Practice Exam Questions

Unemployment and Policy Trade-Offs (Revision Essay Plan)

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 4 May 2019

Here is a revision essay plan on this title: “Evaluate the view that falling unemployment inevitably has trade-offs with other macroeconomic objectives. Discuss with reference to a country or countries of your choice.”

KAA Point 1

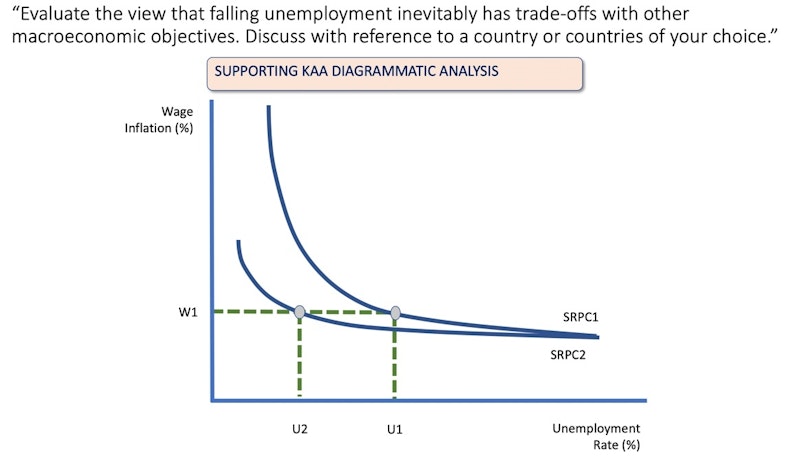

Falling U – may cause an acceleration in wage inflation in labour market – leads to a rise in cost-push and demand-pull inflationary pressures – this is a trade-off suggested by the short-run Phillips Curve analysis. Bargaining power of workers rises + skilled labour shortages & increased demand for raw materials and components can all drive variable costs higher – inward shift of SRAS, leading to a higher rate of inflation.

EVAL Point 1

Not automatic that inflation will rise. Improved supply-side flexibility of the labour market might have caused a fall in the NAIRU (non-accelerating inflation rate of unemployment) – this means that U can fall further without threatening rising wage inflation. External factors (e.g. lower commodity prices, impact of global competition) can also act as off-setting factors even if wages are rising more quickly.

KAA Point 2

Falling U – leads to rising real wages – increased household incomes – causes surge in demand for imports of goods and services – especially if the marginal propensity to import is high – in the absence of offsetting factors, a rise in M will lead to a worsening of the current account of the BoP. E.g. unemployment in UK now less than 4%, in 2016 the UK ran a record current account deficit of more than 5% of GDP.

EVAL Point 2

Falling U might be result of improved supply-side performance e.g. increased labour productivity which makes UK export industries more competitive. Or export sales might have grown because of a depreciation of the exchange rate (e.g. 2016) which (assuming Marshall-Lerner condition holds) will improve the net trade balance whilst also stimulating output and employment in sectors such as cars and tourism.

FINAL CONCLUSION

Phillips Curve for the UK seems to have flattened i.e. improving trade-off between unemployment and inflation. UK might be able to get close to full-employment and stay within the 2% inflation target. But weak productivity and low investment (17% of GDP) mean that strong GDP growth often associated with a worsening of the external trade accounts.

You might also like

What Ever Happened to the Phillips Curve

13th May 2014

Bill Phillips and the Ultimate Teaching Resource

26th June 2013

Practice Data Response Unemployment and Inflation

22nd February 2015

Macro models - the weakest link in Economics

7th June 2016

Is double digit inflation a relic of the past?

16th May 2021

4.2.3.4 The Phillips Curve (AQA A Level Economics Teaching Powerpoint)

Teaching PowerPoints