In the News

Retrenchment at Fitbit

31st January 2017

Fitbit, the global market leader in the fitness wearables industry, is looking to reduce operating costs by $200m a year. As a result it is to reduce the size of its global workforce by 6%.

What is going wrong at Fitbit?

One pressing problem is how to manage investor expectations of revenues growth. When Fitbit's shares were floated in the US stock market in June 2015 investors flocked to buy shares. Since then Fitbit's share price has fallen from a high of $35 to around $6 now as the company has failed to meet revenue forecasts released to investment analysts.

Why are revenues not growing as fast as expected?

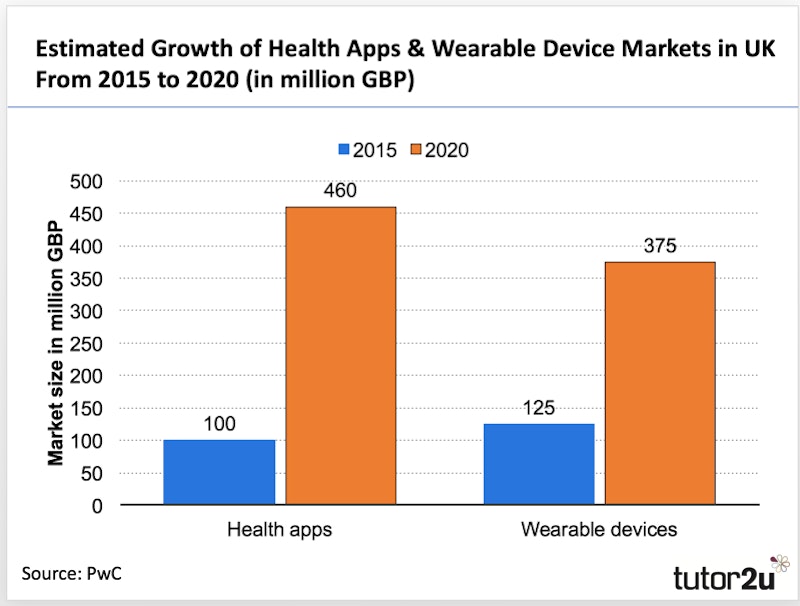

Part of the reason might be a weakening of demand growth in the overall market.

Another is the increasingly intense competition Fitbit is facing from established and new entrants into the wearable market, including Apple, Garmin, TomTom and Samsung.

Fitbit has responded by acquiring a close competitor - Pebble - and launching a smartwatch (the Fitbit Blaze).

You might also like

Strategy: Retrenchment for the Co-op Group to Reduce Gearing

4th August 2014

ResearchBuster: Retrenchment

26th September 2012

Retrenchment

Topic Videos

Burberry - Trench Coat Retrenchment

19th May 2016

Retrenchment at Ralph Lauren as 1,000 Jobs Cut

10th June 2016

Retrenchment in Action | Calm and Peloton

14th August 2022