In the News

Asda's Market Struggles: Debt and Competition in the UK Grocery Sector

22nd August 2024

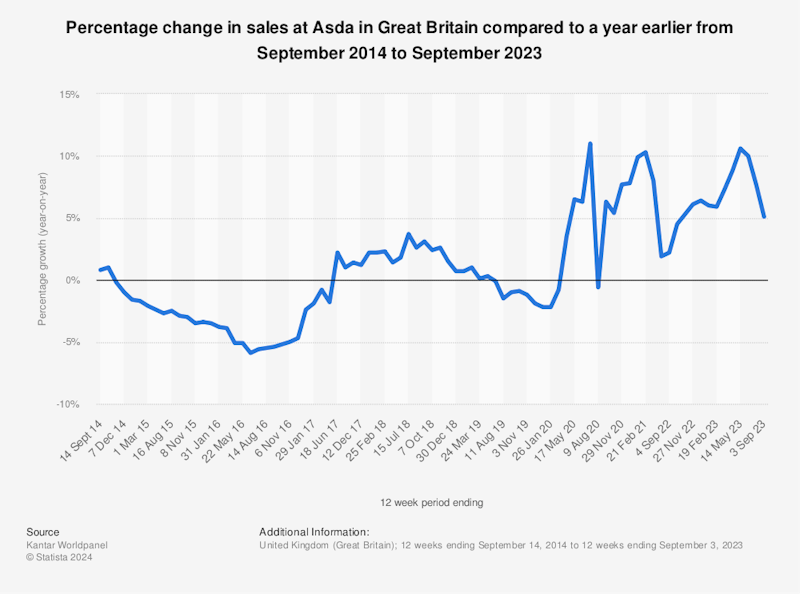

Asda, once a titan of the UK grocery market, finds itself in troubled waters as its market share falls to a historic low. The supermarket chain, which is part of the traditional "big four" alongside Tesco, Sainsbury's, and Morrisons, has seen its sales drop by 6.4% over the last three months. This decline has pushed Asda’s market share down to 11.8%, putting it just slightly ahead of the rapidly growing discounter Aldi.

The fall in market share is not just a result of increased competition. Asda's struggles are deeply tied to the significant corporate debt it has been burdened with since its acquisition by the Issa brothers and private equity firm TDR Capital in 2020. The £6.8 billion leveraged buyout was heavily debt-fueled, leaving Asda with a corporate debt load of £3.9 billion. This has constrained the company's ability to invest and respond flexibly to market changes, exacerbating its competitive challenges.

The Competitive Landscape: A Contestable Market

The UK grocery market is increasingly becoming a contestable market, characterised by low barriers to entry and intense competition. This is evidenced by the rise of deep-discounters like Aldi and Lidl, which have eroded the market shares of traditional supermarkets. Asda's competitors have responded to this threat by adopting aggressive price-matching strategies and expanding their own store networks, making it even harder for Asda to regain lost ground.

Leveraging Assets and Diversification

In a bid to navigate these challenging waters, Asda has embarked on an ambitious diversification strategy. One notable initiative is its partnership with Barratt Developments to create a new "town centre" in London, complete with 1,500 homes and a large Asda store. This move into residential property represents an innovative attempt to leverage its existing assets and tap into new revenue streams. However, whether this diversification will be enough to counterbalance the pressures in its core grocery business remains to be seen.

Corporate Debt and Refinancing

Asda's corporate debt situation remains a significant concern. Despite recent efforts to refinance and extend the maturities of its borrowings, the company's high leverage could limit its ability to invest in necessary improvements and innovations. The supermarket recently initiated a refinancing plan to raise over £2.6 billion, aiming to create a more sustainable capital structure. However, with debt repayments looming and competition intensifying, Asda's future remains uncertain.

Summary of Key Points:

- Market Share Decline: Asda's market share has dropped to a historic low of 11.8%, driven by a 6.4% decline in sales.

- Corporate Debt: The supermarket is burdened with £3.9 billion in debt following a leveraged buyout by the Issa brothers and TDR Capital in 2020.

- Competition: Asda faces intense competition from both traditional rivals and discounters like Aldi, which have eroded its market position.

- Diversification: Asda is diversifying into residential property development, aiming to leverage its assets and create new revenue streams.

- Refinancing Efforts: Asda has embarked on a refinancing plan to raise £2.6 billion, aiming to reduce leverage and extend debt maturities.

Exam-Style Questions:

- Discuss the impact of high corporate debt on a company's ability to compete in a contestable market. Use Asda as an example in your analysis.

- Evaluate the effectiveness of diversification strategies, such as Asda's move into residential property, in countering challenges in a company's core business.

- Analyse the role of price competition in the UK grocery market and its effects on traditional supermarkets like Asda.

- Examine the significance of market share as a measure of success in highly competitive markets like the UK grocery sector.

Glossary of Key Economic Terms:

- Corporate Debt: The total amount of money that a corporation has borrowed and is obligated to repay. High levels of corporate debt can restrict a company's ability to invest and compete effectively.

- Contestable Market: A market structure where there are few barriers to entry and exit, making it easy for new competitors to challenge established firms.

- Diversification: A strategy where a company expands into new markets or product lines to reduce reliance on its core business and spread risk.

- Leverage: The use of borrowed funds to finance the acquisition of assets. High leverage can increase a company's potential return but also its financial risk.

- Market Share: The portion of a market controlled by a particular company. A decline in market share can indicate losing ground to competitors.

Retrieval Questions for A-Level Students:

- What is corporate debt, and how can it impact a company's operations?

- Define a contestable market and explain why the UK grocery market is considered one.

- What does it mean for a company to diversify, and why might Asda choose to diversify into residential property?

- Explain how leverage works and discuss its potential risks and benefits for a company like Asda.

- Why is market share important for a company, and what does a decline in market share indicate?

You might also like

Sports Direct to open a new gym chain

12th November 2014

Revision Presentation on Royal Mail Privatisation

Teaching PowerPoints

Why is supermarket petrol in the UK cheaper than other brands?

7th January 2016

Contestable Markets: Challenges and Opportunities from Open Banking

3rd January 2018

Asda-Sainsbury Merger under threat from the CMA

Study Notes

Portable and digital retailing - Sweden leads the way

11th March 2021

CMA warns against supermarket use of land banks

13th June 2023

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails