In the News

UK Pension Overhaul: Will a Canadian Model Boost Your Retirement Savings?

8th August 2024

The UK's pension landscape is on the brink of a significant transformation with the proposed introduction of a traffic-light rating system for workplace pension schemes. This innovative approach aims to simplify the complex world of retirement savings and ensure that savers get the most out of their investments.

Chancellor Rachel Reeves tackling the pension crisis issue early that rivals in importance Gordon Brown as one of his first acts giving the Bank of England independence. Pension reform is the key to unleashing investment boom and turning round stock market https://t.co/orR3cPrAsn

— Will Hutton (@williamnhutton) July 21, 2024

Understanding the Traffic-Light System

Around 16 million UK workers currently save for retirement through defined contribution (DC) pension schemes. These schemes' performance and the ultimate income received by savers depend on various factors, including investment performance and management charges. For many, navigating these factors is daunting, particularly for those relying on default schemes and not actively managing their investments. There is a lot of potential and actual information failure in the complex world of pensions!

To address this, the Financial Conduct Authority (FCA), the Department for Work and Pensions (DWP), and the Pensions Regulator propose a new framework where pension schemes are rated red, amber, or green based on their value. Green signifies value for money, amber suggests potential for improvement, and red indicates poor value, prompting the need for savers to consider alternative schemes.

A Focus on Value, Not Just Cost

The consultation paper emphasizes that value for money in pensions isn't solely about low charges. While lower fees are beneficial, the best pensions are those that invest in high-potential assets, even if they come with higher management costs. Investments in infrastructure or venture capital, for instance, might offer greater long-term returns, contributing to more robust retirement savings.

Emma Reynolds, the pensions minister, underscores the importance of making pension funds work hard for future retirees. "Last year, over £130bn was saved into workplace pension schemes – money which we want to see working hard for future pensioners to give them better retirement incomes," she said.

Embracing the Canadian Model

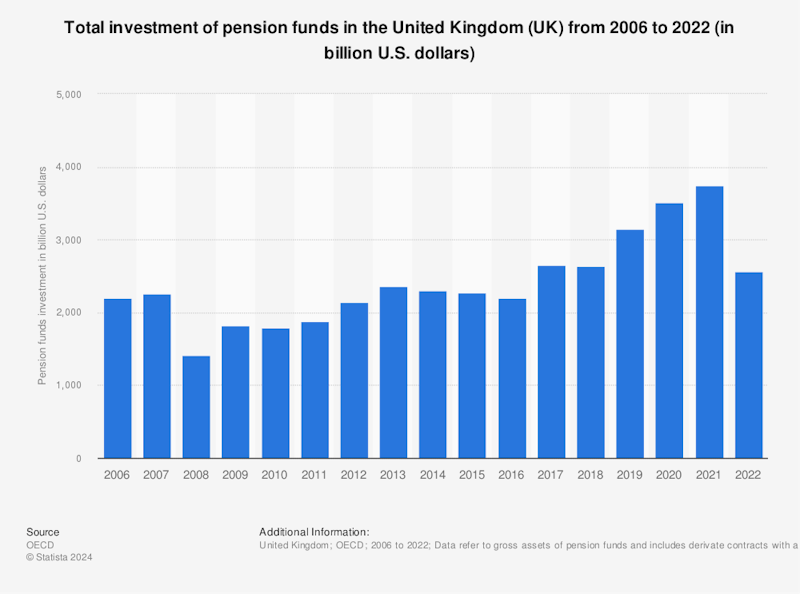

In a bid to boost the economy, Chancellor Rachel Reeves advocates for adopting a "Canadian-style" model for UK pensions. This model, inspired by the success of massive Canadian pension funds like the Ontario Teachers Pension Plan and the Canada Pension Plan, focuses on consolidating funds to reduce costs and increase investment power. By diversifying investments into areas like science, technology, and infrastructure, the government estimates pension pots could grow by £11,000, injecting £8bn into the economy.

I want to boost investment in Britain, increase pension pots and make working people better off.

— Rachel Reeves (@RachelReevesMP) July 21, 2024

My piece in the @DailyMailUK 👇https://t.co/ht2aeWaurE

Local Government Pension Scheme (LGPS) and Consolidation

The UK LGPS, which consists of 86 individually managed funds with 6.5 million members, is a primary focus for consolidation. Currently, each fund bears its own management costs, but pooling resources could reduce these expenses and enhance investment returns. Despite the benefits, some local funds prefer independence to invest in smaller, local projects that larger pools might overlook.

The Bigger Picture

The proposed traffic-light rating system and the push for consolidation reflect a broader goal: to maximise retirement incomes while supporting economic growth. However, the path to achieving this is fraught with challenges, from maintaining fund independence to ensuring effective mergers and consolidations. The success of these initiatives will depend on careful implementation and the cooperation of all stakeholders involved.

Exam-Style Questions:

- Discuss the potential benefits and drawbacks of implementing a traffic-light rating system for workplace pension schemes.

- Analyze the advantages and disadvantages of adopting a "Canadian-style" pension model in the UK.

- Examine the implications of consolidating the Local Government Pension Scheme (LGPS) funds on administrative costs and investment returns.

- Assess the challenges local pension funds might face when forced to merge or pool their resources.

Glossary of Key Economic Terms:

- Defined Contribution Pension Scheme: A retirement plan where the contributions are defined, but the final benefit received depends on investment performance.

- Default Scheme: A pension investment plan chosen by a workplace provider for those who do not select their own investments.

- Financial Conduct Authority (FCA): The regulatory body overseeing financial markets and protecting consumers in the UK.

- Infrastructure Investments: Long-term investments in physical systems and facilities such as transportation, utilities, and buildings.

- Local Government Pension Scheme (LGPS): Pension plans for local government employees in the UK, typically defined benefit schemes.

- Pension Regulator: The regulatory authority responsible for protecting workplace pensions in the UK.

- Pooling: Combining resources from multiple pension funds to achieve economies of scale and improve investment power.

- Value for Money: The optimal balance between cost and the quality or return on an investment.

Retrieval Questions for A-Level Students:

- What is a defined contribution pension scheme?

- What factors influence the income received from a defined contribution pension scheme?

- Who are the main regulatory bodies proposing the new pension framework?

- What do the green, amber, and red ratings signify in the proposed traffic-light system for pension schemes?

- Why is the focus on value rather than just cost important in the context of pension schemes?

- What are the potential benefits of adopting a "Canadian-style" pension model?

- How many members does the Local Government Pension Scheme (LGPS) have?

- What are some of the key investments that could boost pension pots under the new plans?

- What challenges might local pension funds face with consolidation?

- What does the term 'pooling' refer to in the context of pension funds?

You might also like

Ed Miliband and incentives: is he really human?

17th March 2015

What has happened to taxes over time?

5th March 2017

Disposable Income - 'Higher or Lower' Activity

25th May 2018

Consumer spending and saving (Quizlet Activity)

Quizzes & Activities

Price Discrimination: FCA acts to end price gouging of loyal customers

30th December 2021

How a worker exodus is hitting growth in the UK

20th December 2022

Drag on Incomes from Fiscal Drag equivalent to a 5% tax rise

8th October 2023

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails