Exam Support

Economies of Scale - Worked Essay Answer

- Level:

- A-Level

- Board:

- Edexcel

Last updated 15 Oct 2020

Here is an essay plan for a question examining whether economies of scale benefit firms and their shareholders more than consumers.

KAA 1

IEoS occur when there are increasing returns from expanding the scale of production in the long run leading to lower LRAC.

For a business such as Netflix with over 150 million subscribers in 2019, one IEoS is making full use of technical economies such as huge capacity servers to stream their new content.

This leads to a fall in LRAC as new users are added to their network because the marginal cost of an extra subscriber is low and average fixed costs will decrease. As a result Netflix can move down the LRAC curve towards the minimum efficient scale.

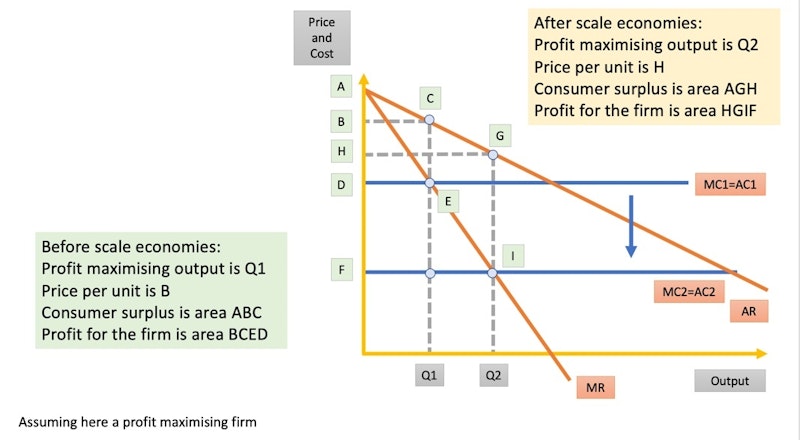

My analysis diagram shows the impact this has on producer surplus shown by rising levels of profit (P-AC)Q. Consequently Netflix will see a rise in profits – which depending on the strategic objectives of management - can lead to increasing dividends and a rising share price for equity-holders.

Evaluation 1

Whilst in theory, it is shareholders who benefit most from IEoS, in practice consumers might also gain.

This is because a fall in LRAC gives a business the opportunity to lower prices.

For example, the German supermarket chains Aldi and Lidl have expanded at a fast pace using their monopsony power to achieve commercial economies of scale from food manufacturers and growers.

This means they can cut prices in the stores which brings about an increase in consumer surplus (again shown in my diagram).

Price discounting is particularly important for families on below-average incomes with low savings and who are vulnerable to higher interest rate unsecured debt.

So one can argue that economies of scale which ultimately make many household products more affordable can have a progressive effect on social welfare.

KAA 2

A second benefit of IEoS for companies and shareholders is that scaling production can lead to increased market power.

This is because investing in large scale capital machinery (for example in mobile phone networks and industrial farming) allows a firm to grow market share at the expense of competitors.

As a result, if market power grows, then a firm will have stronger pricing power which – in theory – will bring higher operating profits. Netflix has gradually increased monthly subscription prices in the UK.

These profits can then be used to help prevent the entry of new rival suppliers.

For example, mobile phone operators might sacrifice some profits in a price war if a credible new entrant tries to take away market share.

As a result, consumers will not benefit because a monopoly will develop. Some economists argue that giant digital platform businesses such as Facebook and Google fall into this category.

Evaluation 2

However one can argue that consumers benefit from the high profits of scaled business.

This is because businesses can reinvest profits into investment. For example, Netflix puts $s billions into new content each year. And telecoms firms are investing heavily into 5G networks.

As a result, consumers can benefit from faster download speeds and increased quality of products.

Economists would call this an improvement in dynamic efficiency.

Provided there is sufficient competition in an industry, prices will be kept low and indeed might fall in real terms if enough firms can utilize economies of scale.

In this way, the balance of benefit might tilt away from shareholders towards consumers.

You might also like

Economic Efficiency Revision Quiz

Quizzes & Activities

Monopoly - Key Terms

Study Notes

Buns, Tax and Zero-Hours

29th August 2015

Uber rival to road test driverless vehicles

7th May 2016

The Journey of an iPhone from Factory to Retail Store

29th December 2016

Monopoly (Online Lesson)

Online Lessons

4.1.4.5 Long Run Production (AQA A-Level Economics Teaching PowerPoint)

Teaching PowerPoints