In the News

Walt Disney buys Fox for $52bn

15th December 2017

Disney has agreed to buy Fox Entertainment for $52.4 billion creating a media empire with a remarkably diverse portfolio of assets, from film studios, via cable television channels to intellectual property rights and so on and so on.

It's horizontal/vertical and conglomerate integration all in one, I guess, and as the article suggests, might be an attempt to position the company for future battles with other media/web behemoths like Amazon and Facebook.

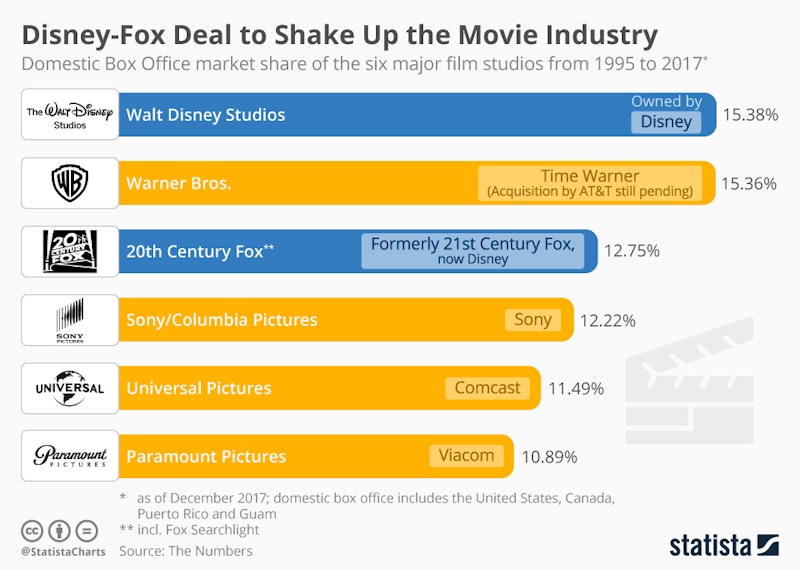

According to Statista, "With a combined domestic box office market share of 28 percent since 1995, Disney including 20th Century Fox will be nearly twice as large as its strongest competitor Warner Bros."

Walt Disney buys Murdoch's Fox for $52bn https://t.co/OvASSmvdjX

— BBC News (World) (@BBCWorld) December 14, 2017

21st Century Fox has agreed to sell its film and television assets to the Walt Disney Company in a deal worth $52.4bn

— Sky News Breaking (@SkyNewsBreak) December 14, 2017

Rupert Murdoch’s $52B sale of a big chunk of 21st Century Fox Inc. to Walt Disney Co. is a turning point in the media mogul’s career, spanning more than 60 years and most of the planet’s continents.https://t.co/VcqSSoHX6d pic.twitter.com/yM0sIN1L0B

— Bloomberg Graphics (@BBGVisualData) December 14, 2017

You might also like

Horizontal Integration - Pure Gym buys LA Fitness

30th May 2015

Digital Conglomerates - What does Google Do?

Study Notes

Against the grain - a UK tech business on the acquisition path

9th September 2016

Spotify in talks to acquire SoundCloud

30th September 2016

Horizontal Integration - Unilever pursues £50bn-plus mega-merger

18th January 2022

Survival of Small Booksellers in the UK

Study Notes

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails