In the News

Will M&S Follow BHS?

7th July 2016

It has been known that M&S have struggled with their clothing sales and this core part of their business has been their weak link.

Analysts predicted that M&S clothing sales would fall by between 5 and 8%, but M&S have been dealt a low blow this week as they announced that sales have fallen by 8.9%.

CEO Steve Row admitted key flaws in M&S' strategy back in May, identifying issues such as high prices, stop start promotions, chasing fashion trends and having too many "sub brands". M&S are facing touch competition, especially against the likes of Next and Primark, who are more reasonably priced and are quicker at turning over new fashion trends. These companies also have a clear place in the market which is something M&S are struggling with. M&S have tried to design more fashionable items aimed at a younger market, but aren't they forgetting who their real, loyal customers are? Richard Lim, chief executive of research consultancy Retail Economics supported this, saying "Its tireless efforts to revive the struggling clothing business have failed to resonate with its core customer base."

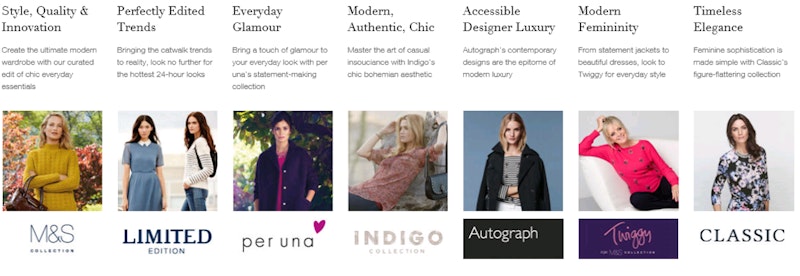

Looking at M&S clothing sales for women, it is easy to identify seven key “sub brands” that are aimed at different target markets. This then makes it difficult to identify a typical customer.

But who is Mrs M&S?

I for one, a 24 year old woman, have bought a fab, on trend, Limited Edition leather jacket at M&S – only then to wear it out and see someone twice my age also wearing it. Would this have happened if I had bought it in Topshop?

One can question if such a drastic drop in sales is due to M&S’ new strategy, in particular their new pricing strategy. CEO Steve Rowe decided that rather than have several promotions throughout the year, they would use these savings to lower prices in store all year round. M&S have repriced 1,000 clothing lines this year, with more than 7,000,000 (that’s right, seven million!) products being affected. On average price cuts have been 17%. They have also cut back on promotions, M&S have only had one cyber sale compared to six by this same point last year. Also, their summer sale has started later and will last a shorter period of time. This change in pricing strategy was required as Steve Rowe claimed M&S’ culture of pricing too high with too many promotions meant customers would wait for promotional offers to buy anything. Therefore, repricing was essential to combat this. However, the drop in sales would suggest this strategy has so far been unsuccessful.

Disappointingly, M&S have also seen their like-for-like food sales drop by 0.9%, however this still remains their more successful business.

So, can M&S recover or will they follow BHS? Should they regroup, give up clothing and focus on food? Or can they revive a struggling clothing business by refocussing on Mrs M&S and having a clear cut target market?

Only time will tell.

You might also like

Starbucks Pricing Strategy Under Attack in China

2nd November 2013

Marketing Mix: Price (Revision Presentation)

Teaching PowerPoints

Capacity Management and Demand-Based Pricing - All Change at Disney

6th October 2015

Rail fare hike reveals burden shifting to passengers

2nd January 2017

Tesco special offers past their Sell-by Date

13th February 2017

Pricing Products: the iPhoneX "Higher or Lower" Activity

Quizzes & Activities