Exam Support

Building Confidence in Writing Synoptic 25 Mark Essays (EdExcel)

- Level:

- A-Level, IB

- Board:

- Edexcel

Last updated 12 Jun 2018

Here are some thoughts on constructing an answer to this question: "Evaluate the likely micro and macroeconomic impact of a decision by the UK government to introduce a tax on carbon emissions."

Extracts on carbon emissions and carbon pricing

Answer

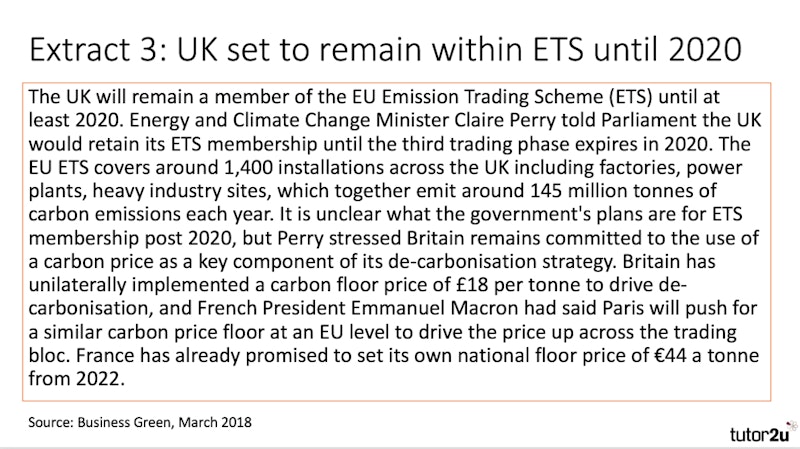

Brief introduction

A carbon tax is an environmental tax on producers based on each tonne of CO2 emitted from supplying goods and services. As Extract 1 says, some economists, including Joseph Stiglitz and Nicholas Stern, say taxes of $100 per tonne could be needed by 2030 which would mean a carbon price of around £75 – this is over ten times higher than the current carbon emissions price in the ETS mentioned in Extract 3 and would therefore represent a significant government intervention which would have micro and macroeconomic effects.

Point 1

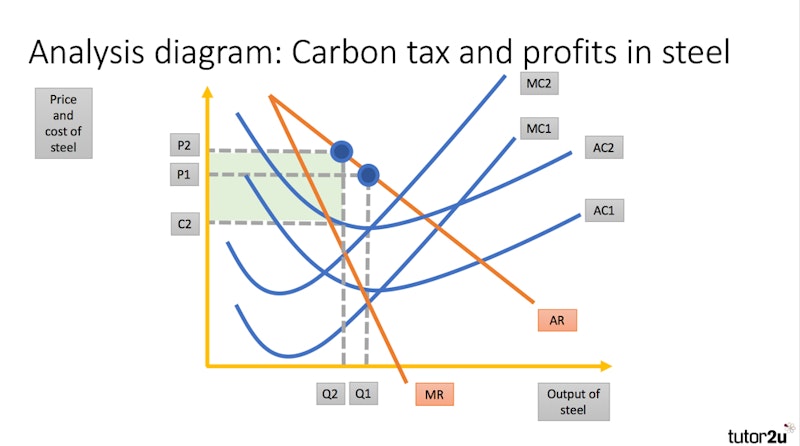

One possible microeconomic effect of a high carbon tax would be to increase costs of producers such as airlines, energy suppliers and steel manufacturers. A tax per tonne of carbon would add directly to their variable costs and this would lead to an upward shift in both MC and AC. Assuming constant AR and MR, this would lead to a fall in industry profits and also higher prices for consumers. For example, air fares would likely have to rise by a significant amount and the rising cost of steel would be an extra cost for car manufacturers and the housing industry. My analysis diagram shows the effect of a carbon tax on steel producers. A fall in profits and indeed, possible losses given tough competition in the global steel industry from countries such as China, Germany and Russia and this could cause job losses and plant closures.

Evaluation of Point 1

However, the carbon tax might also be a strong incentive for businesses to invest money in research and development and fast-forward innovation so that their carbon emissions are reduced. Indeed, one of the main long-term aims of the tax is stimulate innovation in low-carbon technologies. The pollution tax creates a new price signal and businesses such as airlines – if they know that the carbon price will be both high and stable – might decide to increase investment in lighter, more fuel efficient aircraft such as the Boeing Dreamliner. Power companies might ramp up investment in renewable energy sources and house-builders in Britain might find more innovative ways of building new homes with a lower carbon footprint. In this way a carbon tax could stimulate an improvement in dynamic efficiency which will have wide benefits.

Point 2

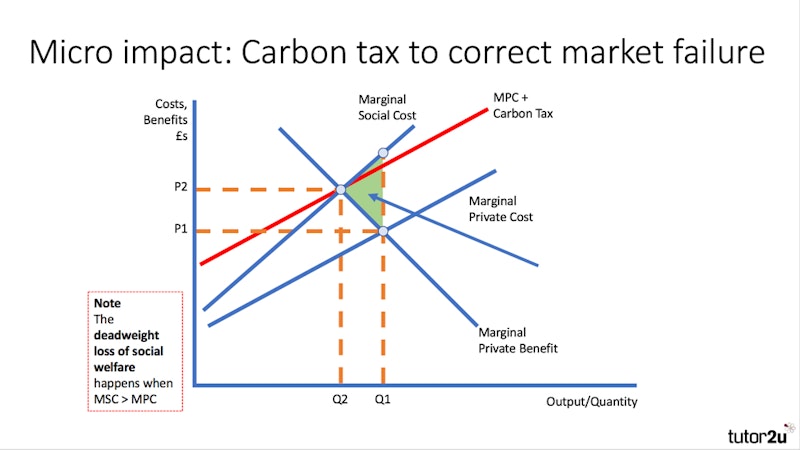

A second microeconomic impact of a carbon tax is that it helps reduce market demand for products with high carbon intensity and therefore addresses market failures associated with negative externalities. Carbon emissions are negative externalities from both production and consumption. In my diagram, we see how marginal social cost diverges from marginal private cost leading to over-production and a deadweight loss of social welfare. There is a case for a carbon tax by “making the polluter pay” to help internalise the externalities. Consumers for would likely face higher prices and this might be a signal for them to curb demand – e.g. by spending money on home insulation or choosing more fuel efficient vehicles. Decisions taking at a micro level by households and firms can have a big macroeconomic effect in aggregate.

Evaluation of Point 2

A counter-argument is that critics of a carbon tax say that it would be inequitable, in other words, it risks having a regressive effect on poorer households. Low-income families might struggle to pay higher energy bills and their transport costs would rise, which limits geographical mobility of labour. If the UK introduces a new carbon tax well above the current ETS carbon price of Euro 18 and this leads to job losses in industries most affected, then people will suffer from structural unemployment and a fall in their real living standards. Much depends on how a carbon tax is implemented and whether the UK government uses revenues generated by a tax to help at-risk families – for example by investing in training to help ease the transition from high carbon industries such as coal or subsidies for home insulation to increase energy efficiency.

Point 3

A carbon tax would also have macroeconomic effects. I will focus on the size of the budget deficit. Extract 2 says that the UK produced total carbon emissions of 388 million tonnes in 2017. If a carbon tax of say £20 per tonne covered all emissions, this would bring in an estimated £7.76 billion of extra tax revenue which might make a sizeable contribution to cutting the existing UK budget deficit which was £42 billion (or 2.3% of GDP) last year. One effect of this would be that the government could increase spending on public services such as improved NHS care or education funding which might have beneficial long-term effects on our competitiveness. An alternative would be to provide a counter-balancing cut in business taxes (such as National Insurance) so that a carbon tax was revenue neutral, cutting pollution but helping to create more jobs in the economy.

Evaluation of Point 3

Although in theory a carbon tax would raise a sizeable amount of extra revenue, in practice the impact on the UK fiscal position might be limited. Firstly, a carbon tax would be unlikely to cover the whole economy and secondly, there is a risk that a large tax would cut business profits and employment which might then cause a decline in revenues from direct taxes such as corporation tax and income taxes. If a carbon tax is introduced, some industries in the UK (in the short term at least) could become less price competitive overseas and this might lead to weaker export sales and slower GDP growth. Some businesses might shift production to countries without a carbon tax even to EU countries where emissions trading continues and where President Macron is according to extract 3 planning a big rise in the minimum carbon price in the ETS to Euro 40.

Final reasoned comment

Even some free market economists agree that there are strong grounds for a tax on carbon to address environmental market failure. But if the UK acts alone by introducing a carbon tax after we have eventually left the EU, a big risk is that it will lose some inward FDI and also bring about a rise in cost-push inflation. In my opinion, there is a case for all revenue from a carbon tax to be ring-fenced so that taxpayers know how much is being raised and how it is being spent. This might help provide stronger public support for a pollution tax which is needed because it makes economic and social sense at a micro and a macro level to put a price on carbon emissions to change the behaviour of agents in the economy.

You might also like

Economic Systems

Study Notes

Government Intervention - Maximum Prices

Teaching PowerPoints

Government Failure - Political Lobbying

Topic Videos

Unintended Consequences in Development Economics

5th July 2017

Teaching Activity: Introduction to Economics (GCSE)

Teaching Activities

In the News Teaching Activity: Vaping and Negative Externalities (Sept 2023)

11th September 2023