In the News

Steel tariffs - losses outweigh the gains.

4th March 2018

Losses to many consumers outweighing the gains to a small number of producers is standard economic analysis of the impact of a tariff. Finding the specific impact on both requires some in-depth economic analysis with some assumptions thrown in as well and may only be calculated many months or years after the event. Arguably a good proxy for a basic understanding of the gains and losses of President Trump's decision to impose steel tariffs can be found by looking at the impact of the announcement on various companies listed on the US sharemarket.

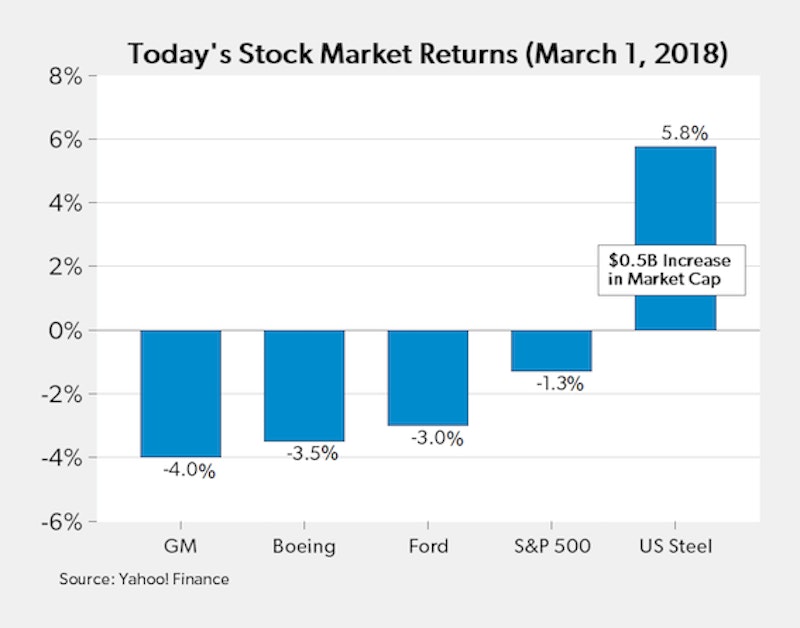

This graph from Mark Perry's Carpe Diem blog shows that unsurprisingly, the major beneficiary of the tariff announcement on March 1st was U.S Steel with a 5.8% increase in its stock price, an increase in value of approximately $500 million. But there were widespread decreases in companies that use steel, including Boeing, General Motors, and Ford. In these three companies alone, the loss in value was greater than $10 billion.

A few ceteris paribus assumptions thrown in there as well, but I will be using it in class to reinforce the "handy quote for revision" from Geoff Riley's post - "Free trade has widely distributed benefits and concentrated costs, while a tariff that is meant to help a particular industry has concentrated benefits and widely distributed costs."

You might also like

Lucrative rubies might bring a resource curse

11th February 2017

Bank of England Inflation Report - food prices

13th March 2017

Is the war on diesel about to start?

17th April 2017

China's condom boom

28th May 2017

Ten Years on from the last UK Interest Rate Rise

5th July 2017

France makes childhood vaccinations compulsory

9th August 2017

Skills to pay the bills

19th September 2017

How do you clear out a fatberg?

16th October 2017