Topic Videos

Import Quotas - KAA and Evaluation Paragraphs

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 21 Feb 2019

This short revision video looks at a sample exam answer to a question about the economic impact of increasing an import quota.

Increasing an import quota is an example of trade liberalization. A quota is an a non-tariff barrier to trade.

KAA Point 1

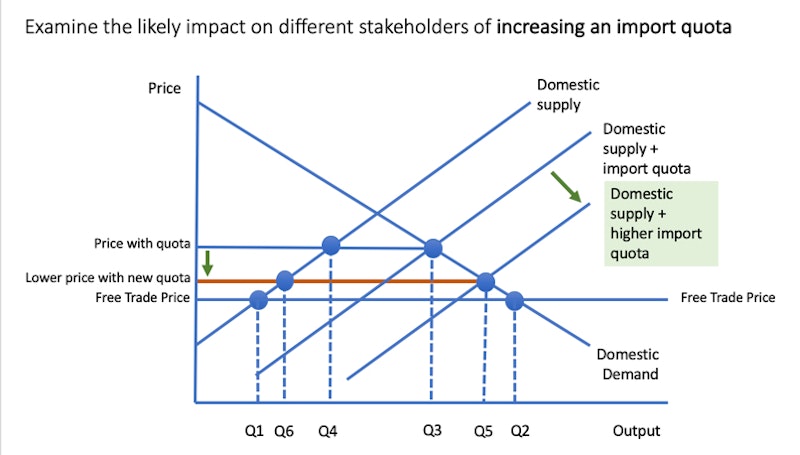

An import quota is a limit on the total quantity of imports that can be brought into a country in a given time period. It is a non-tariff barrier. A quota restricts supply leading to higher prices. For example China has a quota on Cambodian rice exports of 300,000 tonnes per year. Therefore, one consequence of increasing a quota is that competition in a domestic market will increase. Assuming that imports that can be supplied at a lower marginal cost, a greater quantity of imports will enter a country’s market. My analysis diagram shows how this is likely to lead to lower market prices and an expansion of domestic demand. This will then lead to an increase in consumer surplus causing a gain in economic welfare. Consumers will see a rise in their real incomes.

Evaluation Point 1

The extent to which consumers benefit from lower prices depends on the size of the rise in the import quota. Imports might only account for a low percentage of market demand so a relaxation of the quota might make little difference to the price paid by consumers. The impact also depends on whether this increase in quota applies to all countries to might want to sell into a country (it might be restricted to just a small group of nations).

KAA Point 2

Increasing an import quota is also likely to have an impact on domestic producers of the product to which the quota was applied. This is because a tight quota gives domestic firms protection from cheaper imports. Higher prices increases their producer surplus. Thus, one effect of increasing a quota is that the domestic market becomes more contestable. If imports can flow into the market at a cheaper price, then we might expect to see some expenditure switching effects take place. This means that consumers will shift their spending to imports and this may cause a contraction in demand for domestic output. My analysis diagram shows how this is likely to reduce revenues for domestic producers and dividends for their investors.

Evaluation Point 2

In theory domestic producers might suffer from a higher quota, but in practice they might respond by increasing labour productivity which can then help make them more cost competitive against imports. This will allow them to satisfy more of domestic demand. They might improve non-price competitiveness such as investing in product quality, design and environmental performance – these are factors that are often important to consumers.

You might also like

Options for Trade Deals if the UK Leaves the EU

24th April 2016

Is China now leading the free world?

17th January 2017

China defends higher import tariffs on sugar

25th May 2017

Agriculture and economic development

Study Notes

Trade and Economic Growth (Revision Essay Plan)

Topic Videos

Retrieval Activity - Specialisation and Trade

18th September 2022

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails