Exam Support

Chains of Reasoning and Evaluation: Fuel Prices in the UK

- Level:

- AS, A-Level, IB, BTEC National, BTEC Tech Award

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 25 Oct 2019

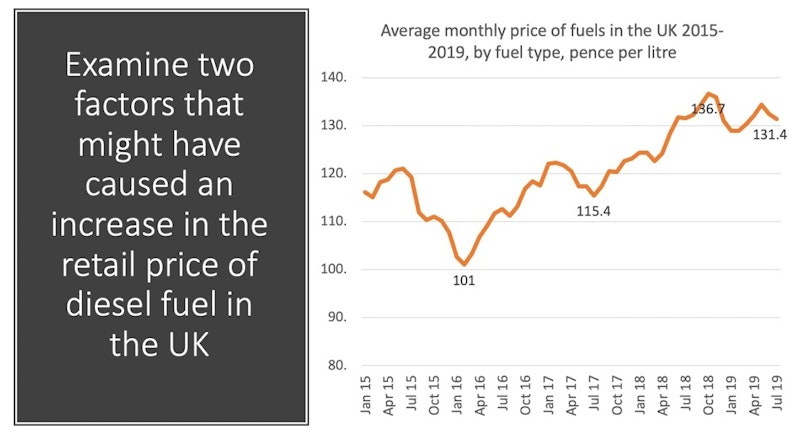

Here is an example of how to build a chain of reasoning and add some evaluation into your answer. This question relates to the changing price of diesel fuel in the UK fuel market.

Point 1

Between January 2016 and October 2018, the retail price of diesel fuel increased by 36 percent – a substantial rise. One reason might be that the government decided to raise the excise duty on fuel which is an example of an indirect tax. Duty on fuel is charged to fuel supply businesses such as Esso, Texaco & Shell. Following a higher tax, they decide whether to pass on the higher fuel duty to consumers via a hike in the retail price. Or they might absorb the duty and cut their profits. Assuming that demand for diesel fuel is price inelastic (i.e. the coefficient of Ped is <1) then an increase in fuel duty is likely to lead to higher prices.

However, strong price competition at retail level might cause some suppliers to hold back from raising prices even if taxes rise. Petrol retailing is an oligopoly and often, there is intense localised price competition between fuel suppliers as they battle to gain and then protect market share.

Point 2

A second factor that might explain an increase in the price of diesel could be a depreciation of the exchange rate. This is because a lot of refined petroleum is imported into the UK and, since oil is priced in US dollars, a a fall in the exchange rate will increase the UK price of imported diesel. As a result petrol retailers will be under pressure to increase their retail prices in order to protect their operating profits. A fall in the exchange rate is likely to affect all petrol retailers in a similar way especially if they get most of their fuel supplies from the wholesale market.

However, the impact of this depends on how far the exchange rate has fallen and whether it is regarded as a temporary change. Taxation of fuel (made up of duty and VAT) forms the biggest percentage of the retail price, so a lower currency can not explain all of the 36% rise we saw between 2016-18.

You might also like

Producer support in markets

Study Notes

How Markets Work - Introductory Demand Concepts

Study Notes

Minimum Prices - 2021 Revision Update

Topic Videos

Maximum Prices - 2021 Revision Update

Study Notes

Government Intervention - Is it Time for a Meat Tax?

11th September 2023

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails