Topic Videos

Economies of Scale and Profits

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 30 Sept 2018

Here is a suggested answer to this question: "Analyse and evaluate the causes of and significance of economies of scale for the profitability of businesses such as Netflix, Amazon and Uber.

Point 1

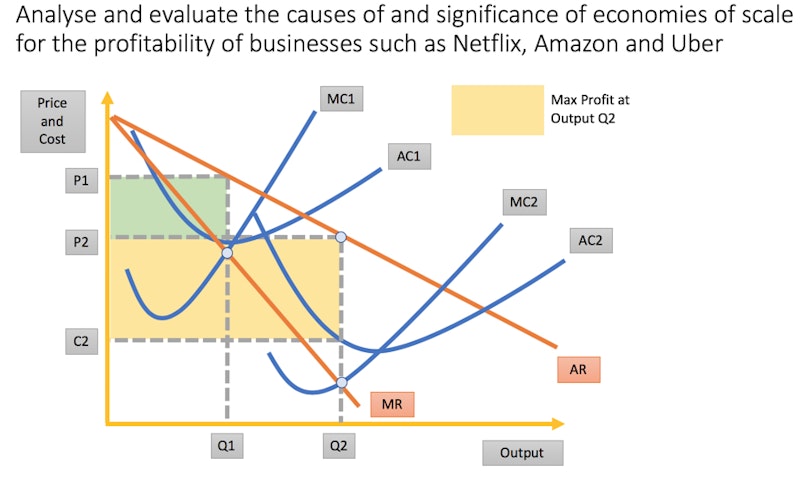

Economies of scale flow from increasing returns to scale as businesses grow in the long run. In theory, lower unit (average) costs increase profitability even if the price per unit charged to customers also falls.

Consider the digital media company Netflix. The business has been in existence for nearly twenty years, but in recent times, they have scaled to offer 5,000 titles, serve 130 million subscribers and generate $11 billion annual revenue. Netflix posted profit of $558m in 2017. One reason for this is a technical economy of scale. Netflix can afford to invest heavily in hugely expensive server-side technologies capable of streaming content to millions of users. This includes a joint venture with Amazon Web Services (AWS) along with Open-Connect, the company’s own proprietary content delivery network. The unit cost of supplying the product falls as the network expands.

What is significant about this internal economy of scale is that the overhead costs of the platform are enormous. But spread across millions of users in different countries, the marginal cost of adding an extra film or paying-customer is low. Thus, the average fixed costs drop as scale is achieved and this lowers the long run average cost as Netflix expands. This is shown in my analysis diagram which also illustrates the impact on operating profits.

Point 2

A second internal economy of scale comes from larger businesses being able to use monopsony power to reduce the prices they pay for their raw materials and components. This is a purchasing economy of scale.

Consider the online retailer Amazon which is the dominant e-retailer in many developed countries. They have made more than seventy acquisitions including taking over Whole Foods in 2017. Monopsony power lowers the cost of acquiring key inputs and therefore reduces the variable and marginal costs of supply. If prices remain constant, a reduced average variable cost leads to a higher profit per unit. This buying power might extend for example to the prices Amazon pays to print and e-book publishers and also food manufacturers using their Amazon Fresh platform.

However, monopsony power is no guarantee that economies of scale will increase profitability. Some analysts have found that inefficiencies in Amazon’s fulfillment systems have countered gains from cheaper supply prices. Although Amazon makes an annual $3 billion profit in North America and their AWS business also contributes $3 billion in profit, their international e-commerce division continues to operate at a loss. Takeovers to fast-forward economies of scale provide no certainty in improving operating profitability. For example, according to the FT, in 2017, Uber was the most lossmaking private company in tech history suggesting scale economies have not yet shown through.

You might also like

Easyjet, local multipliers and economic growth

13th November 2015

Monopoly Power in Markets - Applied Examples

Topic Videos

Restaurants face closure as costs rise and demand dips

5th December 2016

Monopoly Pricing (Multiple Choice Question)

Practice Exam Questions

Barriers to Entry (Quizlet Revision Activity)

Quizzes & Activities

Business Objectives in Economics (Online Lesson)

Online Lessons

4.1.4.5 Long Run Production (AQA A-Level Economics Teaching PowerPoint)

Teaching PowerPoints

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails