Topic Videos

Contestable Markets and the Global Parcels Industry (Revision Webinar)

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 12 Feb 2018

In this recording of our recent revision webinar we look at some the synoptic links between micro and macroeconomics and fast-changing global market for parcels. In particular we focus our revision on the economics of contestable markets - looking at actual and potential competition in the industry.

Background notes:

- The global parcels market is currently going through a period of strong growth and structural change.

- The volume of parcels delivered to customers in the UK has grown from 1.8 billion in 2014 to 2.1 billion in 2017.

- UK industry now has an annual turnover of £8.7 billion.

Consolidation is taking place globally and in the EU - two examples here of horizontal integration

1) FedEx bought TNT in 2016 for £3.4bn - one of the largest and highest profile takeover deals in the sector

2) Dec 2016 - DHL made £243m acquisition of UK Mail

Drivers of UK Market Demand Growth

The UK parcels market is now approaching £10bn in size. Having fallen during the 2009 economic downturn, the main driver of growth has since been home shopping.

Online retail is the main driver of growth in parcel delivery volumes.

Global online sales approached US$2.3trn in 2017, having grown at a rate of 25% per year.

Contestability

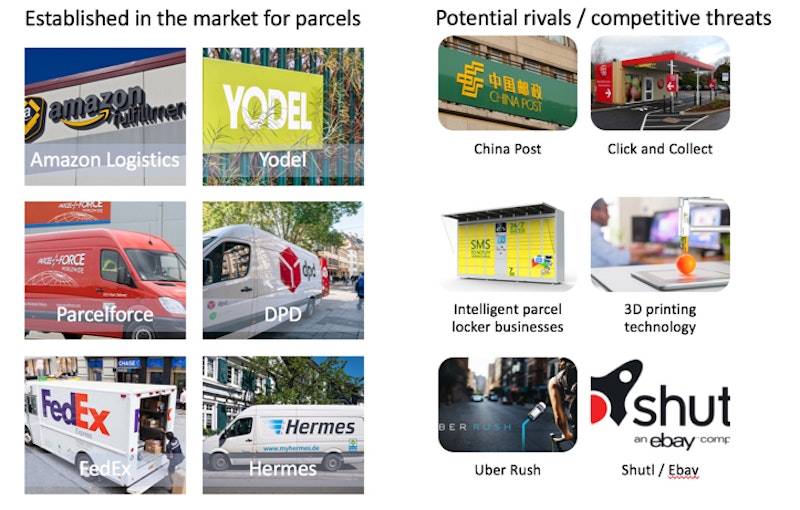

Most markets are contestable to some degree but few come close to being perfectly contestable. The most important condition for contestability is having low entry barriers and exit costs including low sunk costs. It is often easier to enter a market when a new rival is already scaled and have access to the latest technology alongside a brand that consumers recognise and trust and which can be extended into new markets. Amazon Logistics is a good example of this, so too the use of click and collect services by national supermarket / retail chains. If sunk costs are high this makes it difficult for new firms to enter and leave the market. Therefore it will be less contestable

Importance of economies of scale

The leading 12 parcel delivery companies had combined parcel revenues of almost US$190bn in 2015. The leading parcel delivery company handled over 5bn parcels in 2015. All companies in the top ten each handled more than 1bn parcels, and they handled more than 22.5bn parcels between them. Clearly in global and national parcel industries, internal economies of scale are hugely important in helping to bring down unit costs in the long run and maintain the profitability of the industry.

Contestability in action

The UK postal and courier market underwent dramatic changes some years ago when the industry was opened up to full competition. A number of businesses now offer a UK-wide parcel delivery service. These include Amazon Logistics, DHL, DPD, FedEx, Hermes, Royal Mail’s Parcelforce, TNT, UK Mail, UPS and Yodel. Intense competition between service providers has led to a reduction in the average price for each parcel delivered. Ofcom reported that in 2017 the average unit revenue for a domestic parcel had fallen since 2016 from £3.39 to £3.21.

Actual and potential competition

The behaviour of businesses in a contestable market is often shaped not just by the conduct of existing firms but also by the prospect of new competitors or new technologies affecting the market. For example, leading online retailers, led by large global marketplaces such as Amazon and Alibaba, are increasingly getting involved in delivery, reflecting the strategic importance of it to their business models. Their large volumes give them significant market power.

Importance of non-price competition

Competition is driving down average prices for parcel courier services. In a contestable oligopoly, relative success in non-price competition factors can make a big different to a firm’s turnover, revenue, market share and (ultimately) operating profits. Speed of delivery: Amazon Prime Now two-hour delivery service is available in nine cities in the UK, with a one-hour service available to certain postcodes within these areas.

You might also like

Contestable Markets

Topic Videos

Swipe-it! Internal and External Economies of Scale

17th September 2015

Macroeconomics Abbreviations

Study Notes

Ad Blocking - free markets at their best or worst?

3rd March 2016

BBC Newsnight interview with Joseph Stiglitz - a Year 2 homework exercise

5th September 2016

2016 Global Economy in Ten Charts

30th December 2016

Natural Monopoly (Evaluation Skills Video)

Topic Videos

The Renaissance of English Wine: An Economic Perspective

5th August 2024

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails