Topic updates

Financial Market Failure - Cyprus in Focus

5th March 2017

According to many officials in the European Central Bank, the financial crisis in Cyprus was ‘one of a kind, since Cyprus was the first nation in the Eurozone to implement a ‘bail-in’.

Find more statistics at Statista

Given that the linear exams are approaching, it would be ideal for you to learn a good example, of how a financial market has failed, examining both the causes and the consequences of such a crisis.

Several EU countries developed significantly larger banking systems compared to their economies to promote themselves as international financial centres, and Cyprus was no different in this respect.

At its height in 2009 the Cypriot banking sector was equivalent to nine times the country’s GDP, today the sector is being radically downsized closer to the EU average of 3.5 times GDP.

The challenge is to find the optimal size, which will eventually be determined by the availability of capital, scale of opportunities and Cyprus’ capacity to supervise the sector.

Adopting a national financial services strategy and boosting supervision of the banks are high on the agenda today, and Cyprus has already made good headway in establishing a smaller, stronger and safer banking sector.

Most problematic banks: Bank of Cyprus, Cyprus Popular Bank (known as Laiki Bank in Cyprus)

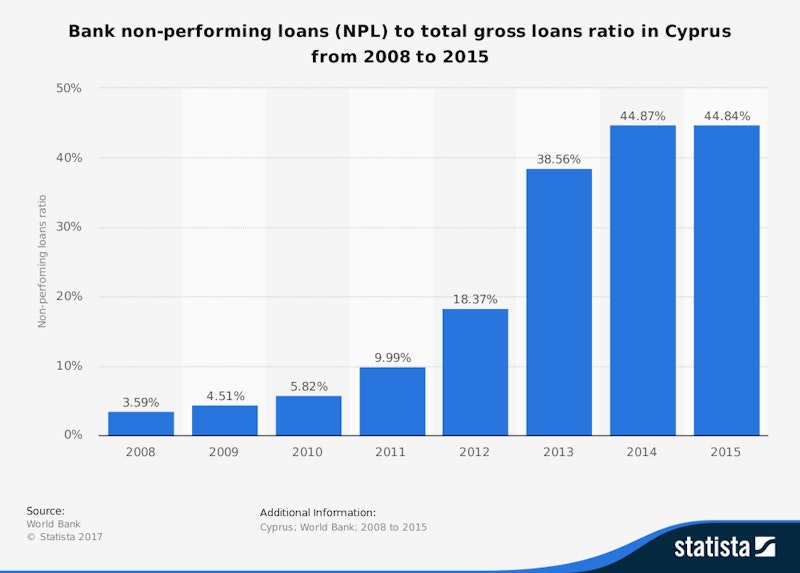

- Banks’ exposure to overleveraged local property companies. The global financial crisis, the effects of which Cyprus began to feel in 2010 as the construction and real estate sector suffered a severe blow with falling property prices and a decrease in overseas buyers. The loans were usually given out to developers. The result was a large portfolio of non-performing loans, that drained banks out of liquidity and generated large liquidity problems.

- The Greek government’s debt crisis – Cyprus banks had invested in Greek bonds, but little did they know, that the Greek bonds would be subject to a haircut, which proved to be a loss-making investment for all parties involved. The collapse of the Greek economy and Cyprus’ significant exposure to Greek government bonds was the last straw for the sector, destroying the banks’ balance sheets. Although domestic funds were running out, Cyprus banks made the fatal decision to expand further by investing €5.7 billion in Greek bonds. The risk was grossly underestimated as was the outcome of the Greek bailout, which imposed staggering losses of around €4.5 billion on Cypriot banks following the EU/IMF debt haircut on Greece.

- Banks’ risky expansion strategies – Cyprus banks had high interest rates therefore they were recipients of large deposits from foreigners, mainly Russian, which gave the banks a great deal of liquidity. Usually, high liquidity encourages banks to make investments, not only internally but also abroad. Consequently, banks invested in risky asset purchases abroad which proved to be high risk and less profitable than expected.

- The reluctance of the government to restructure the troubled Cypriot financial sector – lack of regulation and government intervention, made leveraging and expansion in risky investments easier for banks.

As liquidity was running out, banks had to ask for emergency liquidity from the Central Bank. This increase the debt of banks to the Central Bank to 11 billion euros and had to be repaid. Banks were now considered insolvent. Emergency liquidity assistance was cut off.

At the height of the Eurozone sovereign debt crisis, Cyprus became the fifth EU member state to seek financial assistance under a European Union Program (ESM program). The financial assistance package came from the European Commission (EC), the European Central Bank (ECB) and the International Monetary Fund (IMF) – collectively known as the Troika.

As part of the terms of the €11 billion bailout agreement, which was approved in April 2013, Cyprus was bound by a Eurogroup decision to set the controversial eurozone precedent of imposing losses on large depositors in two of its major banks, Bank of Cyprus and Laiki Bank.

The reason why the Cyprus government was unable to bail-out Cyprus banks, like all other European governments did with problematic banks, was the government’s mismanagement of public finances – large fiscal deficits. The bail-out was so large that the government could not buy it and help the Cyprus banking sector.

This was immediately followed by a closure of the entire banking sector for nearly two weeks with the imposition of capital controls in a bid to prevent a bank run. Cypriots and the local banking sector were severely hit by the closing of Laiki Bank and the restructuring of the Bank of Cyprus, which entailed a haircut of 47.5% imposed on depositors.

Deposits exceeding €100,000 were turned into equity to recapitalise the Bank of Cyprus, which was also lumped with most of Laiki’s assets and debts.

The measures were severe and there was – and still is – much justified anger over these events. Yet unlike other EU countries undergoing bailout programmes, Cyprus did not see a run on the banks or violent riots, but a defiant show of resilience and solidarity among the Cypriots.

The country’s status as a financial centre has certainly been severely wounded, but what remains intact is Cyprus’ solid experience in corporate structuring and offering blue chip companies and tax planners preferential access to high-growth markets like Europe, Russia, China and India.

With close to 50 double tax treaties, Cyprus continues to provide international businesses an attractive base for their operations, a fully EU-harmonised tax and legal framework and one of the lowest and most competitive corporate tax rates in Europe at 12.5%.

Following these events, many investors are in fact viewing Cyprus with renewed interest with its expanding investment opportunities in the tourism, real estate and oil and gas sectors.

You might also like

Aspects of Globalisation - Revision Presentation

Teaching PowerPoints

Lord Mervyn King on The End of Alchemy

26th March 2016

UK Financial Crisis 2008 - "Timeline Match Up" activity

Quizzes & Activities

Globalisation and Inequality (Revision Essay Plan)

Practice Exam Questions

Contestable Markets: Google to offer banking current accounts

14th November 2019

Debt Crisis Looming for Developing Countries

14th April 2023

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails