In the News

Monopsony Power in Action: Tesco demands supplier price cuts in discount battle

6th July 2020

This news covers competition in the supermarket sector, monopsony power costs, income elasticity of demand and more.

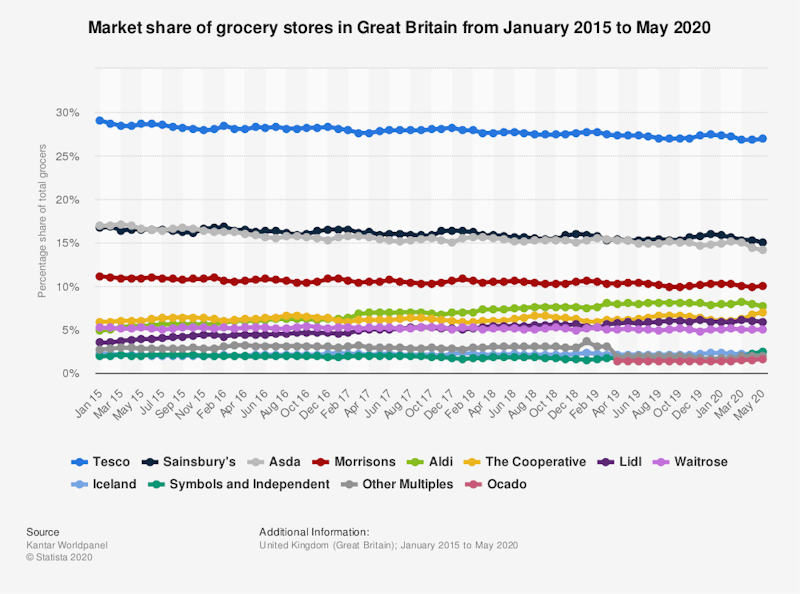

In the first place, the retail environment has changed post-Covid 19: if we're in a deep recession, and incomes have fallen, then it's likely that shoppers will continue to switch to discounters, like Aldi and Lidl, and Tesco have tried to pre-empt this, by putting pressure on suppliers to cut costs. In a recession, retailers of inferior goods are likely to perform better than those selling normal goods - hence expect Aldi and Lidi to out-perform Waitrose in the next 12 months.

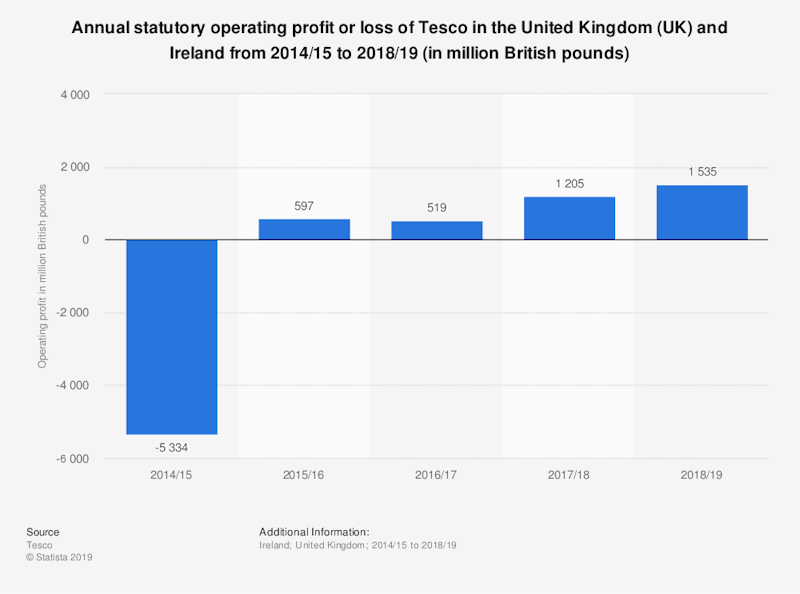

Of course, Tesco may also be banking on the fact that the suppliers themselves face tough trading conditions, and rather than risk not having retail customers, they agree to price cuts. Of course, this is blatant exploitation of a monopsony position. A supermarket who has done rather well out of the pandemic, has reserves of cash, and can borrow at lower interest rates than their smaller suppliers, and the are prepared to take the risk that some of their suppliers will look elsewhere.

Tesco demands supplier price cuts in discount battle https://t.co/N1fbJJQAhz

— BBC Business (@BBCBusiness) July 3, 2020

And then there's the whole issue of costs - in this case, lowering variable costs - the nature of the pandemic has altered Tesco's cost structure, with more spending on online retail - presumably more delivery vans have been bought and so on. Many of these are fixed costs; to compensate, the supermarket is likely to want to reduce variable costs to keep prices low.

I could go on - one wonders if the Grocer Code Adjudicator has an interest in this....

You might also like

Monopoly - Key Terms

Study Notes

Sainsbury takes on Amazon with 1 hour delivery service

28th September 2016

Young and low earners suffer most from the pandemic

7th April 2020

Coronavirus accelerates car industry restructuring

30th May 2020

Monopsony Power - 2021 Revision Update

Study Notes

Charlie's Bar and the Power of Viral Marketing

28th November 2023

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails