In the News

Bank of England Inflation Report - food prices

13th March 2017

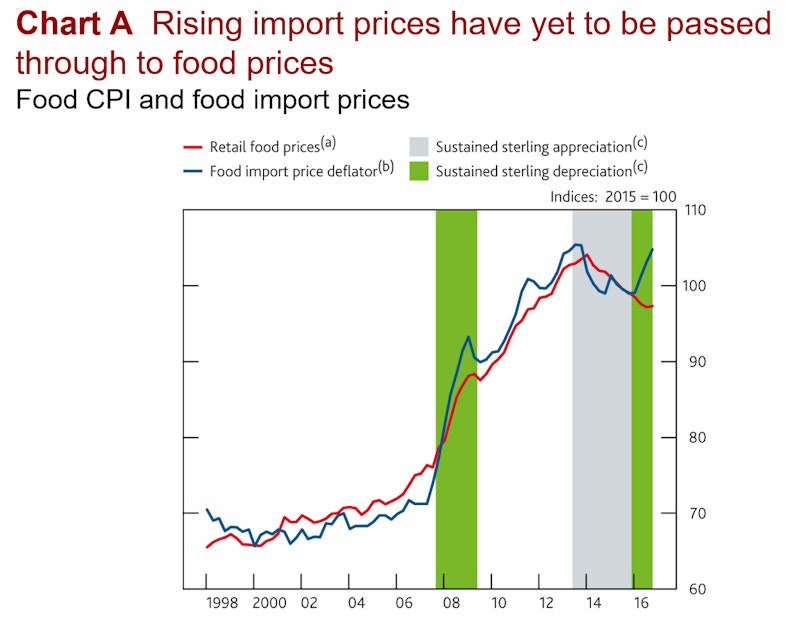

If you only use one chart from the Bank of England's February Inflation Report, this is a great one for students to analyse. You can find it on page 26 of the report, in the Costs and Prices section, and it shows that the impact of sterling depreciation since the EU Referendum last June has had a marked effect on the sterling price of imported food (around 50% of our food is imported), this price rise has not yet been passed on to consumers.

The most likely reason for this, as suggested in the Report, is fierce competition in the supermarket industry, as retailers cut costs in an effort to avoid price rises - households are extremely sensitive to retail food price changes, making their response particularly price elastic. It is not the 'Toblerone effect' - the Bank's analysis makes it clear that the ONS construction of the CPI makes adjustment for any changes in the size or quality of the product they are measuring in their basket of goods, so that any reduction in the size of items such as chocolate bars will result in an adjustment in the prices they record for them.

The conclusion is that as retailers run out of profit margin and so have no more scope for reducing prices, food prices will start to respond to pressure of higher sterling import prices. This is exactly the point that Lord Stuart Rose made on the Today Programme last week - you can find a 47-second clip of that interview here.

You might also like

Inflation & Unemployment Revision Quiz

Quizzes & Activities

Bank of England comes close to raising interest rates

15th June 2017

Request a Bank of England Speaker for your school

24th March 2021

Monetary Policy - Bank of England raises interest rates from 0.1% to 0.25%

17th December 2021

UK Economy - New Revision Videos on Growth and Monetary Policy

25th April 2023

4.4.3 Roles of Central Banks (Edexcel)

Study Notes

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails