Study Notes

Monopoly Power in Markets

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 22 Nov 2021

What is a monopolistic market? This study note covers the essential of monopoly as a market structure.

Students should be able to:

- Understand the characteristics of this model and be able to use them to explain the behaviour of firms in this market structure

- Explain and evaluate the differences in efficiency between perfect competition and monopoly

- Explain and evaluate the potential costs and benefits of monopoly to both firms and consumers

What is a monopolistic market?

A monopoly in its purest form is when one single business dominates the whole market – it has 100% concentration.

The UK Competition and Markets Authority (CMA) describes a working monopoly as any firm with more than 25% of industry sales.

What is a dominant firm?

A dominant firm is one which accounts for a significant share of a given market and has a significantly larger market share than its next largest rival.

Dominant firms are typically considered to have market shares of 40 per cent or more.

What is near pure monopoly?

A near pure monopoly occurs when one firm has a market share in excess of 90 percent.

But more realistically, a near pure monopoly can exist when one seller has more than three quarters of a market defined in a certain way.

Monopoly power enjoyed by a firm depends in part on how the market is defined. Many businesses have local monopoly power, whereas others have market power at a regional or national level.

What are the key characteristics of a monopolistic market?

- Firms have market power / price-setting power (AR & MR slope down)

- Barriers to entry are high – costly to enter / long run profits maintained

- Economies of scale available to larger producers (“scaled advantage”)

- Consumers may face a limited choice of supplier and pay higher prices

- Few close substitutes reduces the cross-price elasticity of demand (XED)

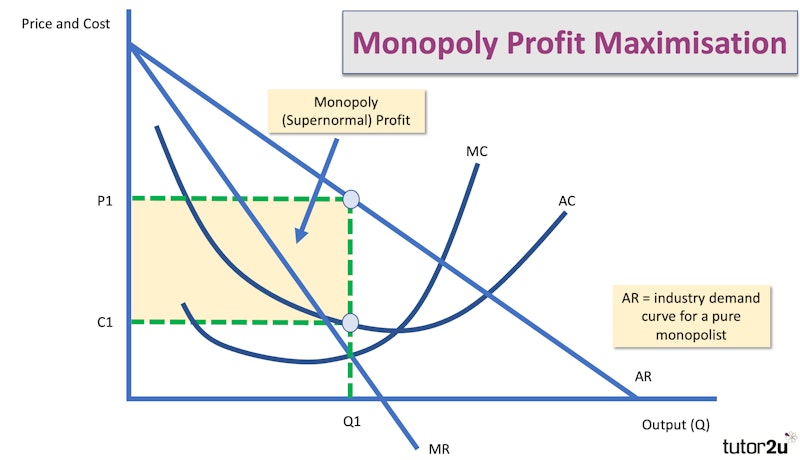

How do we show monopoly price and output using a cost & revenue diagram?

Monopoly can choose price or output but cannot choose both

They are constrained by their demand curve (AR)

What happens to monopoly profit if there is an increase in demand? (Ceteris paribus)

How can a monopolist protect their supernormal profits in the long run?

A monopolist can protect their market power and profits through barriers to entry

- Economies of scale - giving them a cost advantage over new rivals / challengers

- Vertical integration

- Brand loyalty

- Control of important platforms

- Patent protection

Some barriers are natural or intrinsic to an industry, others are strategic behaviours

Are there any important constraints on the market power of a monopolist?

- Industry regulator can investigate alleged anti-competitive behaviour

- Regulator may also impose a price-capping regime on a monopoly

- Extent of international competition can limit domestic market power

- Monopoly can still be contestable with emerging “disruptive” rivals

- Changing states of technology can threaten market power

- Ultimately demand / price elasticity of demand constrains a monopoly

You might also like

Ofwat and Regulatory Failure

13th January 2016

Innovation can challenge the digital monopolies

25th April 2018

Profits and Changes in Demand

Topic Videos

Bus fares in England to be capped at £2 per journey for 3 months

3rd September 2022

How loyalty cards influence what we buy

16th April 2023

The Baby Formula Price Trap: How Branding and Regulation Are Costing Parents

16th February 2025