Study Notes

Cocoa Market

- Level:

- GCSE, AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

Cocoa is a cash crop for some the world's poorest farmers – revenue from producing and selling cocoa provides a livelihood to 40-50 million people in Africa, Latin America, and Southeast Asia

The freeing up of the cocoa marketing systems in the 1990s meant that prices in most cocoa producing countries have been largely determined by international prices. Cocoa is traded on two world exchanges in two currencies: London (LIFFE - Pound) and New York (ICE - USD).

With open trading on international markets, cocoa prices have shown greater variation in most cocoa-producing countries, reflecting changes in international cocoa prices and variations in exchange rates.Supply-side of the cocoa market:

- Cocoa output is dominated by Côte d'Ivoire, which accounts for more than 30% of total output, while Ghana and Indonesia combined account for a further 35%.

- Most cocoa is grown by smaller farms – according to the International Cocoa Organisation, 90% of world cocoa production originates from small farms. In Africa and Asia a typical smallholder cocoa farm covers only 2 to 5 hectares of land.

- Supply is vulnerable to pests and extreme weather conditions such as intense rainy or dry periods. Cote d'Ivoire has been afflicted with political instability which has damaged their supply potential

- Long-term cocoa production has been affected by a lack of investment in cocoa plantations and also by population shift away from farms towards urban areas.

- Competition from alternative crops (such as rubber) that have become more profitable has hit cocoa production in countries such as Brazil and Indonesia

- Productivity is low – as measured by yields per hectare. This is partly the result of limited capital investment spending but also due to ageing trees and limited producer uptake of selection and breeding programmes. Soil fertility levels are declining in many countries

Cocoa Supply Chain

- Cocoa Farmer

- Export Company

- Cocoa bean Grading Company

- Shipping Business

- Cocoa Processor

- Manufacturer e.g. confectioner

- Retailer of cocoa based products

Cocoa prices, incomes and economic development

- The importance of cocoa to developing country producers cannot be overestimated - more than three million farmers depend on cocoa for a major part of their income.

- It is imperative for producers to move up the value chain into manufacturing, marketing and sales, as countries can capture more income from their participation in the chocolate industry.

- Typically the price that a small-scale cocoa farmer gets for their raw product is a tiny percentage of the price that consumers pay for their hot chocolates in a store or for their chocolate bars from a supermarket. Cocoa producer cooperatives seek to increase the selling power of cocoa farmers to get a better price for their output.

- There are signs that multinational corporations themselves recognize the threats of unstable incomes, ageing plantations and falling productivity on cocoa supplies. Kraft's Cadbury Cocoa Partnership is engaged with nearly a quarter of a million farmers in Ghana.

- Many UK retailers have committed themselves to the label of the Fair-trade Foundation

Demand-side of the cocoa market:

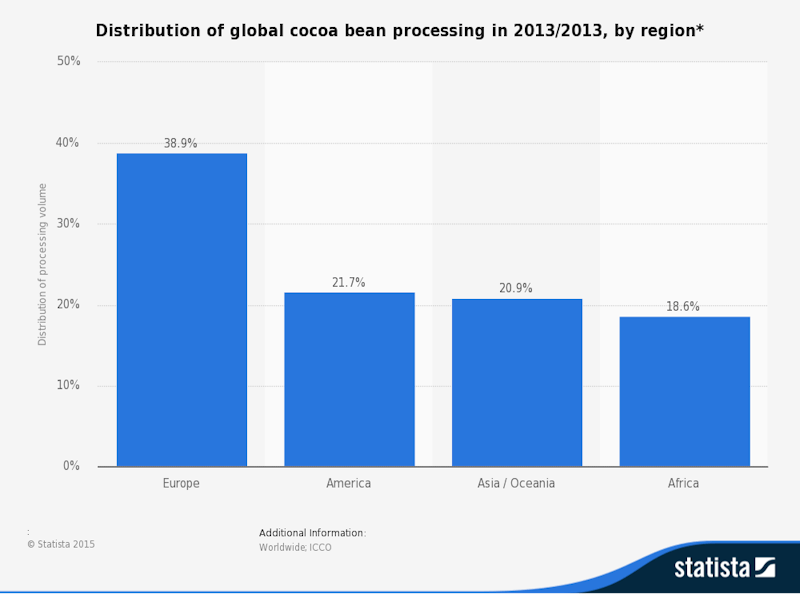

- Derived demand: Most of the global demand for cocoa comes from processing-businesses who use cocoa beans to make chocolate-based products including chocolate bars, powdered drinks and powdered chocolate used in cakes

- Saturation point? Global demand for cocoa in richer developed countries has grown only slowly in recent years and in some countries it has fallen because of the effects of the recession. There has been a shift towards powder-based drinks rather than cocoa-based drinks partly because of the recent steep price in world cocoa prices

- Price elasticity: The demand for confectionery products has been hit by rising retail prices but cocoa is not that significant as a cost of production since it only forms 6% of the price of a bar of chocolate

- Rising per capita incomes in developing countries: International demand for cocoa has been sustained by fast-growing demand in emerging market countries

- Speculative demand: With cocoa being one of the leading soft-commodities traded in world markets, the price is also affected by the size and impact of speculative buying and selling for example by hedge funds. Therefore, expectations for future production/demand can have a big impact on current prices.

You might also like

Sugar Cane and Economic Development in Mauritius

20th October 2014

Coffee Market

Study Notes

Cocoa futures war

27th March 2015

Nigeria: Primary Product dependency and currency depreciation

29th January 2016

Chile's Copper Crash

21st June 2017

Growth and Development Profile: Angola

Topic Videos

Oil's amazing moment as crude prices fall below zero

22nd April 2020

From Burden to Opportunity: Côte d’Ivoire’s Debt-for-Development Revolution

29th December 2024