Study Notes

Exchange Rates - Competitive Devaluations

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

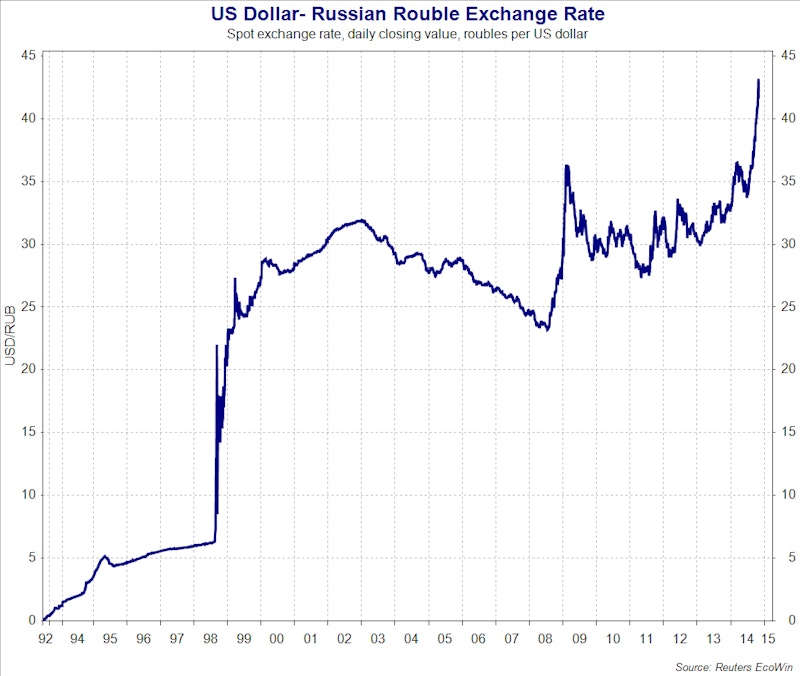

Competitive devaluations occur when a country deliberately intervenes to drive down the value of their currency to provide a competitive boost to demand and jobs in their export industries.

Competitive Devaluations / Dirty Floats

Motivations for a competitive devaluation of a currency

- They may try this when faced with a deflationary recession or to attract extra foreign investment

- For nations with persistent trade deficits and rising unemployment a competitive devaluation of the exchange rate can become an attractive option - but there are risks

- Devaluing an exchange rate can be seen by other countries as a form of trade (or crisis) protectionism that invites some form of retaliatory action

- Cutting the exchange rate makes it harder for other countries to export their goods and services hitting their circular flow.

One of the reasons as to why the 1930s Great Depression lasted so long was that countries acted independently to protect their own interest by undermining their currencies. Ultimately a competitive devaluation provides only a temporary boost to competitiveness. A policy of holding down an exchange rate can be costly.

For many years the International Monetary Fund (IMF) has tried to help countries coordinate their trade and foreign exchange policies in order to prevent repeated devaluations. The 1976 revision of Article IV of the IMF charter was written to avoid "manipulating exchange rates...to gain an unfair competitive advantage over other members

You might also like

Can Denmark Succeed Where Switzerland Failed?

3rd February 2015

Beyond the Bike - photos of the week

24th September 2015

Effects of a Currency Depreciation

Topic Videos

Currency Intervention (Chain of Analysis)

Exam Support

Currency Systems

Topic Videos

2022 Exams - Key Statistics on the UK Economy

Topic Videos

Sterling and the UK Economy

30th November 2022

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails