In the News

BoE raises interest rates to 4% - the highest for 14 years

3rd February 2023

We might be getting close to the peak of interest rates during the current tightening phase for UK monetary policy. The Bank of England today lifted official base interest rates for 10th consecutive time, this time by 0.5% to 4%, their highest level in 14 years.

At the same time, the latest Inflation Report forecasts a milder recession on with hope rising that lower energy prices will help the MPC to keep interest rates where they are for now. The MPC says further rises will happen only if more evidence of inflation persistence becomes available including surging wage inflation.

The BBC take on the 0.5% rise in interest rates.

Here is BoE Governor Andrew Bailey explaining the rationale behind the latest interest rate increase.

We’ve raised #BankRate to 4% today. Inflation has started to fall, but it is still much too high. Raising interest rates is the best way we have to ensure low and stable inflation. Andrew Bailey explains more below. https://t.co/n7j94kLoaX pic.twitter.com/QRLtzXchxi

— Bank of England (@bankofengland) February 2, 2023

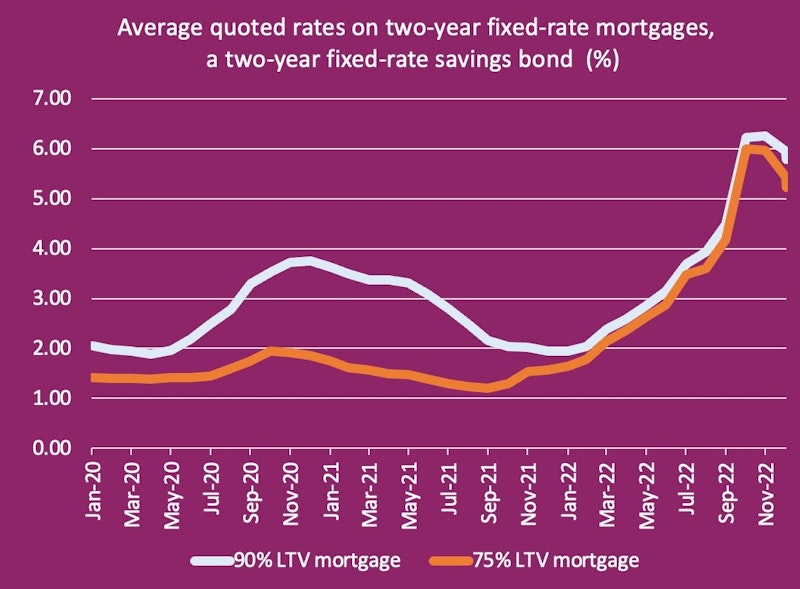

Mortgage interest rates have climbed in recent months increasing the cost of servicing a home loan. Variable/tracker interest rate repayment mortgages rise by about £25 per month (£300/yr) per £100,000 of mortgage. So once again, home-owners will feel the pinch with a reduction in their effective disposable income.

Here are some worried home-owners

‘I’m really worried’: homeowners and would-be buyers on UK interest rates https://t.co/GXNPQduYTY

— Guardian Business (@BusinessDesk) February 3, 2023

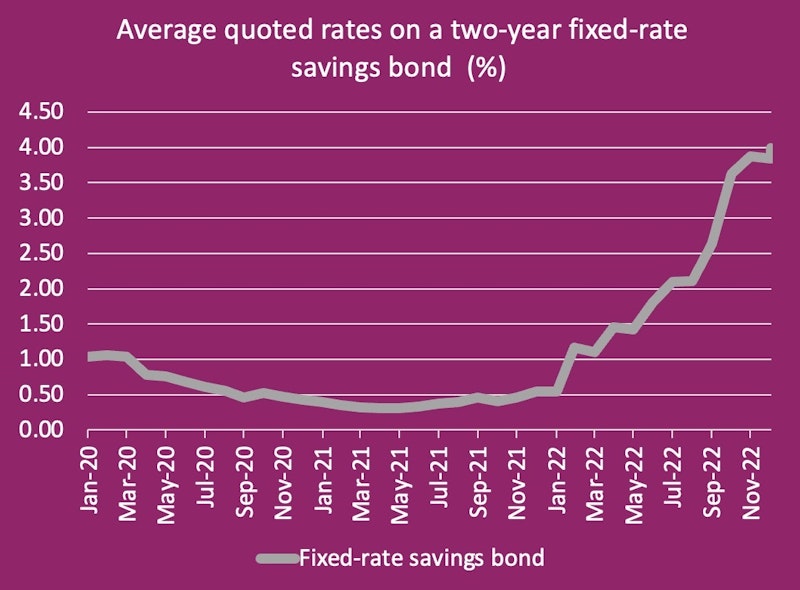

You can now get a better nominal interest rate on a two-year fixed saving bond - close to 4% although with inflation still hovering around 10% (but expected to drop), the real return on savings for millions of people remains negative.

The Bank of England is now forecasting a shallower recession than it did in their November Inflation Report. However, according to the Bank of England, the UK economy will not reach pre-pandemic levels until 2026. That’s *seven years* of lost growth. The UK is currently the only G7 country whose real GDP is still smaller than before the pandemic.

This isn’t one of the main charts in the @bankofengland forecasts today but it might be one of the most important.

— Ed Conway (@EdConwaySky) February 2, 2023

Come 2026 the UK economy will still be smaller than it was in 2019.

Another seven years of lost growth. (I added the red dotted line) pic.twitter.com/aLOZbO4X7I

Earlier this week there was a new forecast from the IMF which had the UK down at the bottom of the growth league table for 2023 - even below Russia.

Truly grisly assessment for the UK economy from the IMF this morning.

— Ed Conway (@EdConwaySky) January 31, 2023

- UK to fare worse than any other major economy this year

- worse even than Russia(!)

- Britain's downgrade came as most other countries saw their growth prospects upgraded

Full story:https://t.co/ATahkwWnqr pic.twitter.com/cRYaO5aa4P

You might also like

Should we take Corbynomics seriously?

20th August 2015

Why Financial Markets Matter - Short Lesson Video

20th November 2015

Should Smaller EU Countries Join the Euro?

Topic Videos

Longer-Term Implications of Brexit

24th March 2017

tutor2u UK Economy Data Chart Quiz

Quizzes & Activities

UK Economic History - Name the Year (Quizlet Activity)

Quizzes & Activities

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails