Topic Videos

Plastic Bottle Tax (Chain of Analysis)

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 12 Jan 2019

This short revision video provides an example of how to build a clear chain of analytical reasoning on the issue of whether the government should introduce a specific tax on single use plastic bottles and cups.

One aim of an indirect tax is to increase the private cost to consumers of buying products that use lots of plastic packaging.

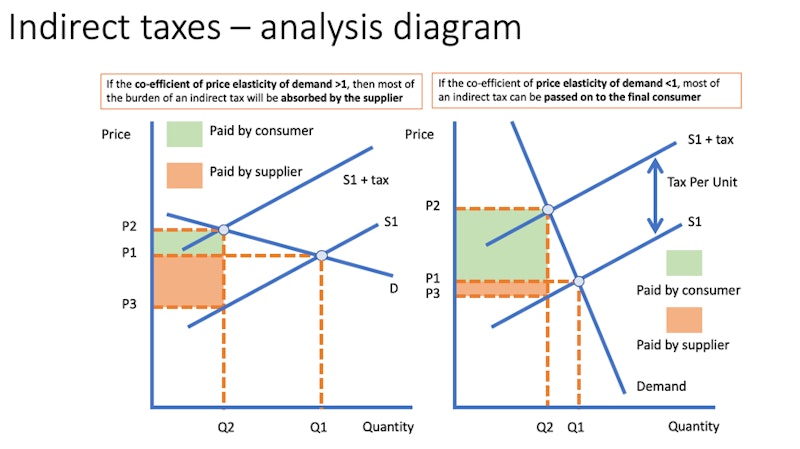

Aspecifictax on the manufacturers of drinks sold in plastic bottles will causea rise in their costs. This is shown in my analysis diagram.

If demand is price inelastic, then manufacturers will be able to pass on most of the tax to consumers through higher prices.

As a response, suppliers may reformulate their products so that less plastic is used in the manufacturing process.

This leads to a reduction in the amount of plastic waste that potentially heads to landfill sites.

As a response, suppliers may reformulate their products so that less plastic is used in the manufacturing process.

You might also like

Privatisation

Study Notes

The Invisible Hand of the Ticket Tout

1st March 2015

The Bots Are Taking Over!

24th February 2016

Economics of Health Care Funding

Study Notes

The Apprenticeship Levy - A Case of Government Failure?

30th March 2018

Taxes (Quizlet Revision Activity)

Quizzes & Activities

Teaching Activity: Introduction to Economics (GCSE)

Teaching Activities

Significance of PED with Indirect Taxes

Topic Videos