Study Notes

Bank Lending

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

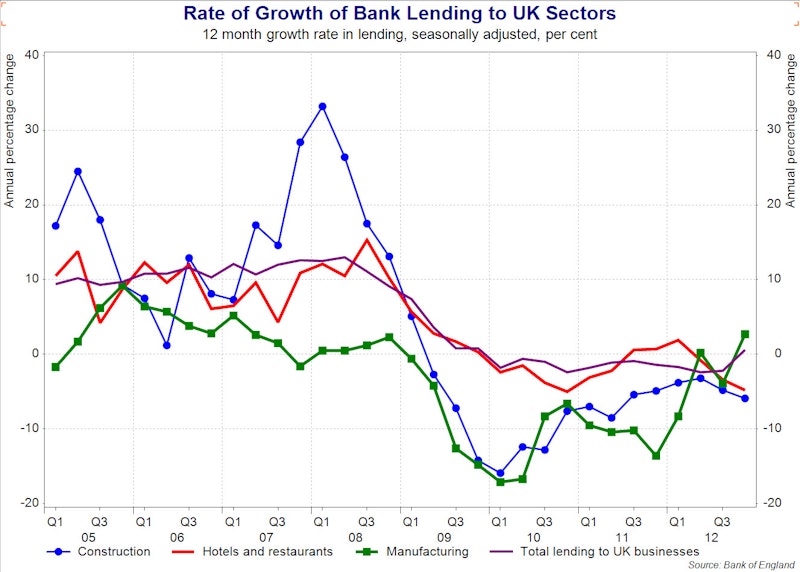

Why has there been a sustained fall in the rate of growth of commercial bank lending in the UK economy?

This has been one of the reoccurring issues in the British economy in recent years. Many have criticised the banks for their failure to supply enough lending to businesses, thereby hampering the scale of recovery from the2008-2010 recession.

Why has bank lending to businesses grown so slowly?

The main reason appears to be because it is not sufficiently profitable. Arranging new loans for smaller businesses can be quite costly compared to the amount involved, hence a reluctance among banks to agree loans.

In today's world of low interest rates, the margin between the interest rate paid by the lender and the the cost of funding the loan for the bank is small. Even with a high loan repayment rate of say 95%, the profitability of lending for the bank remains low.

Many banks favour lending for mortgages rather than the higher risk loans associated with financing capital investment by small and medium sized enterprises.

The Bank of England and HM Treasury launched the Funding for Lending Scheme (FLS) in order to encourage lending to households and companies. The FLS offers funding to banks and building societies for an extended period. And it encourages them to supply more credit by making more and cheaper funding available if they lend more

You might also like

Swedish central bank uses negative interest rates to avoid deflation

16th February 2015

Quantitative Easing (QE)

Topic Videos

Why the Bank of England has raised interest rates

2nd November 2017

Monetary Policy - The US Fed Tapers QE

4th November 2021

Is this a time for central banks to be more cautious in raising interest rates?

12th September 2022

UK Economy - New Revision Videos on Growth and Monetary Policy

25th April 2023

UK Economy: What are neutral interest rates?

25th September 2024

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails