Study Notes

Sugar (Soda) Taxes (Government Intervention)

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 8 Jan 2020

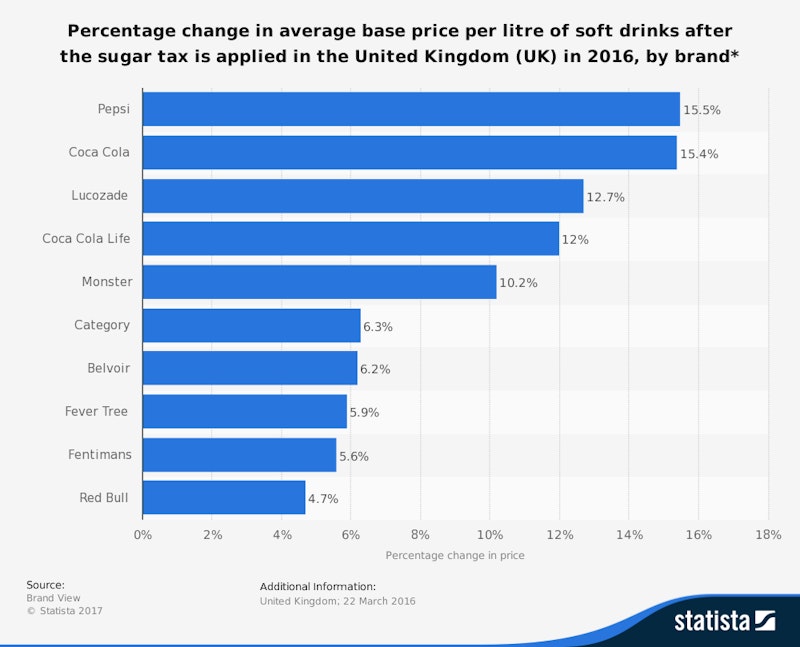

In 2018, the UK government introduced a tax on high-sugar drinks and some campaigners are lobbying for this indirect tax to be extended to other foods including snacks and cereals that have a high sugar content.

Is this an effective and equitable form of government intervention in a market to achieve desired changes in consumer behaviour? This study note brings together some useful resources on the issue. We have a collection of curated articles and study notes on the economics of a sugar tax available from this link.

Arguments in favour of a sugar tax:

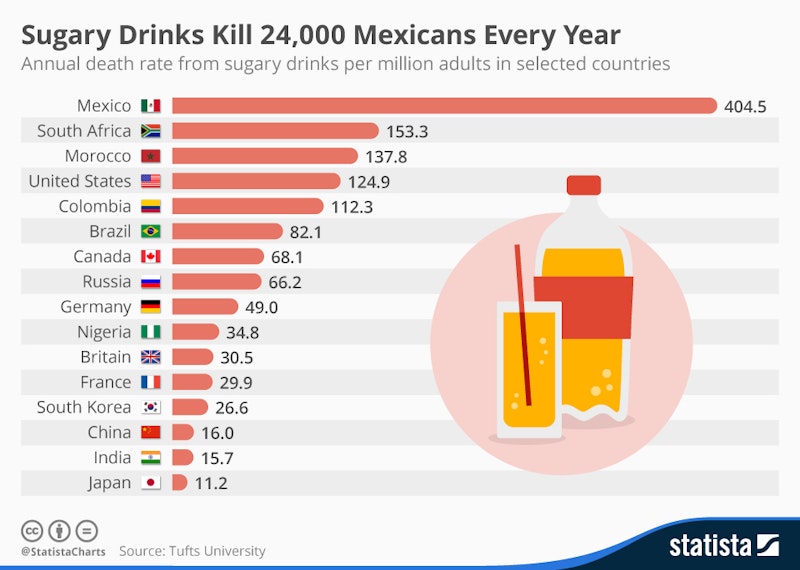

- External costs of sugary drinks – externalities are a cause of market failure

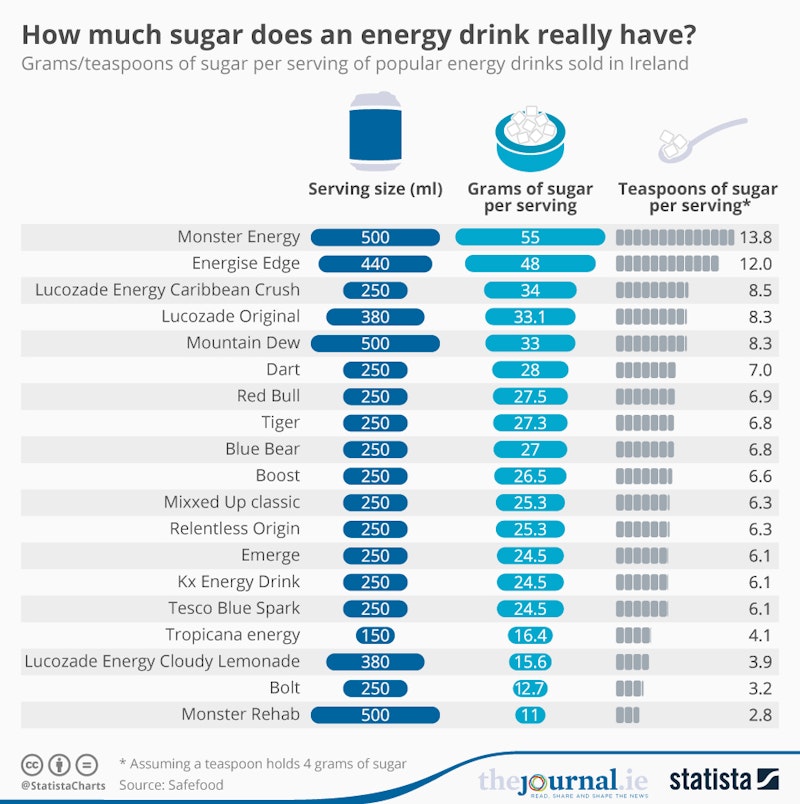

- Information failures – people often under-estimate the long term costs to their own healthcare of eating high sugar foods and drinks

- Sugar tax raises revenue – this might be ring-fenced for other projects such as increased funding for school and community sports facilities

- Tax encourages producers to re-formulate drinks - i.e. make them healthier by reducing the sugar content. There is substantial evidence that this has happened with high sugar drinks.

Independent: 20% snack tax could have huge impact on UK obesity (2019)

BBC: Efforts to cut sugar out of food way off target

Points against the introduction of a sugar tax

- Might be regressive on lower income families i.e. they face a higher burden from the tax

- Other policies might be more effective in cutting consumption in the long run

- People might simply switch to other sugary products

- Risk of lost jobs in pubs and shops that rely heavily on drink and confectionery sales

You might also like

Preventing sunburn by changing habits

7th September 2015

Financial Market Failure (Financial Economics)

Study Notes

Evidence based policies are often built on sand

2nd August 2017

Pork Barrel Politics and the Principal Agent Problem

7th February 2018

Indirect Taxes

Topic Videos

Subsidies - 2021 Revision Update

Study Notes

Welfare Loss from Monopoly Pricing

Topic Videos

Bus fares in England to be capped at £2 per journey for 3 months

3rd September 2022

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails