Exam Support

Chains of Reasoning and Building Higher Analysis Marks

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 13 May 2018

Exam boards all say that clear chains of reasoning using connective words and phrases really help students to get better marks for analysis.

Here are some examples of chains of reasoning in action:

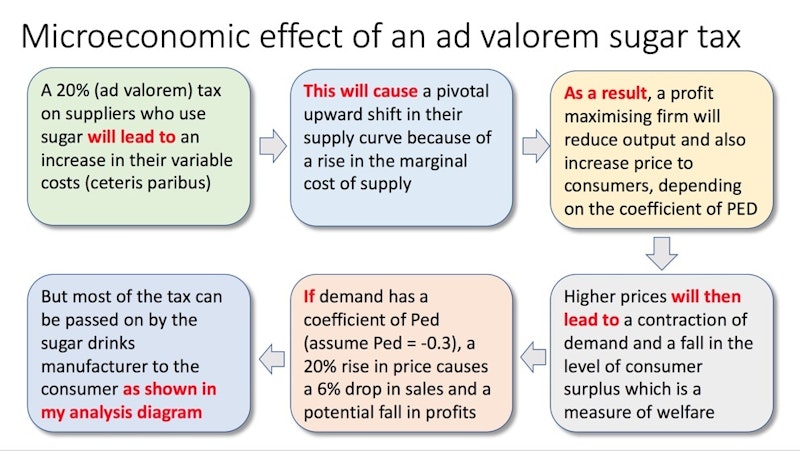

Microeconomic effects of an ad valorem sugar tax

A 20% (ad valorem) tax on suppliers who use sugar will lead to an increase in their variable costs (ceteris paribus)

This will cause a pivotal upward shift in their supply curve because of a rise in the marginal cost of supply

As a result, a profit maximising firm will reduce output and also increase price to consumers, depending on the coefficient of PED

Higher prices will then lead to a contraction of demand and a fall in the level of consumer surplus which is a measure of welfare

If demand has a coefficient of Ped (assume Ped = -0.3), a 20% rise in price causes a 6% drop in sales and a potential fall in profits

But most of the tax can be passed on by the sugar drinks manufacturer to the consumer as shown in my analysis diagram

Macroeconomic consequences of falling oil price (1)

For oil exporting countries such as Norway, a fall in world prices causes a deterioration in their terms of trade.

This means that the weighted index of their export prices divided by import prices has declined

One consequence of this is that export revenues per barrel for Norway will fall leading to a possible decline in their current account surplus

As a result the oil sector will contribute less to the growth of Norwegian real GDP whilst oil prices remain low

A fall in the terms of trade causes a drop in real living standards because Norway will have to sell more oil for each unit of imports

A slowdown in growth and a decline in real wages especially in the oil sector might then lead to a cyclical slowdown & disinflationary pressures

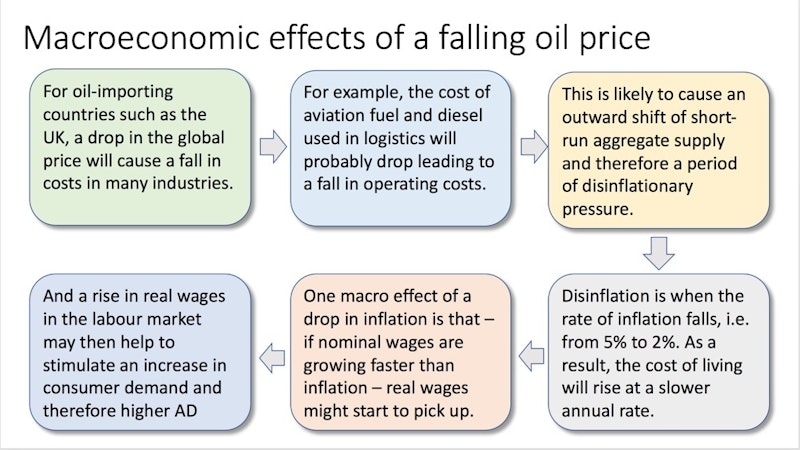

Macroeconomic consequences of falling oil price (2)

For oil-importing countries such as the UK, a drop in the global price will cause a fall in costs in many industries.

For example, the cost of aviation fuel and diesel used in logistics will probably drop leading to a fall in operating costs.

This is likely to cause an outward shift of short-run aggregate supply and therefore a period of disinflationary pressure.

Disinflation is when the rate of inflation falls, i.e. from 5% to 2%. As a result, the cost of living will rise at a slower annual rate.

One macro effect of a drop in inflation is that – if nominal wages are growing faster than inflation – real wages might start to pick up.

And a rise in real wages in the labour market may then help to stimulate an increase in consumer demand and therefore higher AD

Has fiscal austerity been damaging to the UK?

The extract says that government spending has dropped by 5.9% of GDP since fiscal austerity began in 2010.

One reason for this is that the government has introduced caps on the growth of public sector pay with wages rising by only 1% a year

A possible consequence is that it has become harder to recruit people into public sector jobs such as nursing & social care sectors.

This has led to a fall in the number of people choosing to work in the NHS because of the decline in real wages

As a result, with growing demand for NHS services because of an expanding & ageing population, the NHS has had to use private supply agencies.

Therefore, wage costs have risen anyway and staff shortages have also led to increasing delays for treatment e.g. in A&E departments.

You might also like

Marginal decisions in economics

Study Notes

In Economics - what is thinking at the margin?

2nd August 2023