Study Notes

Return on Capital Employed

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

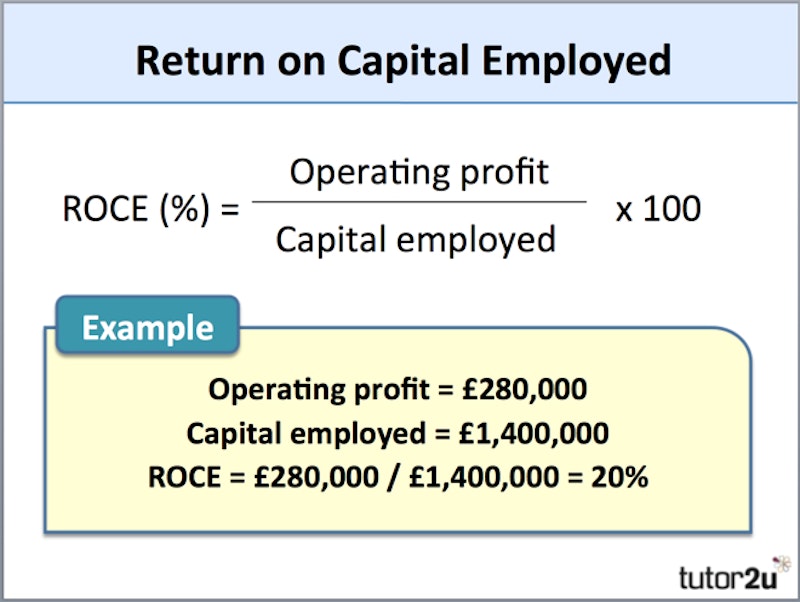

ROCE is sometimes referred to as the "primary ratio". It tells us what returns (profits) the business has made on the resources available to it.

ROCE is calculated using this formula:

The capital employed figure normally comprises:

Share capital + Retained Earnings + Long-term borrowings

(the same as Equity + Non-current liabilities from the balance sheet)

Capital employed is a good measure of the total resources that a business has available to it, although it is not perfect. For example, a business might lease or hire many of its production capacity (machinery, buildings etc) which would not be included as assets in the balance sheet.

With ROCE, the higher the percentage figure, the better. The figure needs to be compared with the ROCE from previous years to see if there is a trend of ROCE rising or falling.

It is also important to ensure that the operating profit figure used for the top half of the calculation does not include any exceptional items which might distort the ROCE percentage and comparisons over time.

To improve its ROCE a business can try to do two things:

- Improve the top line (i.e. increase operating profit) without a corresponding increase in capital employed, or

- Maintain operating profit but reduce the value of capital employed

You might also like

Return on Capital

Study Notes

Liquidity Ratios (Revision Presentation)

Teaching PowerPoints

Shareholder Ratios

Topic Videos

Resource of the Week - AQA and Edexcel A Level Business

29th September 2017

Film star ratios

29th November 2017

Lunchtime Learning with the Calculation Practice Book!

2nd February 2018