Explanations

What is a 1983 £1 coin worth?

20th March 2017

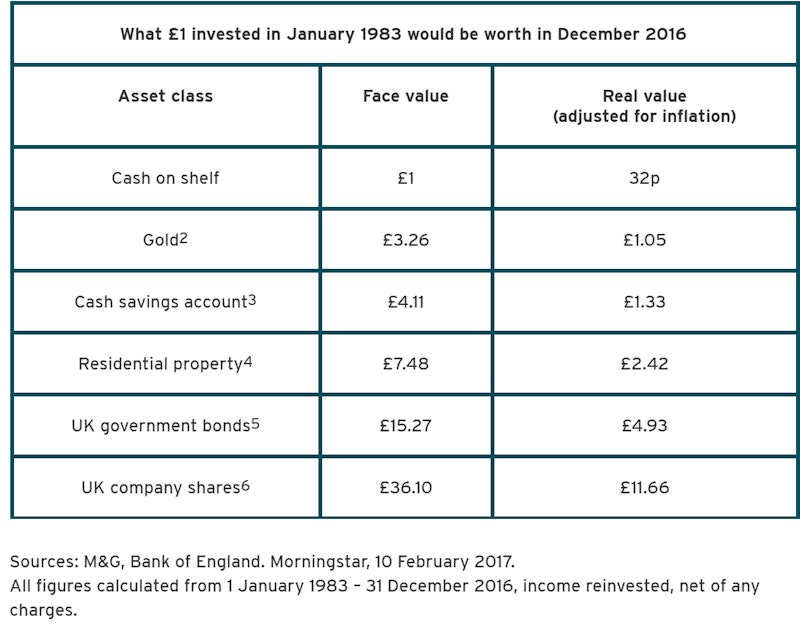

For a different take on how inflation erodes the value of money, calculating 'real' values for nominal values, and considering different forms of investment, this short article on the BBC website is useful. It looks at what an investor could have done with a brand new £1 coin, when it was introduced in 1983, and what the real value of each of them would be now. Asset managers M&G have calculated the returns based on a range of alternative investment options, from 'do nothing' to fully managed investment in the stock exchange, up to the end of 2016.

After taking into account the effects of inflation – which averaged 3.5% between 1983 and 2016 – the M&G report calculates that a newly minted £1 coin kept on the shelf since 1983 would be worth only 32p at the end of this period, in 1983 terms. To have retained its purchasing power, by rising in line with inflation, this £1 would have had to grow to £3.10 by the end of 2016.

Note, though, that for both UK Government bonds, and for investment in the stock exchange, all income and dividends are being reinvested rather than taken as cash. This underlines a point made by M&G's investment director, who concedes that in order to make the greatest return on the investment, it is necessary not only to accept a greater element of risk but also to make a long-term investment with no need of easy, quick access to the cash. The investment listed that seems to buck this trend, at least in terms of risk, is the high return on Government bonds, which might suggest that for a risk-averse investor, they would have been the optimal investment 33 years ago.

You might also like

Inflation - Main Causes of Inflation

Study Notes

Is Christmas getting cheaper? Inflation, elasticity and austerity

14th December 2015

Inflation - The Changing CPI Basket

Topic Videos

The Government Game - Economic Simulation Activity

Quizzes & Activities

UK inflation and interest rates - a quick update

14th September 2022

What is demand-pull inflation?

Study Notes