In the News

Coca Cola Buys Costa Coffee

6th September 2018

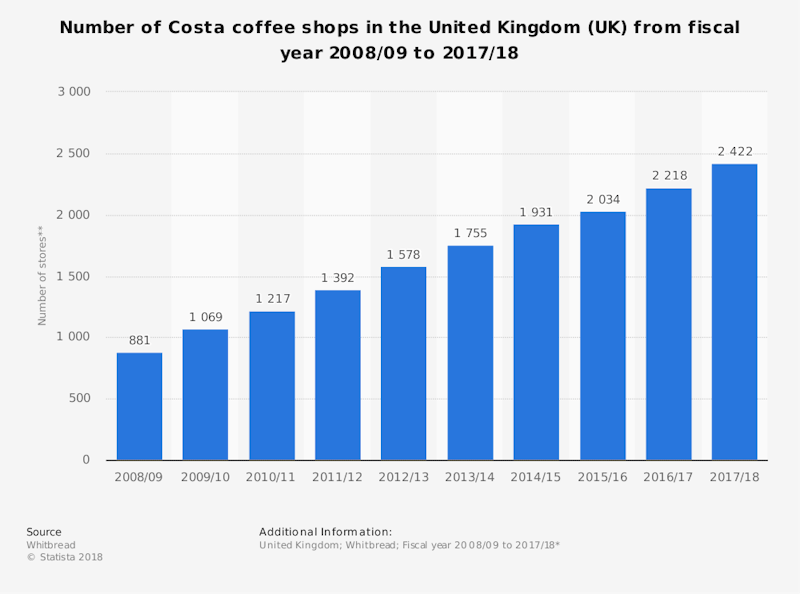

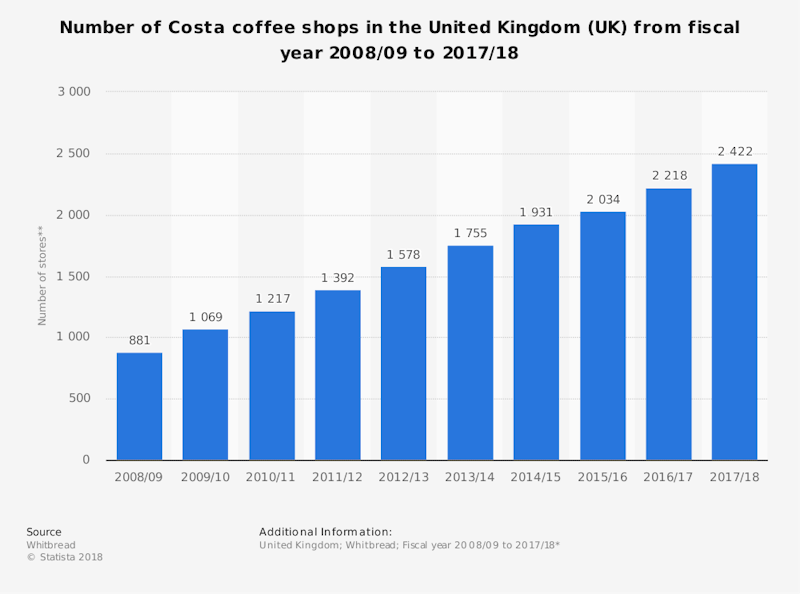

Whitbread bought Costa for £19 million 23 years ago when it had only 39 shops. The breaking news today is that Coca Cola is buying the Costa Coffee chain from Whitbread plc for just under £4 billion.

This will be an example of external business growth that students and teachers can use as a terrific case study in the relative benefits and drawbacks of acquisition.

Whitbread were planning to demerge Costa from their other businesses which include Premier Inn. Instead they have sold Costa to one of the iconic drinks manufacturers and brands. What changes can we expect?

Whitbread CEO Alison Brittain is quoted as saying that the deal was “great news” for shareholders as the price received from Coca-Cola was far higher than if it had decided to demerge the business instead.

How will Whitbread use the money? The Whitbread press release says that a significant majority of net cash proceeds intended to be returned to shareholders and the business will also use some the proceeds of the sale to reduce debt and make a contribution to the pension fund, which will both provide space for further expansion of Premier Inn in the UK and Germany.

For Coca Cola, the acquisition gives is a coffee brand with a global footprint. Costa operates in 31 markets with a total of 3,821 stores. What price on a new brand name - Coca Coffee!

'I think Coke realises that sugary soft drinks are under attack..they need to be involved in things like water, energy drinks and finally coffee', TCC Global retail analyst Brian Roberts tells Sean Farrington on @bbc5live pic.twitter.com/95Kvf5uTJT

— BBC Business (@BBCBusiness) August 31, 2018

Coca-Cola is to buy the Costa Coffee chain from Whitbread for £3.9bn https://t.co/f49WFwsGMa

— BBC Breaking News (@BBCBreaking) August 31, 2018

Here is why Coca Cola are buying Costa Coffee for £3.9 billion - because it doesn't have a global coffee brand (yet...)

— Sean Farrington (@seanfarrington) August 31, 2018

lots more @bbc5live this morning

Do you care? Where do you get your coffee these days? pic.twitter.com/65sC0UEopx

The coffee revolution: in 1995, when Whitbread bought @CostaCoffee it had 39 stores in UK. Now has 2,400 in UK, 1,400 internationally and 8,000 Costa Express self-service outlets https://t.co/kqUTWVDJx8 Those £2.45 lattes have certainly been lucrative

— Kamal Ahmed (@kamalahmednews) August 31, 2018

Coca-Cola will expand in hot drinks by buying Britain's Costa Coffee for £3.9 billion ($5.1 billion) https://t.co/7YDAQNfpBi

— Bloomberg (@business) August 31, 2018

You might also like

Is Another Mega Brewing Merger On The Cards?

20th September 2015

Dell agrees $67bn EMC Takeover

12th October 2015

A Game-Changer in Retail? Amazon buys Whole Foods

17th June 2017

Mergers and Consumer Welfare (Revision Essay Plan)

Practice Exam Questions

2021 - A Year of Shortages in Global Supply Chains

2nd June 2021

China's Accelerating Bid for Chip Supremacy

5th June 2021

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails