Topic updates

A Closer Look at the UK Economy's Fragile Foundations

19th August 2024

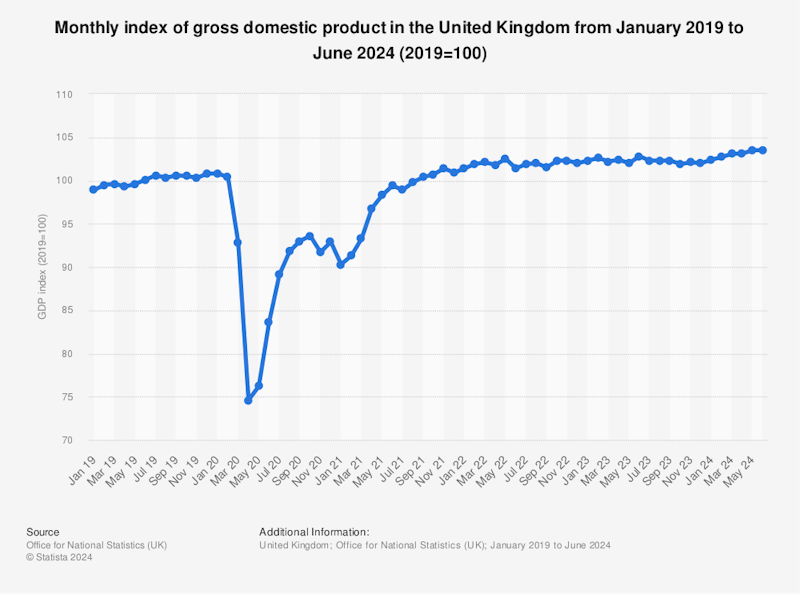

Writing in the Guardian, Larry Elliott argues that, whilst the United Kingdom recently celebrated its status as the fastest-growing economy among the G7 nations, with a respectable GDP growth rate and declining unemployment, it is essential to recognise that this growth hides deeper, more troubling issues within the economy—issues that have plagued Britain for years.

The Illusion of Growth

At first glance, the UK’s economic performance in the first half of 2024 looks impressive. Quarterly growth of 0.6%, an inflation rate down to 2.2%, and unemployment at 4.2% paint a picture of an economy on the mend. These figures suggest that Britain is on a path of recovery, especially when compared to the gloomy predictions that followed Brexit and the COVID-19 pandemic. However, a deeper dive into the data reveals a more complex and less rosy reality.

The growth the UK is experiencing is largely driven by the services sector, which accounts for around 80% of the economy. While services have thrived, manufacturing and construction sectors have contracted, highlighting an unbalanced growth pattern. This dependency on services is not new and has been a growing trend since the decline of British manufacturing, but it poses risks, especially in times of global economic uncertainty.

Productivity Puzzle

A critical area where the UK continues to struggle is productivity. Despite improvements in GDP, productivity—measured as output per hour worked—remains stubbornly low. In fact, it was 0.1% lower in the second quarter of 2024 compared to a year earlier and has only risen slightly since the pandemic. This lack of productivity growth is directly linked to weak business investment, which saw a slight decline in the last quarter despite favorable tax conditions. When companies are not investing in new technologies, equipment, or processes, productivity stagnates, which in turn limits wage growth and overall economic prosperity.

Regional Divide

Another structural issue lurking beneath the surface is the stark regional inequality within the UK. Employment rates vary significantly across the country, with the south of England enjoying higher employment levels compared to regions like Wales, Northern Ireland, and the north of England. This divide is largely due to the concentration of the services sector in the south, leaving manufacturing-dependent regions behind. The result is not just a gap in employment but also in economic opportunities and living standards.

Trade Deficit Dilemma

The UK’s trade figures also tell a troubling story. The country continues to run a significant trade deficit in goods, partially offset by a surplus in services. While being a global leader in services exports is an achievement, it’s concerning that Britain has not had a trade surplus in goods since the early 1980s. The decline of manufacturing has left the UK overly reliant on service industries, which may not be sufficient to sustain long-term economic health.

Key Points and Facts:

- Unbalanced Growth: The UK's recent economic growth is heavily skewed towards the services sector, while manufacturing and construction have contracted.

- Productivity Issues: UK productivity growth remains weak, with output per hour worked barely increasing since the pandemic.

- Regional Disparities: Significant employment rate differences exist between the prosperous south of England and the less economically dynamic regions like Wales and Northern Ireland.

- Trade Deficit: The UK continues to run a substantial trade deficit in goods, which is only partially offset by a surplus in services.

- Business Investment: Despite tax incentives, business investment in the UK is declining, contributing to poor productivity growth.

Exam-Style Discussion Questions:

- Evaluate the implications of the UK's reliance on the services sector for long-term economic stability.

- Discuss the potential causes of the UK's persistent productivity stagnation and suggest policy measures to address it.

- Analyse the economic impact of regional disparities within the UK, and propose strategies to reduce these inequalities.

- How can the UK government encourage greater business investment to boost productivity and economic growth?

Glossary of Key Economic Terms:

- Business Investment: Expenditure by businesses on capital goods such as machinery, technology, and infrastructure to improve productivity.

- Cyclical Upswing: A phase in the economic cycle where the economy grows due to favourable conditions, such as increased consumer spending or investment.

- GDP per Capita: A measure of the total economic output of a country divided by its population, indicating average economic prosperity.

- Inflation: The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

- Productivity: The efficiency of production, often measured as output per hour worked.

- Regional Disparities: Economic inequalities between different geographical areas within a country, often reflected in employment rates and income levels.

- Services Sector: The part of the economy that provides intangible goods, such as finance, education, and healthcare, rather than physical products.

- Structural Problems: Long-term economic issues that affect the fundamental health of the economy, such as low productivity or poor investment.

- Trade Deficit: A situation where a country's imports of goods exceed its exports, leading to more money leaving the economy than entering it.

Retrieval Questions for A-Level Students:

- What sector has driven the majority of the UK's recent economic growth?

- How has UK productivity changed since the pandemic?

- What are the current challenges with business investment in the UK?

- What is the significance of the regional divide in employment rates within the UK?

- Why is the UK's trade deficit in goods a concern for the economy?

- How does the services sector compare to the manufacturing sector in terms of economic contribution in the UK?

- What are structural economic problems, and how do they differ from cyclical issues?

- What is GDP per capita, and why is it an important economic indicator?

You might also like

Policy Analysis of Key 2015 Election Issues

30th April 2015

Has Britain coped better than in previous recessions?

18th October 2015

Unemployment and Inflation in the UK Economy

Topic Videos

Is it time to abolish the OBR?

30th November 2016

ONS reimagines how to measure the economy

5th August 2017

The UK Economy in 2018 - Essential Exam Update

Topic Videos

Economics of Brexit (2020 Update)

Topic Videos

UK Economy in Focus - Investment Spending

Topic Videos