Study Notes

Gearing Ratio

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

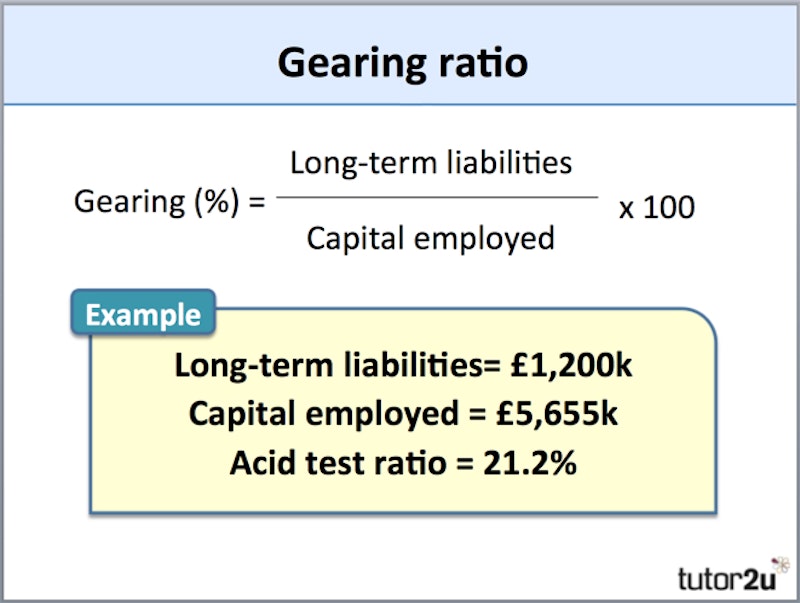

Gearing focuses on the capital structure of the business – that means the proportion of finance that is provided by debt relative to the finance provided by equity (or shareholders).

The gearing ratio is also concerned with liquidity. However, it focuses on the long-term financial stability of a business.

Gearing (otherwise known as "leverage") measures the proportion of assets invested in a business that are financed by long-term borrowing.

In theory, the higher the level of borrowing (gearing) the higher are the risks to a business, since the payment of interest and repayment of debts are not "optional" in the same way as dividends. However, gearing can be a financially sound part of a business's capital structure particularly if the business has strong, predictable cash flows.

Notes:

Long-term liabilities include loans due more than one year + preference shares + mortgages

Capital employed = Share capital + retained earnings + long-term liabilities

How can the gearing ratio be evaluated?

- A business with a gearing ratio of more than 50% is traditionally said to be "highly geared".

- A business with gearing of less than 25% is traditionally described as having "low gearing"

- Something between 25% - 50% would be considered normal for a well-established business which is happy to finance its activities using debt.

It is important to remember that financing a business through long-term debt is not necessarily a bad thing! Long-term debt is normally cheap, and it reduces the amount that shareholders have to invest in the business.

What is a sensible level of gearing? Much depends on the ability of the business to grow profits and generate positive cash flow to service the debt. A mature business which produces strong and reliable cash flows can handle a much higher level of gearing than a business where the cash flows are unpredictable and uncertain.

Another important point to remember is that the long-term capital structure of the business is very much in the control of the shareholders and management. Steps can be taken to change or manage the level of gearing – for example:

You might also like

Debentures

Study Notes

Liquidity Ratios (Financial Ratios Explained)

Topic Videos

Cash is King… Profit is Prince!

26th September 2016

Quantitative Skills in A Level Business - Ratios

Topic Videos

Lunchtime Learning with the Calculation Practice Book!

2nd February 2018

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails