Study Notes

External Environment: Taxation (GCSE)

- Level:

- GCSE

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

There are some key reasons why government needs to levy taxes; the main ones are:

- To raise revenue to finance government spending

- Managing aggregate demand - to help meet the government's economic objectives

- Changing the distribution of income and wealth

- Market failure and environmental targets – taxes may help correct market failures (e.g. pollution)

An important distinction can be made between direct and indirect taxes:

Direct taxation

Direct taxation is levied on income, wealth and profit

Direct taxes include:

Income Tax

National Insurance Contributions

Corporation Tax

Capital Gains Tax

Indirect taxation

Indirect taxes are levied on spending by consumers on goods and services

Examples:

VAT (currently 20% on relevant spending)

Excise duties on fuel and alcohol, car tax, betting tax and the TV licence

Who pays?

The burden of an indirect tax might be passed onto the consumer by the producer

Depends on the price elasticity of demand and supply for the product

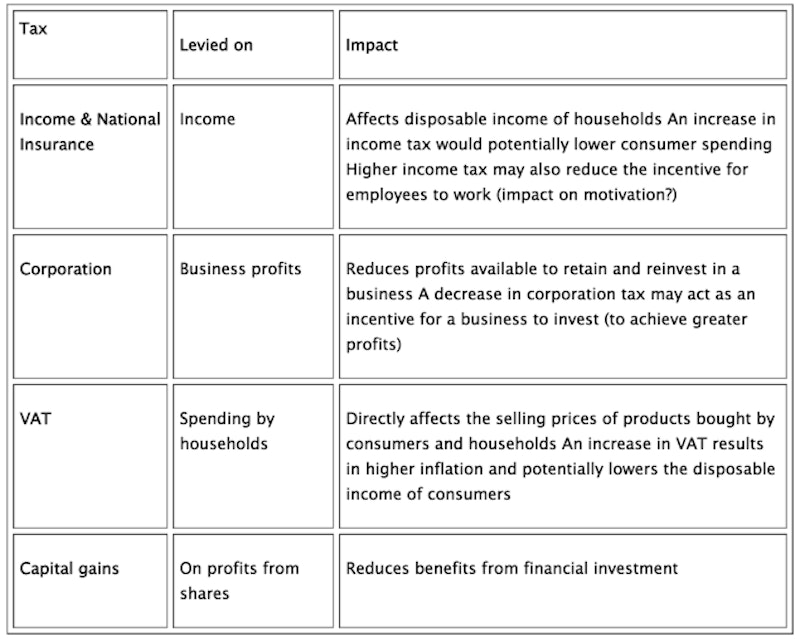

The effects of the main types of taxation on businesses (in the UK) can be summarised as follows:

You might also like

Fiscal and Monetary Policy

Study Notes

Fiscal & Monetary Policy

Quizzes & Activities

Tax Avoidance and the Diverted Profits Tax

25th May 2015

Understanding the Economy: Govt Budget Deficit and Debt

11th December 2015

The impacts of Budget 2017

9th March 2017

Daily Email Updates

Subscribe to our daily digest and get the day’s content delivered fresh to your inbox every morning at 7am.

Signup for emails