In the News

UK government signals yet another cut in stamp duty

21st September 2022

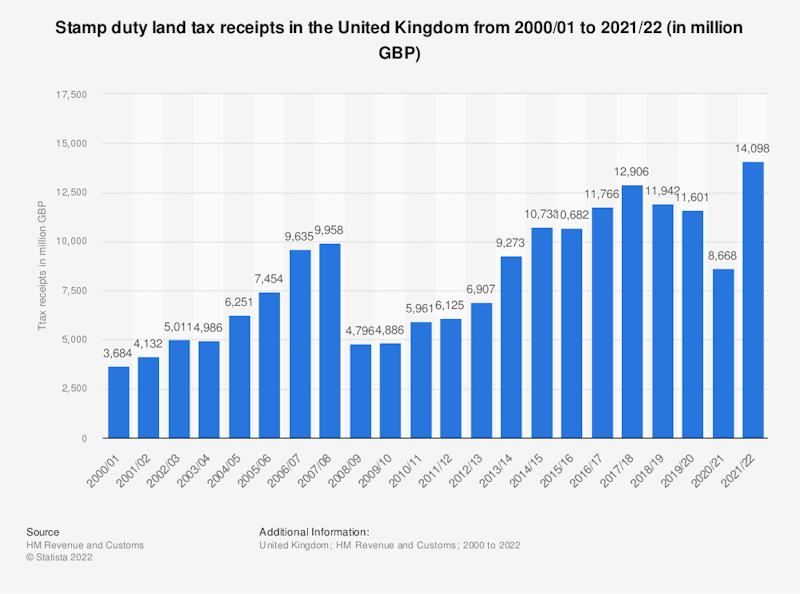

We have been here many times before. The government seems to think that cutting stamp duty will act as a stimulant to the housing market that will feed an expansion of new building and a much-needed pick up in housing supply. The reality is different.

Reducing stamp duty – a tax on the value of housing transactions – works mainly on the demand-side of the market. The dominant effect is to raise average prices (already surging towards £300,000) and thereby make property even less affordable for first-time buyers and those hoping to trade up as family circumstances change. Policy myopia rules again.

One of the fault-lines in government economic policy is the belief that rising house prices are a reliable indicator of a successful, growing economy. And that policies deliberately designed to increase demand and prices will have all kinds of wider effects including increased investment by house-building companies. Cutting stamp duty raises average prices and tends to benefit those looking to buy second-homes. It is ignores the wider, deeper, structural supply-side constraints that have and are holding back the building of new affordable housing in the UK.

You might also like

Rising female employment in the construction industry

31st December 2014

Indirect Taxes and Subsidies

Topic Videos

Is private sector debt sinking China?

20th January 2016

The Lorenz Curve

Topic Videos

UK House Prices and Living Standards - "A-maze-balls" activity

7th November 2017

Who are Britain's Biggest Mortgage Lenders?

1st December 2022

What was a NINJA loan?

Study Notes