Study Notes

European Union Enlargement

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

The expansion of the EU to embrace more countries has been perhaps the most important development in Europe in many years. Since 1957 then there have been six main waves of enlargement.

- 1973 (UK, Ireland and Denmark)

- 1981 (Greece)

- 1986 (Portugal and Spain)

- 1995 (Austria, Finland and Sweden)

- 2004 (Latvia, Lithuania, Cyprus, Malta, Slovenia, Slovakia, Estonia, Hungary, Czech Republic, Poland)

- 2007 (Bulgaria and Romania)

- 2013: (Croatia)

For new EU members the opportunities of participating in the EU single market have been centered on attracting high levels of inward investment, and promoting their economic development through free trade access to the higher income consumers of advanced EU nations. The Central and Eastern Europe (CEE) region experienced a five-fold increase in foreign direct investment (FDI) inflows between 2003 and 2008, rising from US$30 billion to US$155 billion – although much of this went to Russia which is outside of the EU. Inward investment was particularly attracted to countries with low relative unit labour costs in manufacturing and where expected growth of per capita incomes was high.

In addition they have been recipients of EU funding -- which have financed road construction, environmental clean-up schemes, job training and other supply-side projects.

How has EU enlargement affected the UK economy?

The UK government has for many years championed the further expansion of the EU single market. It favours bringing more countries into the European Union partly because of a belief that the UK's own economic performance can improve as a result (economists term this a “positive-sum game").

Among the benefits cited from having more countries within the market here are four key ones:

- Export Potential: There are trade creation effects from increasing the size of a customs union. Britain can now source some of her imports of goods and services more cheaply leading to an improvement in her terms of trade. The efficiency of the economy should increase as resources are diverted to areas of the UK's comparative advantage.

- Exploitation of economies of scale from supplying to a larger market: As the size of the European market increases and accession countries become richer creating new demand for goods and services. For example, the value of British exports to Poland (at current prices) has more than doubled since Poland's accession to the EU in 2004.

- Foreign Investment and Incomes and Profits: Foreign investment by British firms into Europe's newest states will provide a flow of interest profits and dividends thereby boosting our GNP and supporting the current account of the balance of payments. FDI will also help to speed up the economic transformation of Europe's new countries.

- A more diverse European labour market: There are now greater opportunities for British businesses to import lower-cost skilled labour in areas where there are labour shortages. The migration of labour from accession countries was larger than many economists predicted in 2004 but during the strong growth years of 2005-2008, inward migration into the UK helped to offset some of the longer-term effects of ageing populations and the slow growth of the population of working age. It kept wage inflation and consumer price inflation lower than would otherwise be the case and may have contributed to a higher level of potential national income.

Risks of EU Enlargement for the UK

- Extra budgetary costs for financing EU programmes – most of the new member states of the EU are relatively poor in terms of real GDP per capita and the EU has raised the size of their spending on cohesion funds much of which has been targeted at relatively poorer countries and regions.

- Social and economic pressures from inward labour migration

- A shift of foreign direct investment and jobs to Eastern Europe – partly driven by tax competition and by lower unit labour costs.

Case Study: Croatia Joins the European Union

Croatia joined the European Union on the 1st of July 2013 as its 28th member. It is be the second ex-Yugoslav state to become an EU member after Slovenia, which joined in 2004.

- Population (millions) 4.6

- GDP per capita (US$) 14,457

- Croatia was badly hit by the global financial crisis and GDP remains well below the level achieved in 2007.

- From 2008 to 2012, the economy shrank by 11%

- Unemployment is persistently high and has been above 20% of the labour force for some time

- The Croatian government has run a fiscal deficit of over 4% of GDP for several years and public debt as a % of GDP has climbed to more than 60%.

Accessing the EU single market

In the medium term, full access to the single market, increased investor confidence and stronger financial integration should boost the economy – provided that Croatia manages to implement overdue structural reforms, in particular tackling a rigid labour market, an overblown public sector and a weak business climate. Croatia's accession will only have marginal effects for the EU economy as a whole. Croatia will be the 9th smallest country in the EU by GDP size at 0.34% of the total. Its population will account for 0.87% (8th smallest). The Croatian GDP per capita (in PPS) in 2011 amounted to 61% of the EU27 average.

Trade integration with Europe

27% of Croatian exports are sold to Germany and 17.5% to Italy. Overall, 60% of exports go to members of the single currency area. It is highly unlikely that Croatia will join the single currency in the near future. The Croatian currency, the kuna, is informally pegged to the euro. With around 70% of loans and above 60% of deposits denominated in or linked to foreign currency

Competitiveness Challenges

Structural problems lie at the root of Croatia's medium term problems. These include a low diversification of Croatia's exports, which mainly rely on shipyards as well as (a strong) tourist industry, two strongly pro-cyclical sectors. The competitiveness of Croatia is low, reflecting in particular rigidities in the labour market, an overblown public sector, and a weak business climate. Labour costs are relatively high compared to productivity. According to the European Commission, the shadow economy could account for 40% of GDP.

Global competitiveness rankings for 2013 (out of 144 countries surveyed)

- Infrastructure 44/144, Health and primary education 60/144

- Goods market efficiency 114/144, Labour market efficiency 106/144

Access to EU funds

Now that the country is part of the EU single market, Croatia will gain access to the Cohesion Fund, the Structural Fund and the European Fisheries Fund. The total sum of approved funds for Croatia amounts to 1.5% of their GDP.

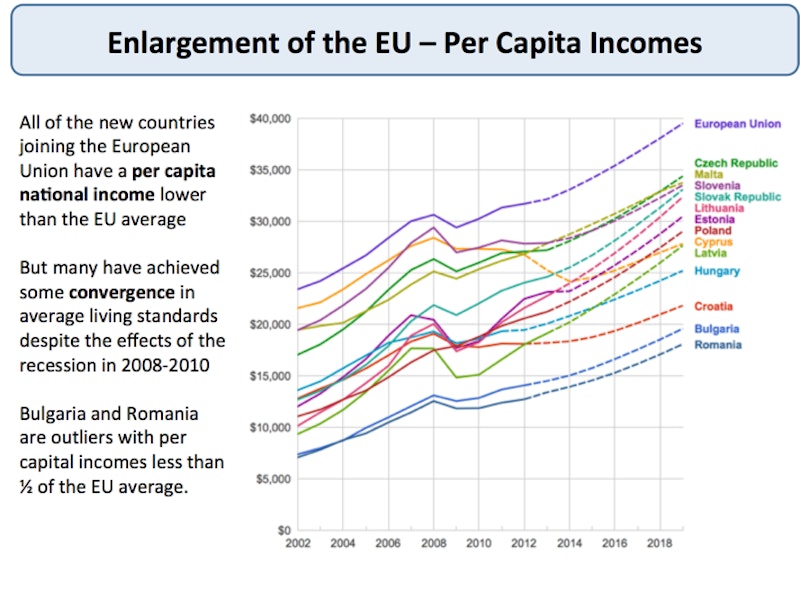

Changes in PPP per capita income for the EU's newer member nations

Enrichment reading

How much do countries benefit from membership in the European Union? http://www.voxeu.org/article/how-poorer-nations-be...

You might also like

Transatlantic Trade and Investment Partnership

Study Notes

Economic Principles of the Refugee Crisis

10th September 2015

Economics After Brexit - Immigration and the Single Market

21st August 2016

Apple faces an £11n corporation tax bill from the EU

30th August 2016

Brexit

Study Notes

EU agrees biggest free trade deal with Japan

10th December 2017

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails