Study Notes

Economic Growth in Brazil and Mexico

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

The Atlantic-facing economies of Argentina, Brazil and Venezuela—the largest members of the Mercosur regional trade bloc are all experiencing slower economic growth which threatens their continued economic development. On the other side of the continent, Chile, Colombia, Mexico and Peru—which make up the Pacific Alliance—are forecast to grow at solid rates well above the rate of growth of population. Why is Mexico growing more quickly than Brazil?

Reasons for slow growth in Brazil:

- Falling world commodity prices: Brazil is a major exporter of oil, coffee, soybeans and other primary products. Lower prices have worsened the terms of trade for Brazil and cut their export revenues

- Chinese economic slowdown: China is Brazil's biggest export market (19% of exports) and is experiencing a slowdown in growth towards a new target of 7%. Weaker growth in China is a key factor behind the falling prices of commodities such as oil and iron ore

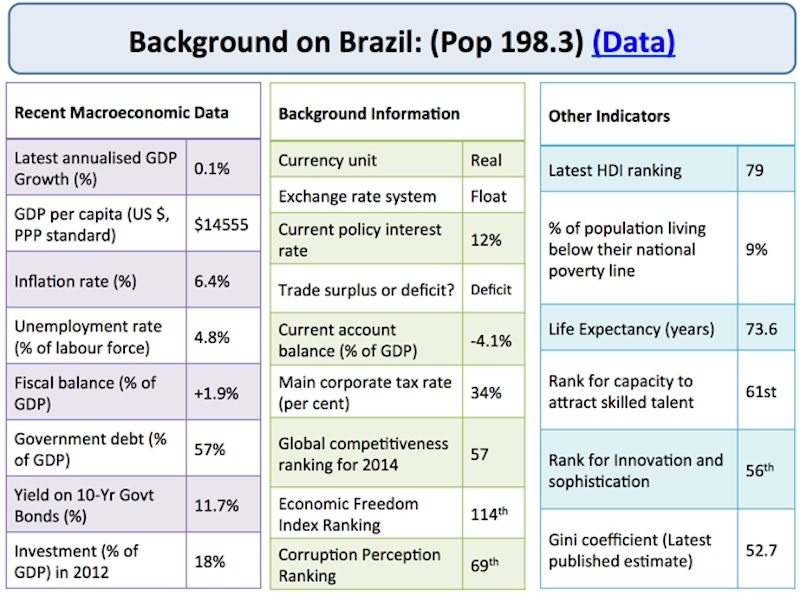

- High interest rates (currently at 12%) as the central bank tries to keep inflation close to the 4.5% target. Interest rates are over 6% in real terms and this is hitting business investment

- High inflation (currently more than 6%) is eroding the real incomes of millions of Brazil's growing middle-class consumer base

- Relatively high rates of corporation tax (34%) and high cost / barriers to doing business in Brazil is having a negative effect on their ability to attract FDI

- Brazil is running a budget surplus - fiscal policy could be more expansionary but Brazil needs to run a primary surplus to afford the high interest payments on their national debt

- Corruption - Brazil is suffering from endemic corruption epitomised by the Petrobras scandal

- Trade deals: Growth perhaps hampered by failure to secure new trade deals with EU and other regions. Brazil is part of Mercosur, a relatively closed trade bloc (including Argentina and Venezuela) that only has preferential trade access agreements to 7% of world markets

- Weak currency: A 30% depreciation in the Brazilian real is helping her manufacturing sectors but also causing imported inflation to rise thereby limiting room for interest rate cuts. A weak volatile currency also increases risks for investors.

Brighter growth prospects for Mexico:

- Trade with the USA: Majority of Mexican trade is with the USA (75% of exports) - stronger US recovery is helping Mexico given their close proximity to the major market

- Strong rise in inward FDI especially for manufacturing - Mexico has become one of the world's largest car manufacturers. Investors attracted by low unit labour costs - investment expands capacity and builds capabilities helping to establish a comparative advantage for Mexico in manufacturing.

- Membership of the Pacific Alliance which has preferential trade access to 75% of world markets may be helping Mexico - it has a more business-friendly approach and has reduced non-tariff barriers (such as visa requirement) leading to increased trade creation effects

- Economic reforms: Growth helped by faster progress towards reforms e.g. increasing competition in energy sectors

- Per capita incomes are $2000 higher than in Brazil, Mexico boosted by rapid growth of market size - another favourable factor for inward investment

- Inflation is relatively stable at 4% and monetary policy interest rates are 3% - some negative real interest rates - contributing to an expansion of aggregate demand

You might also like

Productivity and Economic Growth

Study Notes

Economic Growth - Advanced Nations

Study Notes

Chinese businesses winning contracts on the new Silk Road

8th September 2015

Economic Growth - The Importance of Institutions

Study Notes

Focus on the Vietnamese Economy

7th April 2017

Inside iPhone City - A Factory with 350,000 workers

7th May 2018

The Government Game - Economic Simulation Activity

Quizzes & Activities

OBR forecasts a long, shallow recession for the UK

18th November 2022

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails