Exam Support

Trade Agreements - Exam Question Walkthrough for Edexcel A-Level Economics

- Level:

- A-Level

- Board:

- Edexcel

Last updated 3 Oct 2021

Trade agreements are the focus of this video where we walkthrough some suggested responses to short-answer exam questions for Edexcel A-Level Economics.

Extract 1: UK and Singapore agree a free trade deal

Singapore and the UK signed a free trade deal in December 2020. The deal will cover trade worth more than $22bn (£17bn). The agreement removes import tariffs by 2024 and gives both countries access to each other's markets in services.

It will also cut non-tariff barriers for electronics, cars and vehicle parts, pharmaceutical products, medical devices and renewable energy generation.

The agreement mirrors the EU-Singapore Free Trade Agreement which entered into force in 2019

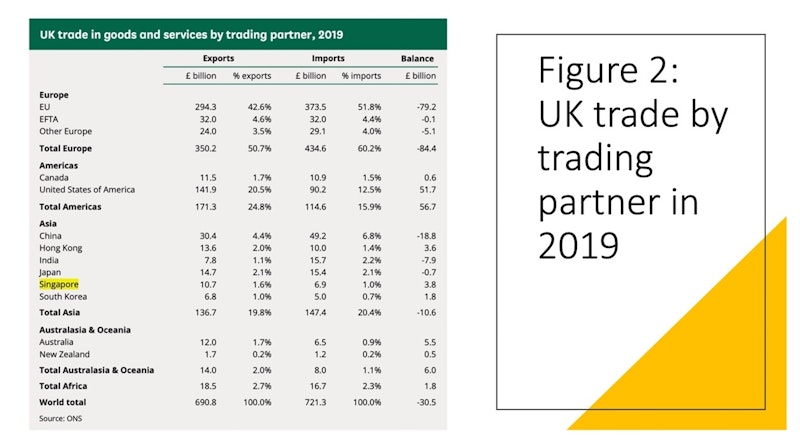

Singapore is the United Kingdom's 16th biggest trade partner outside the EU. The UK exported £10.7bn of goods and services to Singapore in 2019 and imported £6.9bn worth products giving the UK a trade surplus of £3.8bn in 2019.

Questions:

Distinguish between tariff and non-tariff barriers to trade (2)

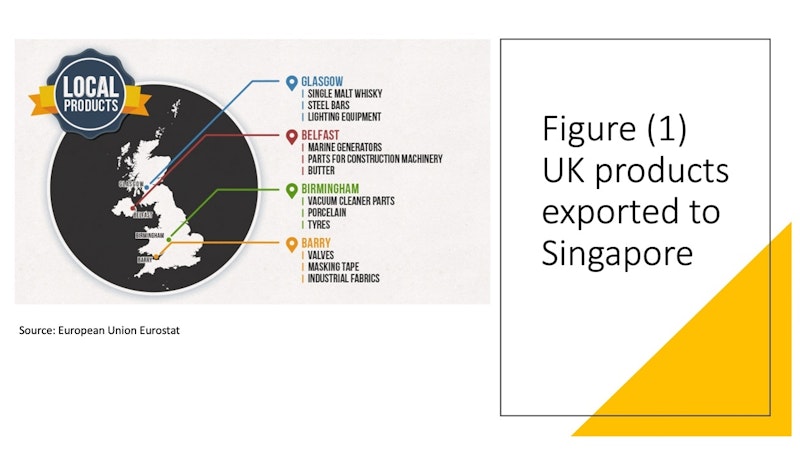

With reference to the theory of comparative advantage and Figure 1, explain how this trade agreement may increase the GDP of both the UK and Singapore (5)

With reference to the extracts and your own knowledge, assess the importance of free trade deals to the UK economy (10)

Q: Distinguish between tariff and non-tariff barriers to trade (2 marks)

Tariffs are a tax paid on a product that is imported. This tax adds directly to the costs of trade, increasing the price of goods and services traded across borders.

Non-tariff barriers are administrative, technical and regulatory obstacles to trade such as labelling requirements and product specifications.

Q: With reference to the theory of comparative advantage and Figure 1, explain how this trade agreement may increase the GDP of both the UK and Singapore (5 marks)

Comparative advantage is a theoretical idea that suggests countries specialise in and then export products in which they have a relative cost advantage where the opportunity cost of specialisation is lower than another country. For example, Figure 1 suggests that whisky producers in Glasgow are exporters to Singapore perhaps because their unit costs of supply are lower. Exports are an injection of demand into a country’s circular flow which leads to an increase in AD for the UK and ultimately a higher real GDP. For Singapore, trade is also beneficial. They can import products such as whisky and vacuum cleaner parts for a lower supply price than their domestic manufacturers can achieve. This effectively increases their real incomes and releases productive resources into industries where they have a comparative advantage over the UK. In this sense, there are mutual gains from trade.

Q: With reference to the extracts and your own knowledge, assess the importance of free trade deals to the UK economy (10 marks)

KAA Point 1:

Having left the European Union Customs Union and Single Market, the UK is now seeking to sign trade deals with many countries so that trade in goods and services (which accounts for nearly 70% of UK GDP) can continue to be a driver of economic growth. Free trade deals offer an opportunity for import-tariff free access to markets of high-income countries such as Singapore (where Extract 1says the UK runs a trade surplus of £3.8bn) and South Korea which has been one of the fastest-growing and mostsuccessful economies in Asia in recent years. Exports are part of aggregate demand (C+I+G+X-M) and expanding the value of exports via trade agreements helps to stimulate real GDP growth year-on-year.

Evaluation Point 1:

However, whilst trade deals with countries such as Singapore, Japan and South Korea are important, they merely replicate or mirror trade deals that the UK enjoyed inside the European Union. Figure 2 shows that trade with Asia accounts for under 20% of UK trade whereas trade with the EU remains above 40% of GDP. The UK has left one of the biggest single markets in the world and many small businesses especially food producers are finding that the extra cost of meeting non-tariff barriers is creating extra trade frictions that makes exporting less profitable. This could then damage the UK’s growth prospects.

KAA Point 2:

Another advantage of free trade deals is that open trade largely free from import tariffs is an important source of employment not just for export sectors themselves such as masking tape manufacturers in Wales and marine generators in Northern Ireland (Figure 1) but also in industries such as trade finance, trade insurance and logistics. Many economists believe that there is a strong, positive trade multiplier effect from free trade deals. This is because exports that use a high percentage of locally-sourced components and provide well-paid jobs to domestic workers generate factor incomes in local and regional economies which helps to improve living standards and level up some regional inequalities.

Evaluation Point 2:

However, in practice, the size of the trade multiplier for a country such as the UK depends on the marginal propensity to import (MPM). In a globalized economy, manufacturers import component parts and raw materials from around the world. So, although UK exporter can benefit from free trade deals, tariff-free deals also allow for the cheaper imports of inputs. A high marginal propensity to import lowers the value of the export multiplier. And free trade deals with non-EU countries might also threaten some jobs in the UK and risk rising structural unemployment now that the UK is outside of the protection of the EU customs union’s common external tariff.

You might also like

26 Nation African Free Trade Area Planned

22nd May 2015

Beyond the Bike - lesson resource on development in landlocked countries

15th October 2015

Trump's Tariff Threat - Bad News for US Sneaker Lovers

23rd December 2016

Trade in Sub Saharan Africa Short Answers

Topic Videos

How tariffs could shake-up the US car industry

9th August 2018

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails