Topic Videos

Growth and Development Profile: Mexico

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 22 Dec 2019

In this new growth and development video we look at the challenges and opportunities facing the emerging market economy of Mexico.

Download the presentation on the Mexican economy using this link

We have chosen Mexico because it has reached upper middle-income status with a per capita income in excess of $17,000 a year but it is a country at risk of falling into the Middle-Income Trap which is where an economy is unable to make the next step to high income advanced country status.

Mexico is a sizeable economy and one of the largest exporting-nations in the world. But can they maintain their comparative advantage in manufacturing? How exposed are they to external shocks such as persistent trade tensions with the United States and the competitive threat from low unit labour cost countries such as Indonesia?

Quick overview on the Mexican economy

- Mexico is an OECD country

- Now upper middle income – but few countries make the transition to high income

- A manufacturing hub in the global economy with a rising share of trade to GDP

- Fierce competition in manufacturing from China and emerging Asia / Africa

- Now 9th largest export economy in the world and the 21st most economically complex

- Very high dependency on exports to the USA

- IMF Report (2019) stated that “Mexico faces three structural challenges—corruption, informality and crime.”

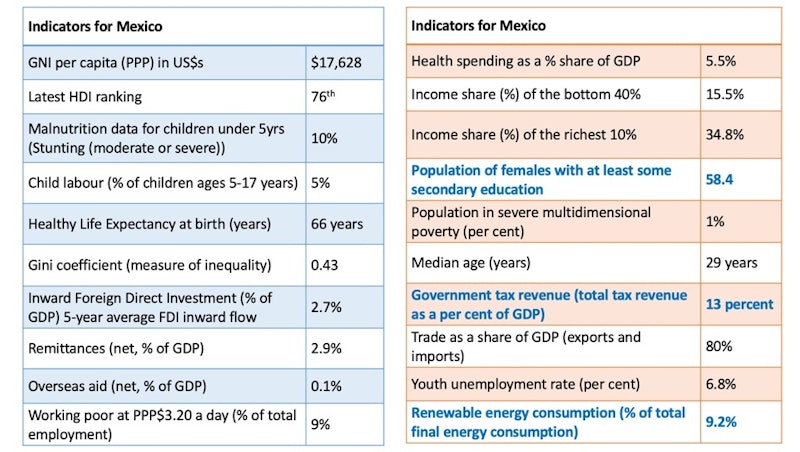

Range of key development indicators for Mexico

Key Recent Macro Data for Mexico

- Average annual real GDP growth, 2010–20 (%) 2.6%

- Inflation rate (%) 3.1%

- Unemployment rate (% of labour force) 3.3%

- Fiscal balance (% of GDP) 0.9%

- Current account balance (% of GDP) -1.9%

- External debt (external debt to GDP ratio) 36.6%

- Investment spending (% of GDP) 22%

- Gross national savings (% of GDP) 21%

Unemployment in Mexico is very low. At the end of 2018, the average unemployment rate in Mexico was 3.3%, the fourth lowest among the countries of the Organization for Economic Cooperation and Development (OECD), only behind the Czech Republic, Japan and Iceland.

Consumer price inflation is now more firmly under control – heading towards the target of 3 per cent although the Mexican central bank has recently raised interest rates to 8 per cent to control inflationary pressures.

But the economic growth rate of just over 2.5% pa over the last decade is not fast enough for a country that is hoping to reach high income status. Per capita income growth is much lower once we account of population growth.

Some economists believe that Mexico may fall into the Middle Income Trap.

The middle-income trap exists for some countries that make significant progress in reducing extreme poverty and experience structural change and growth but then find it difficult to make the climb from being a middle-income country to achieve high-income fully developed status. GDP growth rates often slow down and a country can struggle to maintain international competitiveness.

Key Background Information for Mexico

- Currency unit: Peso

- Currency system: Free floating currency

- Policy interest rate (%): 8%

- Member of a Regional Trade Agreement?: Yes including United States–Mexico–Canada Agreement

- Main corporate tax rate (Per Cent): 30%

- Competitiveness Ranking (World Economic Forum): 48th / 141 countries

- Corruption Perception Ranking (Transparency International): 138th / 180 countries

- Ease of Doing Business Ranking (World Bank): 60th in 2018 out of 190 countries (54th in 2017

Mexico’s exposure to shocks

- Protectionism: E.g. US threat to levy import tariffs on Mexico in the absence of measures to curb cross-border migration

- Lower oil prices and oil production – Pemex is Mexico’s biggest company and is the most heavily indebted company in the world – their debts amount to 9% of Mexican GDP

- Natural disasters: Mexican territory is highly exposed to natural disasters such as earthquakes, droughts, cyclones, hurricanes and floods.

Importance of remittances for Mexico

- Remittances into Mexico were worth $230 per capita in 2017. In 2018, 94% of these flows originated in the United States.

- The bulk of remittances flow to Mexican households in the bottom forty percent of the income distribution

- Flow of remittances is strongly associated to the performance of the USA economy.

- Depreciation in Mexican peso v US dollar increases the value of $ remittances sent back to Mexico

- Several FinTech start-ups are engaged in trying to lower the cost of remittance transfer.

Importance of foreign direct investment for Mexico

- Since 2005, Mexico has received, on average, US$28 billion in inward FDI a year (worth 3 percent of GDP) or 12% of total investment.

- Mexico is ranked 54th out of 190 in the World Bank's 2019 Doing Business ranking

- Foreign investments are mostly concentrated in towns neighbouring the U.S border (where many assembly factories are located)

- Examples of companies with investment in Mexico - IBM, Coca-Cola, Motorola, Walmart, Procter & Gamble and L'Oreal

- Some critics argue that much of the FDI into Mexico has centred around assembly of manufactured products such as cars rather than FDI which acts as a catalyst for increased research & development and innovation.

Examples of current growth policies for Mexico

- Modernize road infrastructure and expand the train network

- Improve urban infrastructure and expand / improve housing quality

- Promote tourism and expand microcredit

- Expand and unify healthcare and raise the minimum wage

- Introduce guaranteed minimum prices for small producers of five agricultural products

- Create a carbon emissions trading scheme to promote clean energy (alongside a carbon tax)

Using Mexico as applied context in your economics exams

- Can Mexico escape the “Middle Income Trap”?

- Evaluate the impact of large inflows of remittances

- Very low female labour market participation – examine the possible impact on economic growth

- Dual economy – Mexico’s large informal sector – consider why this is a structural barrier to growth

- Evaluate the benefits and drawbacks of Mexico operating with a free-floating exchange rate

- Mexico collects only 13 percent of GDP in tax revenues.Examine the impact of this for Mexico.

- Perceived corruption is the highest in the OECD – assess the impact on the Mexican economy

- High dependence on one economy - In 2018, the U.S. was the origin of 38% of FDI in Mexico and the source of 94 percent of remittances. Are remittances a benefit to Mexico in the long run?

You might also like

Macroeconomic Profile for Mexico

13th March 2016

African Free Trade Agreement (Chain of Analysis)

Practice Exam Questions

Growth and Development Profile: Bangladesh

Topic Videos

How coronavirus has rocked India's economy

21st December 2020

Globalisation - Lego to build $1bn factory in Vietnam

9th December 2021

Growth and Development Country Profile - Vietnam

Topic Videos

Is the Chinese economy a ticking time bomb?

31st August 2023