Study Notes

Monetary Policy - Managing Demand

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

Monetary policy influences the decisions that we make about how much we save, borrow and spend

Decisions made by the central banks that operate monetary policy can have a powerful effect on consumers and businesses

Changes in interest rates have both demand and supply-side effects

What is Money?

Money is any asset that is acceptable as a medium of exchange in payment for goods and services. The functions of money are as follows:

1.A medium of exchange used in payment for goods and services

2.A unit of account used to relative measure prices and draw up accounts

3.A standard of deferred payment – for example when using credit to purchase goods and services now but pay for them later

4.A store of value - money holds its value unless there is a situation of accelerating inflation. As the general price level rises, so the internal value of a unit of currency decreases.

Interest rates

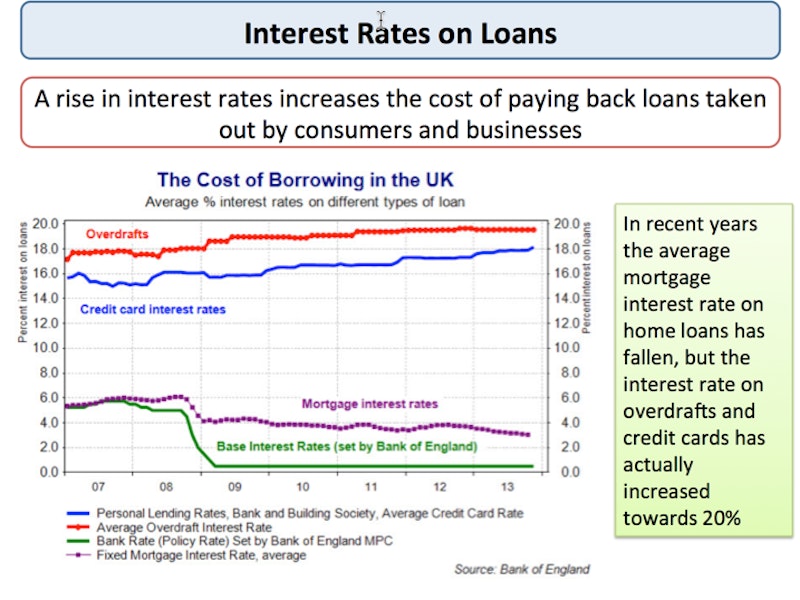

The media often talks about interest rates going up, or interest rates going doing as if there was one single or unique rate of interest in the economy. That isn't true – indeed there are thousands of different rates in the financial markets – it can get confusing!

For example we distinguish between savings rates and borrowing rates, interest rates on secured and unsecured loans and short term and long term interest rates on different forms of savings account.

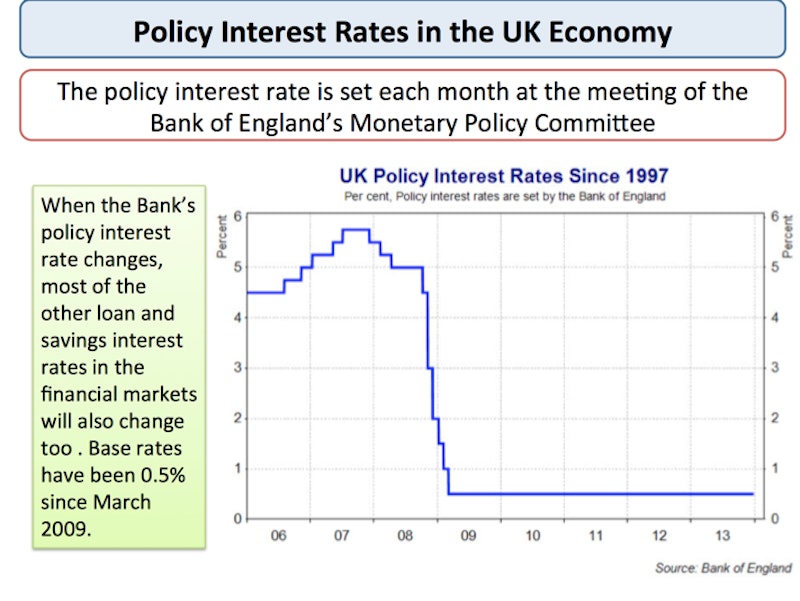

However we find that interest rates tend to move in the same direction. For example if the Bank of England cuts the base rate of interest then we expect to see commercial banks cutting the rates on their loans and lower rates are offered on savings accounts with Banks and Building Societies

The Real Rate of Interest

- The real rate of interest is important to businesses and consumers when making spending and saving decisions

- The real rate of return on savings, for example, is the money rate of interest minus the rate of inflation. So if a saver is receiving a money rate of interest of 6% on his savings, but price inflation is running at 3% per year, the real rate of return on these savings is only + 3%.

- Real interest rates become negative when the nominal rate of interest is less than inflation, for example if inflation is 5% and nominal interest rates are 4%, the real cost of borrowing money is negative at -1%.

You might also like

Japanese Economy - Abenomics

Study Notes

Payday lenders subject to an interest rate cap

17th November 2014

Should Smaller EU Countries Join the Euro?

Topic Videos

Quantitative Easing - BBC Briefing Room

30th September 2016

Real Value of Savings (MCQ Revision Questions)

Practice Exam Questions

Resources from the Reserve Bank of Australia

9th July 2018

Federal Reserve’s Interest Rate Cut: What It Means for the US Economy

18th September 2024

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails