Topic Videos

A* Exam Technique: Potential benefits of FDI for developing countries

- Level:

- A-Level, IB

- Board:

- Edexcel

Last updated 26 Jan 2020

Here is an A* example of using chains of reasoning and evaluation to help answer a 25 mark question on the potential benefits of FDI for developing countries.

Foreign direct investment

Foreign direct investment (FDI) inflows to developing countries in Asia rose by 3.9% to US$512 billion in 2018, according to UNCTAD’s World Investment Report 2019. Growth occurred mainly in China, Hong Kong (China), Singapore, Indonesia and other countries that belong to the Association of Southeast Asian Nations, as well as India and Turkey. The region remained the world’s largest FDI recipient, absorbing 39% of global inflows in 2018, up from 33% in 2017. Asia also hosts more than 4,000 special economic zones - three quarters of the world total.

(Source: UNCTAD)

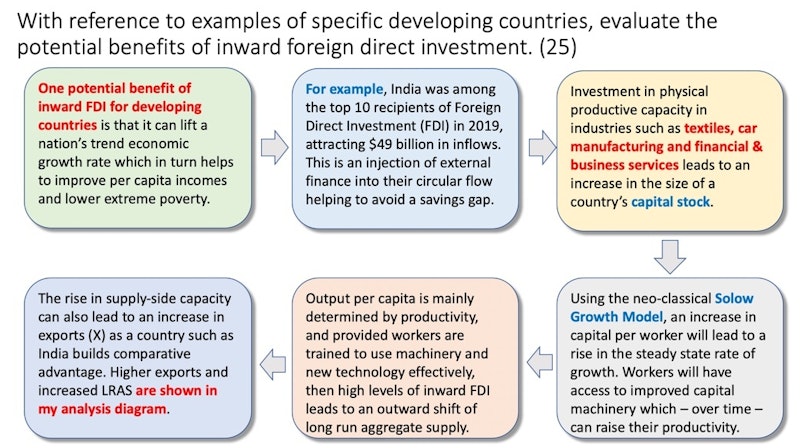

Question: With reference to examples of specific developing countries, evaluate the potential benefits of inward foreign direct investment. (25)

One potential benefit of inward FDI for developing countries is that it can lift a nation’s trend economic growth rate which in turn helps to improve per capita incomes and lower extreme poverty. For example, India was among the top 10 recipients of Foreign Direct Investment (FDI) in 2019, attracting $49 billion in inflows. This is an injection of external finance into their circular flow helping to avoid a savings gap. Investment in physical productive capacity in industries such as textiles, car manufacturing and financial & business services leads to an increase in the size of a country’s capital stock. Using the neo-classical Solow Growth Model, an increase in capital per worker will lead to a rise in the steady state rate of growth. Workers will have access to improved capital machinery which – over time – can raise their productivity. Output per capita is mainly determined by productivity, and provided workers are trained to use machinery and new technology effectively, then high levels of inward FDI leads to an outward shift of long run aggregate supply. The rise in supply-side capacity can also lead to an increase in exports (X) as a country such as India builds comparative advantage. Higher exports and increased LRAS are shown in my analysis diagram.

Cambodia has attracted inward FDI in recent years. In 2018, FDI of $3.6bn was 12% of their GDP which is a significant figure for a country with ambitions to become an upper middle-income country by 2030. Cambodia’s per capita GNI is $3,300 and although the country is growing by 7% pa, their domestic savings rate is only 13% compared to a gross investment ratio of 23%. FDI into industries such as tourism and garments can help create formal employment especially for women. There are now over 800,000 female garments jobs; this has been a big contributor to rural-urban migration within Cambodia. A rise in employment and incomes from new jobs created by FDI can have a direct benefit to human development outcomes whilst also addressing gender disparities for a young and fast-growing population. In Cambodia, only 15% of females have secondary education and levels of stunting among children under five remain high. Formal jobs e.g. in textile manufacturing can help improve basic nutrition & access to schooling. In this sense, FDI can contribute both to stronger economic growth but also lowering poverty.

Evaluating the potential benefits of FDI

- Foreign multinationals might take advantage of weak laws on environmental protections

- Multinationals (e.g. clothing companies) have been criticised for poor working conditions in foreign factories when outsourcing production

- Profits from FDI are often repatriated to shareholders in the host country (an outflow from the circular flow)

- Multinationals may only employ local labour in lower-skilled jobs rather than skilled, managerial roles

- The share of locally sourced components for FDI projects is often relatively low – this reduces the multiplier effect of inward investment.

Examples of final reasoned comments:

The impact depends on whether inward FDI is sustainable in the long run. For example, many Chinese textile manufacturers invested heavily in Thailand, but rising unit wage costs mean that they can easily relocate to Indonesia or Bangladesh where labour costs are lower.

In theory, inward FDI is beneficial to both AD and LRAS for countries such as Cambodia, but in practice FDI might be too heavily dependent on Special Economic Zones which then limits the tax revenues that the government receives. Investment and production designed for export also makes a country vulnerable to global economic shocks such as a trade war.

You might also like

Why some countries grew rich

16th February 2015

Building Capabilities - Car Manufacturing in Ghana

13th July 2015

FDI and LRAS: Microsoft to open UK data centres

10th November 2015

Beyond the Bike Lesson Resource - dictators and their economic legacy

26th February 2016

Harnessing FDI in Africa

2nd September 2016

Should Zambia ban food imports?

15th April 2017

New World Bank country classifications by income level are published

10th August 2022

2.2.3 Investment (Edexcel)

Study Notes

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails