Study Notes

Exam Answer: Internal and External Devaluation

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 18 Apr 2019

Here is a suggested answer to this exam question: "Explain the difference between internal devaluation and external devaluation" We also evaluate some of the risks associated with each form of devaluation.

Internal devaluation

Internal devaluation happens when a country seeks to regain and improve price competitiveness through lowering their wage costs and increasing productivity and not reducing the external value of their exchange rate.

Good examples of internal devaluation in recent years have applied to Latvia (a Baltic State) and Greece, in the wake of a very severe depression which followed the Global Financial Crisis. Ecuador is also implementing internal devaluation at the moment.

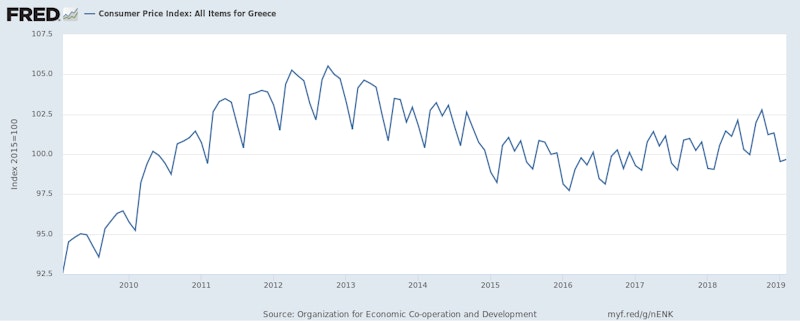

An internal devaluation requires several years of low relative inflation i.e. a country’s inflation rate lies below price increases in other countries. In the case of Greece, this involved a period of price deflation i.e. a negative rate of inflation.

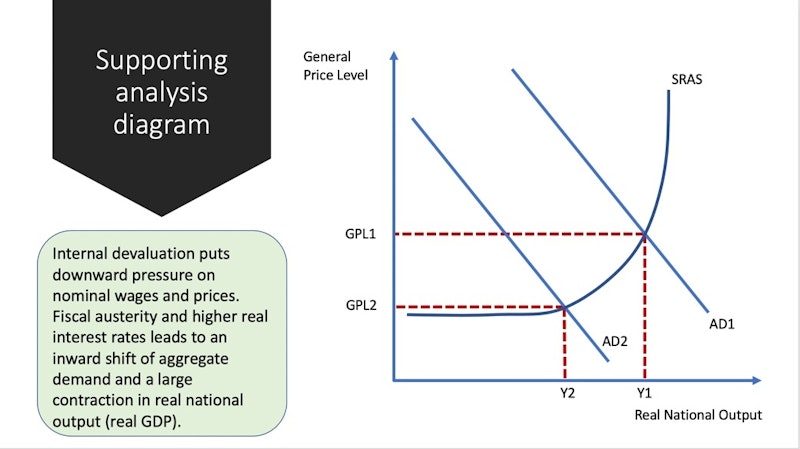

Internal devaluation can be brought about by fiscal austerity (via higher taxes and cuts in government spending) and/or a sharp rise in real interest rates – both of which impose deflationary pressure on output & prices.

Internal devaluation is more likely to happen with a country that has a fixed exchange rate e.g. Ecuador has a fixed rate against the US dollar. Greece is inside the Single European Currency zone and cannot devalue unilaterally.

External devaluation

An external devaluation happens when a country operating with a fixed or semi-fixed exchange rate system decides to deliberately lower the external value of their currency against one or a range of other currencies.

A devaluation of the currency means adomestic currency buys less of a foreign currency. One motivation is to make exports more price competitive in overseas markets and to make imports relatively more expensive than domestic supply.

Linked aims might include reducing the size of a trade deficit and also to cut the real value of sovereign. Debt owed to international creditors. In theory, currency devaluation is a fast way of improving price competitiveness than an internal devaluation.

Examples of countries that have devalued in recent years include Egypt (a 16% fall versus the US$ in 2016) and Ghana whose currency was devalued by 17% against the US dollar in 2019.

Evaluation: Risks with internal and external devaluation

Internal devaluation

- Severe loss of output and rising unemployment

- Fall in nominal wages reduces living standards

- Risks from sustained price deflation

- Real value of debt increases

- Danger of a country suffering a permanent loss of output (known as “hysteresis”)

External devaluation

- Increase in cost-push inflation from higher import prices

- Reduces real incomes

- No guarantee that the trade deficit will improve (J Curve theory)

- Foreign creditors will demand higher interest rates on new issues of government & corporate debt

- Currency uncertainty makes country less attractive to inward FDI

You might also like

Measuring the Balance of Payments

Study Notes

Exchange Rates - Competitive Devaluations

Study Notes

Economics of Internal Devaluation

Topic Videos

Difference between Depreciation and Devaluation

Topic Videos

Explaining the J Curve

Topic Videos

Exchange Rates (Online Lesson)

Online Lessons

Argentina’s Austerity Gamble: Inflation Drops, But Poverty Soars

2nd October 2024

Protectionism’s Price: Trump’s Tariffs and the UK Economy

6th November 2024