Study Notes

Peer to Peer Lending (Financial Economics)

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 21 Mar 2021

Peer-to-peer lending happens when individual savers are able to lend directly to borrowers, often through online peer-to-peer lending platforms.

Market participants include Zopa (launched 2005), Crowdcube (launched 2009), Funding Circle (launched 2010), Rate Setter (also launched 2010) and Thincats (launched 2011).

Both the investor and the borrower benefits as the lender achieves higher interest rates and the borrower lower interest rates than would be on offer if either had gone through a commercial bank.

Lenders are at more risk because loans are generally unsecured – the risk of borrower default is higher

Individuals can choose the level of risk they are prepared to tolerate – the higher risk loans offer a better rate of interest

Funding Circle

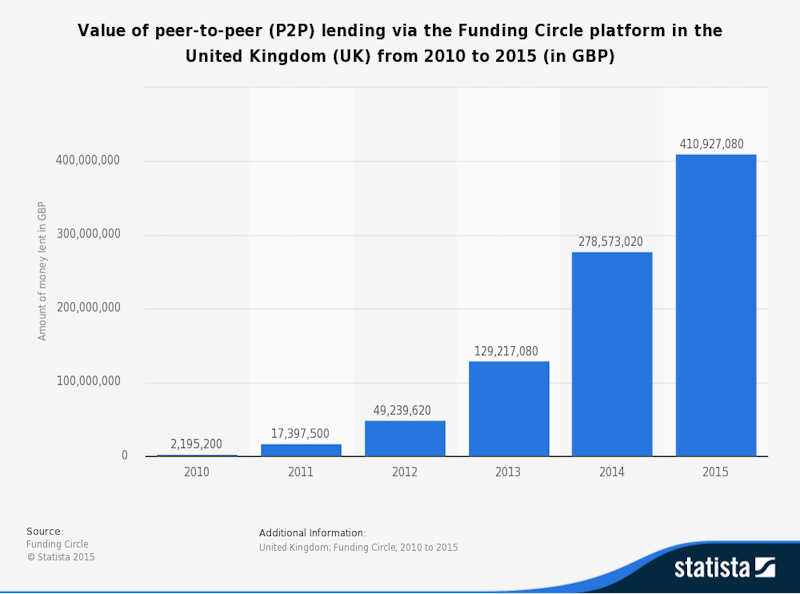

Funding Circle is a peer-to-peer lending platform that allows investors to lend money directly to small & medium-sized businesses. Funding Circle is the largest P2P lender in the UK.

You might also like

The Trouble with Financial Bubbles

20th October 2015

Financial Economics - Introduction to Money and Finance

Teaching PowerPoints

Crowdfunding (Financial Economics)

Study Notes

What are Commercial Banks? (Financial Economics)

Topic Videos

Investment Banks (Financial Economics)

Study Notes

Green Bonds

Topic Videos

Financial Times - Bank Failures in 2023

27th December 2023

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails