Study Notes

Asda-Sainsbury Merger under threat from the CMA

- Level:

- AS, A-Level, IB, BTEC National

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 20 Feb 2019

In an important moment for the future of food retailing in the UK, the Competition and Markets Authority (CMA) has made a provisional ruling that the planned £12 billion horizontal merger between Asda and Sainsbury may be blocked on a number of competition grounds.

The CMA states that "The CMA has provisional concerns that the merger could lead to a substantial lessening of competition at both a national and local level .... should the two merge, shoppers could face higher prices, reduced quality and choice, and a poorer overall shopping experience across the UK. We also have concerns that prices could rise at a large number of their petrol stations."

One of the consequences of the planned merger - without the CMA requiring the enlarged business to sell of some of their stores / assets - would be that the newly integrated firm would become the biggest seller of fuel by volume in the UK.

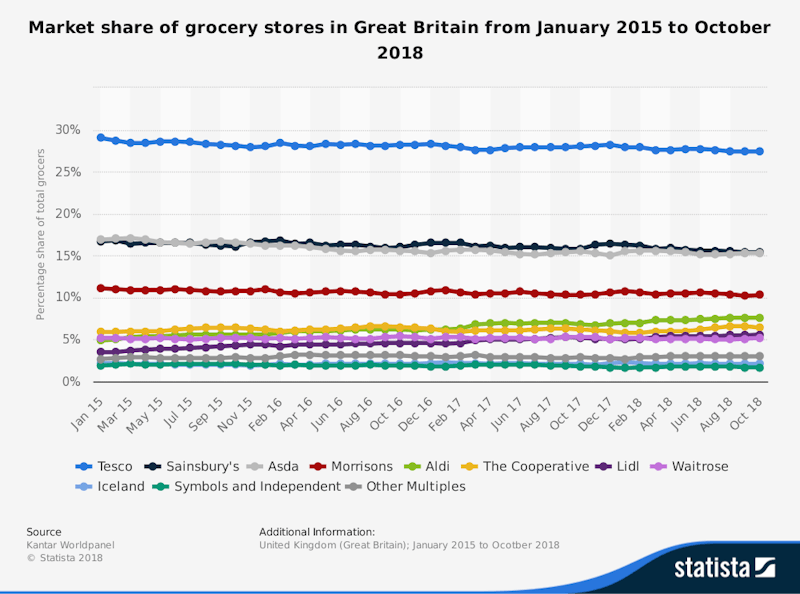

The chart below tracks the market share of the leading food retailers in the UK.

Background:

Sainsbury's

Sainsbury’s operates a network of 1,428 grocery stores (including 647 supermarkets and 781 convenience stores), 314 PFSs and an online grocery business. Sainsbury’s also operates Argos and Habitat. Their share of the food grocery market in October 2018 was 16.5%.

Sainsbury’s sells clothing, footwear and accessories under its Tu brand.

Asda

Asda operates a network of 676 grocery stores (including 582 supermarkets and 61 convenience stores which are all attached to PFSs), 33 Asda Living stores (focused on non-grocery products including clothing), 320 PFSs and an online grocery business. Their share of the food grocery market in October 2018 was 15.5%.

Asda sells clothing, footwear and accessories under its George brand.

If the merger was allowed:

- The combined business would have around 32 percent of food grocery sales in the UK

- A combined Asda/Sainsbury's share of supply in school wear of 20–30% by value, making the merged entity the largest generic school wear retailer in the UK.

Remedies

One of the possible remedies following the CMA report is that Sainsbury/Asda would be expected to see a large number of stores (perhaps upwards of 100) to rival retailers such as Lidl, Aldi, Morrisons and others to maintain competition at local level for both supermarkets and convenience stores.

Competition watchdog ‘concerned’ over Asda-Sainsbury’s deal https://t.co/u2MnD6YDmG

— Financial Times (@FT) February 20, 2019

You might also like

Oligopoly - Collusion

Study Notes

First Group wins extended franchise for rail services

23rd March 2015

Micro experiments - If it costs nothing, is it worth anything?

3rd February 2016

Sainsbury takes on Amazon with 1 hour delivery service

28th September 2016

Key Diagrams - Monopoly and Allocative Efficiency

Topic Videos

3.4.4 Oligopoly - Introduction (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints