrated to the EU in 2016. For more data on labour migration into and within the EU, follow this link.

- Tax-free or subsidised child care: Lowering the cost of child care can be an effective policy designed to encourage mothers to return to the labour force. In the UK, for eligible working families, tax-free child care offers to cover 20% of childcare costs, up to a maximum value of £2,000 per child per year, for children under the age of 12 (or up to £4,000 per year for children with disabilities under the age of 17). More details here

- Higher minimum wage / expansion of the Living Wage: A more generous statutory pay floor in the labour market can help to improve incentives for people to actively search for and accept paid work thereby increasing the labour supply. The UK National Minimum Wage (NMW) applies to most workers and sets minimum hourly rates of pay, which are updated annually. From April 2019, the National Minimum Wage will rise from £7.83 an hour to £8.21 an hour for workers aged 25 and over. There are lower rates for younger workers. More details on the economics of the minimum wage can be found here

- Changes to the official state retirement age: One reform to expand the labour supply might be to increase the age at which people can claim the state retirement pension. The state pension age is under review in the UK. It is currently 65 for men. It’s gradually increasing for women from 60 to 65.

- Tax incentives to find paid work: Changes to direct taxation of income can influence incentives to actively search for work. Some economists favour cutting marginal tax rates on lower incomes so that people in relatively poorly paid jobs can keep more of their gross income. The current basic rate of income tax in the UK is 20 percent. Others argue that a broader policy of increasing the annual income tax-free allowance has more impact in lifting work incentives and creating a larger wedge between incomes from work and transfer payments available from the welfare system. In recent years, there has been a sizeable increase in the personal tax allowance in the UK. From April 2019, the Personal Allowance rises to £12,500 for 2019 to 2020 and tax at the basic rate (20%) will be on taxable incomes up to £37,500 . Thereafter the higher 40% tax rate threshold will be £50,000.

In the medium to long run, growth in the size of the workforce comes mainly from population growth which itself is the result of natural demographic changes such as trends in fertility alongside movements in annual net migration. The Bank of England discusses some of the key labour supply changes here in their May 2018 Inflation Report.

You might also like

Macroeconomic Equilibrium - Revision Presentation

Teaching PowerPoints

Labour Force Participation (Labour Markets)

Study Notes

Will a fall in labour migration hurt the UK economy?

29th December 2016

Microeconomics diagram in your pocket

4th June 2017

Labour Migration: Revision Video Series

Topic Videos

Labour shortages - is market power shifting to workers?

30th August 2021

Supermarkets Battle for Staff

27th February 2024

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails